Forex Strategies Create Your Own

Post on: 12 Апрель, 2015 No Comment

There are probably as many forex strategies as there are traders, but not all forex strategies and trading plans are created equal. I suggest that you find some strategies and then build a trading plan around them (see How to Make a Trading Plan ). There are a plethora of forex strategies available to you on this site, but I also encourage you to create your own forex strategies

Creating Strategies

I always encourage traders to develop their own forex strategies, time permitting. There are several reasons why I believe it is important for traders to develop their own strategies. First of all, creating strategies requires the traders develop a greater knowledge of the market and its price movements. Secondly, when one develops their own forex strategy they are tuned into how the strategy actually works, what will cause it not to work and they will be in a much better place to make adjustments when needed. Even if you trade someone elses forex strategy. test it thoroughly, and in the process, you make it your own as you learn the in-and-outs of it, possibly adding your own twist.

How to Create Forex Strategies

This is time consuming part, but can also be fun. For me the real fun is testing out what I come up with, but before we can test we need an idea. How I generate ideas is by watching charts, both past and real-time. No matter what time frame I am viewing on the chart, I look for moves where there was money to be made.

Once I have found a move that looks profitable I start to ask myself questions about it:

-What precipitated the move?

-Was it a chart pattern, a candlestick pattern, a news event or certain time of day? These are samples of the questions you want to attempt to answer.

-Did the move start before a certain session (NY, London, Tokyo, etc), near the close, mid-day? Is there any relation to an opening or closing market? (Understanding Forex Market Hours and Forex Hourly Tendencies )

-Where could I enter?

-How could I have gotten into the trade (market order, pending order?)?

-Looking at my answers from above, how could I take advantage of this opportunity in real-time?

-Does the pattern I am watching give an entry signal such as a break out of resistance/support/pattern, a certain amount of movement before it takes off, a certain time of day, a short term reversal pattern?

-Are there any technical indicators that aid in this?

-Does the currency pair generally stay within an average range for the day?

-Look for anything that would allow you to enter into the big move as it is happening (see Simple Non-Farm Payroll Forex Strategy (NFP) ).

-Where could I exit?

-This is very important – more important than the entry!

-What signals are present once the move has topped or bottomed and started to reverse?

-If my entry criteria disappear, can I use that as an exit?

-How can you stay in the move to capture the bulk of it, but also not give up too much profit when it reverses?

-Are there any indicators that aid in this?

-Would a trailing stop have allowed me to capture a large profit? If so, what should my trailing stop be?

-Would a fixed number profit target work (ie. if stop is $100, then profit target is $200, $300, etc.)

-Does the currency pair generally stay within a certain percentage move for the day? (all pairs have average movements per day)

-Money management – is the trade worth taking?

-From the entry point you identify, what is your risk in dollars based on your position size ?

-What is your potential profit?

-Based on the above two answers, was the trade worth taking (see Day Trade Better Using Win-Rate and Risk-Reward Ratios )? If the risk is too large, or you are getting into moves too late you will need to adjust. If you are giving up too much profit when prices reverse, you will also need to adjust.

-Other things to consider

-Does this signal you identify for entry occur at other times, and not just before large moves? For example, are you going to get a lot of false signals?

-Can you cut down on false signals by only trading a certain time of day, adding indicators, or filtering out certain patterns?

In short, you want to analyze your charts looking for opportunities. Examine those opportunities and construct how you turn those opportunities into real money, without exposing yourself to excessive risk. Once you have gone through several opportunities in this fashion you will be well on your way to creating profitable forex strategies.

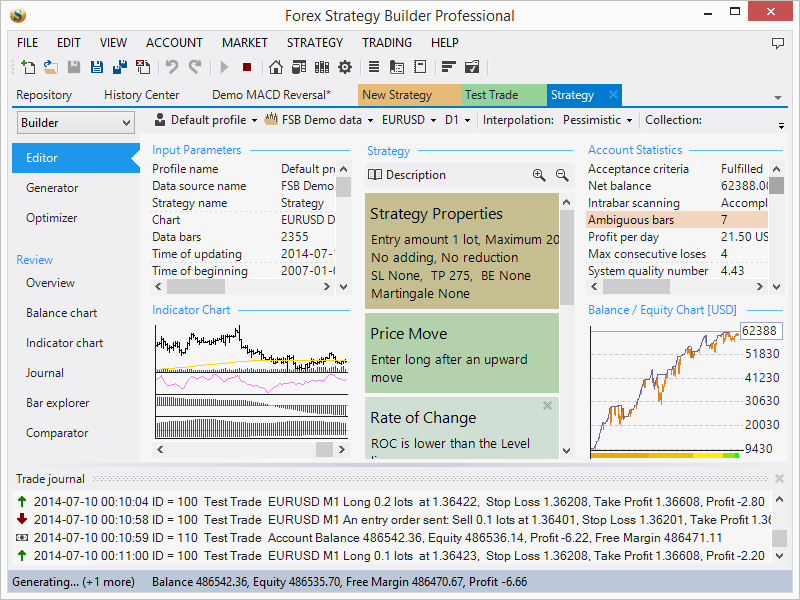

See if the strategy worked on recent movements, looking for at 20 or more trade signals. Check for profitability by adding up the wins and losses and getting a net result. Then check to see if the strategy works on upcoming movements. If it does, then start trading it in real-time on demo data (see 5 Step Plan For Forex Trading Success ). If you produce a profit in the demo account (only using that strategy) each month for at least two months, then consider trading the strategy with real capital.

Over 300 pages, forex basics to get you started, 20+ forex trading strategies, how to create your trading plan for success.