Forex scalping system strategy

Post on: 26 Апрель, 2015 No Comment

By george.UK, January 24th, 2010

Forex scalping is the foreign exchange technique which is based on short term time period and is a chart which is usually meant for maximum five minutes duration. It involves quick buy and sell transactions over few minutes in order to earn good profits. Money exchangers usually dislike Forex scalping but its trend is rapidly increasing.

The scalpers have to increase the per pip dollar values to take up profit which is similar to the conservative transactions in this regard. It appears a bit scary but provides people with the foreign exchange in a quick manner. Its major and basic purpose is to give quick trade and exit opportunity for the traders. It is beneficial in cases of overnight transaction requirements due to its short time frame nature. So the scalpers would not undertake trades that involve long term profit prospects. When the cost of pip bought is lower, the chances of loss are low. But it is always the aim of scalpers that they succeed in making high value pips. For this they make up Forex charts for just few minutes ranging from one to five minutes and show up trends of currency that they want to exchange. In a quick way the interested people trade with them and hence scalpers earn profits on the specific time values of a currency like dollars or Euros.

The Forex scalping involves maximum liquidity. Hence the scalpers do not accumulate currencies for longer duration of time as it is against scalping strategies. The Forex transaction in which high risk is involved usually make high profits. The scalpers earn good profits in short period of time as they are high risk takers. The chances of loss are high in such foreign exchange market transactions. If the scalpers increase their per pip value even if they have very few pips, they leave the foreign exchange market quickly with the similar profits as the other traders earn. The Forex scalping is a good means in which one earns quick and easy profits.

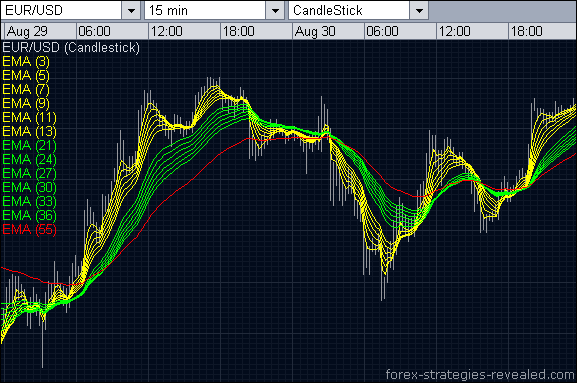

The basic requirement for the scalpers is the technical analysis ability as they have to analyze and represent the market situation in a short period of time. If they will have good analytic reasoning they will better perceive the profit chances and hence would earn profits. Otherwise, loss is obvious and inescapable. The scalp charts can be prepared using certain software programs. In fact now mostly scalps are made using such software. It is considered as the most risky form of currency trades. It opens position for few minutes and exits at the same pace which may depend upon the luck of scalper. The few minute entrance may not succeed in getting clients. But it is also facilitating the traders who need currency exchanges. It involves the leverage which reveals high risks. The brokers have special bias against the Forex scalpers because they find it difficult to get good market share in the presence of these scalpers. But in short, scalping is becoming increasingly popular form of currency trade.