Forex Risk Management How much to risk per Forex Trade

Post on: 10 Сентябрь, 2015 No Comment

As a Forex trader, you’re the boss, all the control is at your fingertips. With this kind of power you can crash the plane or fly safely above the clouds. Unfortunately, the thought process of most traders will lead to the plane crash. Silly, obvious mistakes knock Forex traders out of the trading game, sometimes for good.

No matter how certain you are about a situation, there is always going to be the chance your predictions are wrong. Traders are focusing on ‘the big win’, risking way too much per Forex trade. Traders will neglect Forex risk management in the hope of achieving financial freedom in one swift move .

Successful traders know there are no guarantees in trading. That’s a key principle we as traders need to build our trading mindset around.

Trade risk management needs to be part of your overall risk management plan. Forex risk management should not be hard or complicated. There are some core ideas that will give you a better idea on how to trade safely and with confidence. So, how much should you be risking on your trades?

In this article I am going to compare some of the common risk management strategies which are repetitively preached in the industry.

Don’t place trades absent a stop loss

Before we go any further, I just wanted to brush up against the subject of stop losses. I still see traders today not using a hard stop loss. I can’t stress enough how important it is to always set a stop loss with your initial trade order .

You just can’t manage your risk without a stop loss. When a trader fires off a position with no hard stop, then the account is exposed with 100% risk. Think about the off chance of a power outage or equipment failure! What if a central bank intervenes at the same time, moving the market 1000 pips against you? You’re going to suffer huge, unnecessary losses.

No Stop Loss = No Money Management

Do you know how many traders I know that lost a huge chunk of their capital when the Bank of Japan intervened? Do yourself a favor, if you’re not placing stops it’s time to clean up your Forex risk management and start protecting yourself. Placing trades with no protective stop is one of the biggest newbie Forex trading mistakes .

Dynamic Forex Risk Management

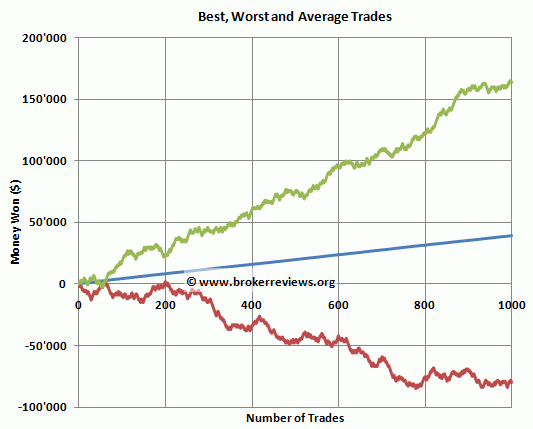

One of the most popular Forex risk management models, promoted heavily in the Forex community, is the ‘2% rule’. Before a trade is placed, you calculate your position size with your stop loss sizing to risk 2% of your available capital.

The idea behind this system is to limit losses in periods of draw down and to gradually increase your risk as your account grows.

It works like this; if you’re in the middle of a Forex losing streak. your account will be obviously be in the negative. Therefore when you risk 2% of your remaining available capital, you will be risking less money than your first initial trade.

The further into drawdown you go, the less you risk per trade. This is effective at slowing down capital disintegration when the markets are not responding well to your system. Sounds good so far, right?.

The only problem with this model is you must work harder to regain your losses. When using a risk/reward money management system, where you aim for 3x what you earn, your profits won’t be as good as they would have been before the losing streak.

Let me elaborate with an example…

Let’s say you start with a $5000 account. You lose a couple of trades and you’re down $1000. The account is now sitting at $4000.

@ 2% risk, you would now be risking $80, instead of the $100 risk taken @ $5000

If you use a 1:3 risk/reward ratio, your trade profits will be $240 instead of $300, making it a little tougher to recoup losses.

Have a look at the chart below. It shows the further you go into draw down the harder it is to recoup your losses.

Drawdown Percentage