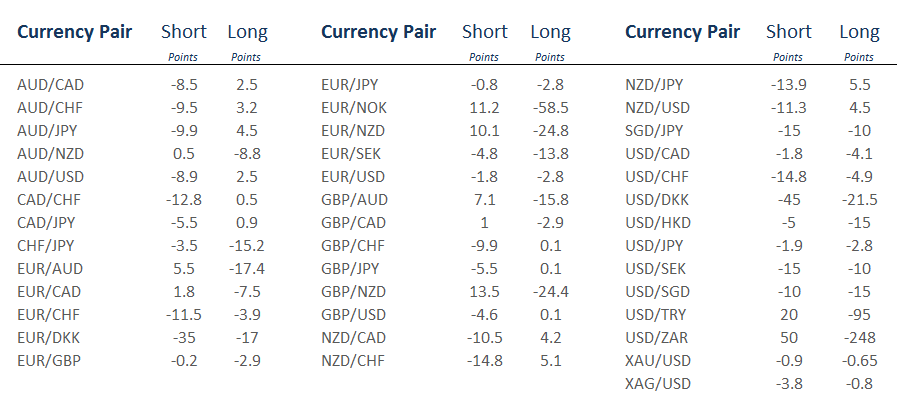

Forex Swap Rates Forex Rollover Rates

Post on: 14 Апрель, 2015 No Comment

What Is Rollover or Swap?

All the positions in the spot forex market have to be expired at 5pm EST everyday. The clearing house will roll over the open positions automatically at 5pm EST everyday. It means the open positions will be exchanged (swapped) for the new positions. Again, the new positions will expire the following settlement date at 5pm EST rollover. This process is also known as tomorrow, next day or simply tom next.

When you buy EURUSD. it means you pay USD to buy Euro. In fact, it is not you who pays USD and buys Euro. It is the liquidity provider (the bank) that does it for you and on behalf of you. They pay USD and receive Euro. When you hold your position overnight and the time reaches the roll over time which is 5pm EST, the liquidity provider has to do the rollover process and the two currencies that are exchanged during the rollover, are not generally valued at the same price. The difference in the value of the two currencies is based on the difference of the overnight bank interest rates between the two currencies.

When you buy Euro against USD while Euro has a higher overnight interest rate than USD, it means the bank gives a lower interest rate currency (USD) and holds the one that has a higher overnight interest rate (Euro). Therefore, they make some money through the higher interest rate of the currency they hold and that is why they pay you some small credit to your account at 5pm EST. Conversely, if they hold a currency that has a lower overnight interest rate and give the currency that has a higher overnight interest rate, they lose some money on the interest difference and therefore, you have to pay some small money as the swap. After the rollover at 5pm EST, you may also notice a small difference in the price of your original position and the new position assigned during the rollover.

Here is the rollover calculation formula:

Contract notional value x (base currency interest rate quote currency interest rate) / 365 days per year x current base currency rate = daily rollover interest debit/credit

Example:

You buy one lot EURUSD while the EURUSD price at rollover time is 1.3700. How much swap you should pay/receive at 5pm EST?

EURUSD price at 5pm EST: 1.3700

Euro overnight interest rate: 0.78125%

USD overnight interest rate: 0.23700%

Therefore: $100,000 x (0.78125% 0.23700%) / 365 x 1.3700

Further: $100,000 x 0.54425% / 500.05 = +$1.0883

That was just an example. Swap can change on a daily basis. Ultimately, with the real ECN/STP brokers. it is only the bank that calculates the swap, and the broker has no control on it.

Regarding the CFDs, you will be charged for the swap only when you have a long position. and you will not be paid any swap when you have a short position. The reason is that when you take a long position with one of the CFDs, the bank pays USD to buy the CFD. Therefore the bank gives something that has an overnight interest (USD) to receive something that has NO overnight interest (CFD).

Some More Articles And Resources:

Don’t Miss Our New Articles!

Be the first who receives our most recent articles:

Learn more: