Forex Stop Loss Hunting 2 Simple Ways To Avoid It

Post on: 26 Июнь, 2015 No Comment

Forex Stop Loss Hunting-2 Simple Ways To Avoid Getting Caught

Posted by Mangi Madang on October 17th, 2014

Today, I called one of my friends and he told me he found it frustrating when he is trading the bounce of major support and resistance levels and his stop loss always seem to get knocked outhe suffers a loss and guess what happens next?

The price bounces back in the direction he was hoping for initially but unfortunately he is not in a trade to make profits off that move.

So, really, what’s the problem and what’s going on?

Don’t you find it peculiar that sometimes the price just goes up or down past a significant resistance or support level just enough to knock your stop loss out before heading back in the direction which you correctly analysed?

What is this phenomenon?

Ive seen it happen on my trades many times.

It sometimes looks and feels like somebody must exactly know where my stop loss is and they just engineer price just go there and get me out and then the market goes in the direction I thought it would go.

This is called Forex Stop hunting / forex stop loss hunting .

Forex stop loss hunting is not fictionits a fact.

Stop hunting does exist in the currency trading and in this article, I will explain why there are people/large financial firms that employ this technique of wiping out your stop loss for their benefit .

FOREX STOP LOSS HUNTING-WHY AND HOW IT HAPPENS

When traders enter a trade, most will place a stop loss. These stop losses are placed generally around:

- recent highs and lows

- fibonacci levels

- above resistance and below support levels

- just above/below trend lines

Now, there are big players in the forex market that trade with huge orders and they dont trade like you and me-the retail traders.

I mean, they trade huge orders.

These big forex players have huge orders that they need to get filled, when they initiate it. So when they initiate a position, a substantial order needs to be filled and price can easily go against them-this comes as they create a large imbalance in the supply and demand.

Remember this important point: the forex market moves if there is liquidity. The less liquidity there is, the market does not move at all.

So what these big players want is liquidity and so they need a location where they will be capable of filling orders with zero to minimal slippage.

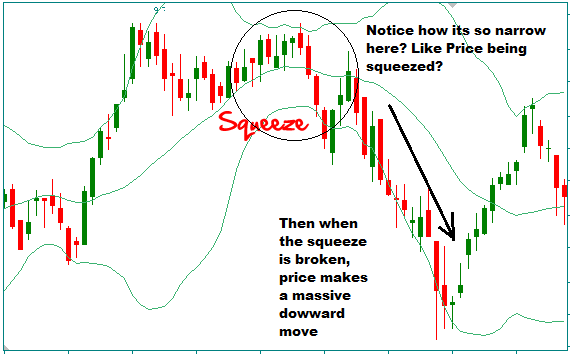

When they want to initiate these massive order, they need to run up price/run down price to these levels of accumulated stop loss orders and running the stops. This will help them fill their large positions.

How are they going to do that? Well, first, they will have some information of where all the stop loss orders are and that are sufficient enough that once these stop loss get knocked can fill these big firms massive sized orders.

HERE ARE THE STEPS INSTITUTIONAL TRADERS ENGINEER STOP LOSS HUNTING

Lets say a big forex trader is trying to sell EURUSD and it has a massive order to fill. Now, lets say that EURUSD is now almost near a big resistance level. Heres what they will do:

- They will wait for price to hit the resistance level (as an example)

- They will enter a large order to push prices up past that resistance level.

- This will cause the market to shoot up past that resistance level.

- This next situation is like a shark in a feeding frenzy! All those traders who have their stop loss a few pips above the resistance level will get stopped out.

- Also there will also be lots of buy stop orders just above the resistance levelthese are traders who are hoping for a breakout of the resistance level to the upside. Their buy stop orders will also get activated and they will be smilingthinking they got into a buy trade at the right time. But soon the smiles will be wiped of their faces. And because of that, prices continue to go up, hitting more of stop losses.

- Then right after that, a massive sell order will be placed by the big forex player(s) and this will push the prices lower.

- Now those traders who had their buy stop orders activated are not longer smilingtheir stop loss are being hit. This also helps to push prices down. (Remember, they buy to open a trade initially, and they have to sell to close itso the hitting of their stop loss is actually a sell trade happening! So this also adds to pushing the price down)

Now, there will also be lots of traders still sitting on the sidelines waiting to see what happens on that resistance line.

The failure of the price to close remain or close above the resistance level will give them the confidence to enter short(sell) orders. This further strengthens the downward move and price will continue heading down because now the buyers are exhausted and sellers take control.

2 SIMPLE WAY TO AVOID STOP RUNS

The only way to escape from stop loss hunting is dont trade. But seriously, if you dont trade, you wont make money.

So knowing how and where these institutional traders engineer stop runs, you have to be a bit smart yourself too. Heres what you can do to avoid these stop runs.

- place wider stops

- place no stop loss initially and then place stop loss later when the market has settled.

(3)Bonus Option: Dont trade! (But I guess, this will be out of question