Forex risk management strategies for controlling risk while trading forex_1

Post on: 11 Сентябрь, 2015 No Comment

Forex risk management strategies

Learn about the basic strategies for controlling risks while trading Forex

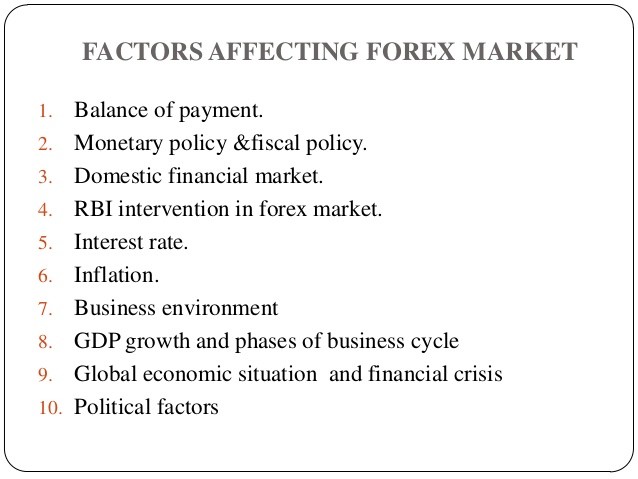

The Forex market behaves differently from other markets! The speed, volatility, and enormous size of the Forex market are unlike anything else in the financial world. Beware: the Forex market is uncontrollable — no single event, individual, or factor rules it. Enjoy trading in the perfect market! Just like any other speculative business, increased risk entails chances for a higher profit/loss.

Currency markets are highly speculative and volatile in nature. Any currency can become very expensive or very cheap in relation to any or all other currencies in a matter of days, hours, or sometimes, in minutes. This unpredictable nature of the currencies is what attracts an investor to trade and invest in the currency market.

But ask yourself, How much am I ready to lose? When you terminated, closed or exited your position, had you had understood the risks and taken steps to avoid them? Let’s look at some foreign exchange risk management issues that may come up in your day-to-day foreign exchange transactions.

- Unexpected corrections in currency exchange rates

- Wild variations in foreign exchange rates

- Volatile markets offering profit opportunities

- Lost payments

- Delayed confirmation of payments and receivables

- Divergence between bank drafts received and the contract price

There are areas that every trader should cover both BEFORE and DURING a trade.

Exit the Forex market at profit targets

Limit orders, also known as profit take orders, allow Forex traders to exit the Forex market at pre-determined profit targets. If you are short (sold) a currency pair, the system will only allow you to place a limit order below the current market price because this is the profit zone. Similarly, if you are long (bought) the currency pair, the system will only allow you to place a limit order above the current market price. Limit orders help create a disciplined trading methodology and make it possible for traders to walk away from the computer without continuously monitoring the market.

Control risk by capping losses

Stop/loss orders allow traders to set an exit point for a losing trade. If you are short a currency pair, the stop/loss order should be placed above the current market price. If you are long the currency pair, the stop/loss order should be placed below the current market price. Stop/loss orders help traders control risk by capping losses. Stop/loss orders are counter-intuitive because you do not want them to be hit; however, you will be happy that you placed them! When logic dictates, you can control greed.

Where should I place my stop and limit orders?

As a general rule of thumb, traders should set stop/loss orders closer to the opening price than limit orders. If this rule is followed, a trader needs to be right less than 50% of the time to be profitable. For example, a trader that uses a 30 pip stop/loss and 100-pip limit orders, needs only to be right 1/3 of the time to make a profit. Where the trader places the stop and limit will depend on how risk-adverse he is. Stop/loss orders should not be so tight that normal market volatility triggers the order. Similarly, limit orders should reflect a realistic expectation of gains based on the market’s trading activity and the length of time one wants to hold the position. In initially setting up and establishing the trade, the trader should look to change the stop loss and set it at a rate in the ‘middle ground’ where they are not overexposed to the trade, and at the same time, not too close to the market.

Trading foreign currencies is a demanding and potentially profitable opportunity for trained and experienced investors. However, before deciding to participate in the Forex market, you should soberly reflect on the desired result of your investment and your level of experience. Warning! Do not invest money you cannot afford to lose.

So, there is significant risk in any foreign exchange deal. Any transaction involving currencies involves risks including, but not limited to, the potential for changing political and/or economic conditions, that may substantially affect the price or liquidity of a currency.

Moreover, the leveraged nature of FX trading means that any market movement will have an equally proportional effect on your deposited funds. This may work against you as well as for you. The possibility exists that you could sustain a total loss of your initial margin funds and be required to deposit additional funds to maintain your position. If you fail to meet any margin call within the time prescribed, your position will be liquidated and you will be responsible for any resulting losses. ‘Stop-loss’ or ‘limit’ order strategies may lower an investor’s exposure to risk.

Easy-Forex foreign exchange technology links around-the-clock to the world’s foreign currency exchange trading floors to get the lowest foreign currency rates and to take every opportunity to make or settle a transaction.

Avoiding/lowering risk when trading Forex:

Trade like a technical analyst. Understanding the fundamentals behind an investment also requires understanding the technical analysis method. When your fundamental and technical signals point to the same direction, you have a good chance to have a successful trade, especially with good money management skills. Use simple support and resistance technical analysis, Fibonacci Retracement and reversal days. Be disciplined. Create a position and understand your reasons for having that position, and establish stop loss and profit taking levels. Discipline includes hitting your stops and not following the temptation to stay with a losing position that has gone through your stop/loss level. When you buy, buy high. When you sell, sell higher. Similarly, when you sell, sell low. When you buy, buy lower. Rule of thumb: In a bull market, be long or neutral — in a bear market, be short or neutral. If you forget this rule and trade against the trend, you will usually cause yourself to suffer psychological worries, and frequently, losses. And never add to a losing position. On Easy-Forex the trader can change their trade orders as many times as they wish free of charge, either as a stop loss or as a take profit. The trader can also close the trade manually without a stop loss or profit take order being hit. Many successful traders set their stop loss price beyond the rate at which they made the trade so that the worst that can happen is that they get stopped out and make a profit.

On the Easy-Forex platform, traders can change the setting of their Stop-Loss or Take-Profit rates while the deal is still running.