Forex SavvyForex Technical Analysis Techniques and Strategies

Post on: 30 Июнь, 2015 No Comment

Understanding technical analysis is vital to your success in the currency market. Most professional forex traders rely on technical analysis to make their trading decisions, and so should you.

So what is technical analysis? It’s the study of market action used for the purpose of forecasting future price trends. Put more simply, technical analysis looks only at the prices with complete disregard for why those prices are acting the way it is. The reasons behind the price action are already reflected in the price so are therefore irrelevant to our analysis.

Some fundamentalists look at technical analysis with distain. Fundamental analysis focuses on the underlying economic forces of supply and demand to determine where the market is going. They do not believe in technical analysis.

But the fact is… technical analysis works.

The reason that so many traders depend on technical analysis is because it works. History repeats itself, and patterns emerge. Technical analysis will be able to identify these patterns so you can profit from them.

I personally don’t care why the price of a currency is going up. I just care about making money. Technical analysis will provide you the tools and techniques to help you make the right decisions.

The Art of Charting

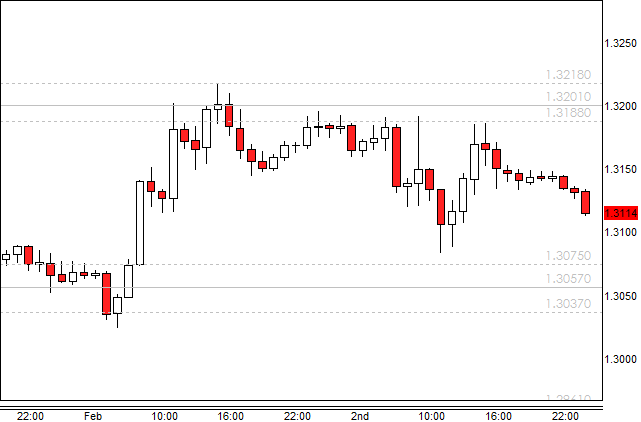

Learning to read charts is essential to gain a full understanding of technical analysis. It is the building blocks of the more advanced topics.

Start by understanding the basics of bar charts and candlesticks charts.

Once you understand the basics, discover what all those analysts are referring to when they talk about support and resistance. Support and resistance levels are important to predicting how prices will react when they reach a particular support line or resistance line, and more importantly, how they will react when they break such lines. Click here for a full explanation of support and resistance.

Once you understand the basics, then you can start unlocking the power of trends. Trend following is the most important concept you will ever need to know. Once you know you are in an uptrend, all you have to do is to go long and sit back and relax until the trend I is over. Learn how to recognize trends by learning to draw trend lines the right way.

In addition to drawing trend lines, there are lots of continuation patterns and reversal patterns that have some predictive value. I would not rely on these patterns completely because it is quite subjective, but it is still good to be familiar with them.

Moving Averages – Indicator for the Trending Market

There is more to technical analysis than reading charts. Quantitative analysis gives you a different perspective. Technical indicators based on numbers can be easily tested and quantified, which can be applied more easily to mechanical trading systems.

The most widely used technical indicator is the moving average. It has become the basis for many trading systems, and can be used to generate reliable buy and sell signals. It attempts to determine the beginning of trends, and also the reversal of current trends. Click here to learn how to profit using moving averages.

Another technique based on moving averages was developed by John Bollinger, which is aptly named Bollinger Bands. It places bands that are two standard deviations above and below the moving average, and by looking at the chart, one can see that prices are overbought as it touches the upper band, and oversold when prices touch the lower band.

Moving averages are excellent indicators in trending markets. However they are not as useful in markets trending sideways.

Oscillators – Indicators for the Non-Trending Market

Sometimes there is not a noticeable trend going on. The market is said to be choppy or trending sideways, which occurs when prices fluctuate horizontally.

Oscillators are the best indicators for a non-trending market.

The most basic oscillator is the measure of momentum. It tries to capture the rate at which prices are changing. It generates a buy or sell signal when the momentum chart crosses the zero line.

Other oscillator indicators like the relative strength indicator (RSI), stochastic, and the MACD oscillators are used also to determine whether the market is overbought or oversold.

Summary

Technical analysis can be subjective, and definitely is more art than science. You can not master technical analysis just by reading about it. You must apply it, and see the principles in action for yourself. Only then will you have enough confidence to trade successfully using technical indicators.