Forex Risk Management_1

Post on: 12 Сентябрь, 2015 No Comment

PREVIOUS ARTICLE:

NEXT ARTICLE:

There are not too many trading “rules” that I pay attention to except for managing risks while Forex trading. I fully understand that my capital is my business and once the capital is gone, the trading business goes with it. Trading is not a game and if you don’t treat trading like any other business and take Forex risk management seriously, you will become part of the 90% that don’t succeed in this business .

Dont focus on making money; focus on protecting what you have. Paul Tudor Jones

Leverage Can Hurt

In order to grasp how important understanding risk is, it helps to understand that Forex is highly leveraged. This means that you only need a small amount of capital to trade a significant sized contract. Here is a simple example using the maximum 50:1 leverage available in North America:

50:1 means you need to have 2% of the total value of the trade in order to have your order filled.

If you have $2000 in your trading account, using 50:1 means you can trade a position size equal to $10000. Using a USD currency pair such as EURUSD, you could trade 1 standard sized contract ($100000) where each pip would equal $10. Your profits are based on the full contract amount and not the amount in your trading account. Your losses are also on the full contract amount.

First Line Of Defense

Whenever you read about Forex risk management, the first thing you read is about a protective stop. Stops are designed to protect you at a certain price point if the trade goes against you. If you are short, your protective stop sits above the current market price. For longs, your stop sits below current price.

There is a problem with protective stops that most people are not told about. Stops are a unique order in that they sit in the market as a limit order waiting to be filled. Once executed, they do have the risk of not being filled at that price as they are converted to market orders. Like all market orders, slippage is a risk although most times, this only happens during volatile times such as news releases or government intervention in a currency.

Remember the 50:1 leverage where you can make $10 per pip?

If you are long in the market and you placed your stop at 25 pips and were stopped out, you just lost 10% of your trading account. One loss like that can have you abandon your trade plan and revenge trade which will only lead to bigger losses.

Limit Your Exposure

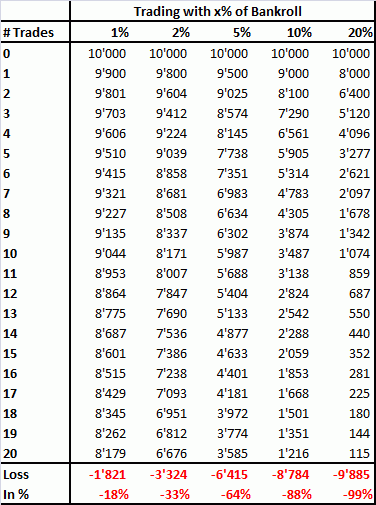

It is quite simple to stay afloat in trading. Assuming you have a decent trading method, one easy way is to limit your exposure to no more than 2% of your account. This number varies but rarely have I ever seen someone risk 5% of their account on one trade.

The most important thing in making money is not letting your losses get out of hand. Marty Schwartz

Risking 2% will allow you to run a string of 10 full losses in a row and still have money in your account. This assumes no trade management to take exposure out of the market when price is in your favor.

Using the 50:1 leverage example…..

I base the risk on the actual amount I have an NOT the leveraged amount. My risk per trade is now defined as 2500x.02=$50.00. Using the 25 pip stop from above, I am unable to trade $100000. I can trade 2 mini contracts at $10000 each. Each pip will be worth $2 and if I take a full loss, I only lose a manageable $50.

Managing risks while Forex trading can be as easy as understanding leverage, exposure and sticking to a defined trading strategy.

It’s Not Just You

There are other risks that can impact your trading that you have no control over. News releases such as FOMC or Non-Farm Payroll releases can cause sudden and violent swings in the market. You must learn about Forex trading risks that include releases that report on the financial health of a currency (country) and any interest rate increase or decrease. Knowing which reports can have a strong impact on the markets allows you to take precautions such as standing aside and not initiating a trade if currently flat.

It never was my thinking that made big money for me. It was always my sitting. Got that? My sitting tight! Jesse Livermore

Government intervention is not very common but it does happen and it mostly occurs in the Japanese Yen. This chart shows an intervention using a four hour chart that occurred in August 2011.

The USDJPY was trending down on the four hour chart and the daily chart. The Japanese are not fans of a strong currency and intervened. This is small compared to the intervention in October 2011 which rallied about 400 pips. There were many people short in this pair that got stopped out and the point is, they never saw it coming. This is why limiting exposure is the key to Forex risk management.

Reward To Risk Is Bunk

You will hear a lot about not taking trades without a certain reward to risk parameter as a means of managing risks while Forex trading. The thinking behind that is that I can lose two trades in a row and still be ahead if the third is a winner. Reward to risk is best guess and since trading is uncertain, using this in terms of a risk strategy really does not hold water. It can also hold you back from taking a trade that could run for hundreds of pips.

I do use reward to risk as a Forex risk management tool however but not in the way most books describe. I break my position down into usually two units. My first unit is exited for a profit if that profit is at least a 1:1 reward to risk. What this allows me to do is leave my stop at the current location and if stopped out, I lose nothing. This leaves me risk free and allows me to use the last unit as a runner to catch a trend if it occurs. This exact plan allowed me to withstand a small draw down years ago and ride a trade for 1021 pips. That actually funded my trading career.

When I take a trade, I assume the worst case scenario will occur. That is why my initial stop is always at an area where my analysis shows the trade would be wrong. Actually, my entire philosophy and how I approach risk is I assume every trade will be incorrect and how can I get hit with the least amount of damage.

The Key Is You

It is not complicated managing risks while Forex trading. Once you have an understanding of the variables in this post, you will then be able to work on you. Most people understand not to risk too much on one trade but the real psychological aspects of fear and greed are very real.

Out of fear, people will take small profits but will let their losers run. They hope the markets will come back but it usually never does before you get a margin call.

Margin Call: A demand by a broker that an investor deposit further cash or securities to cover possible losses.

Out of greed, people will throw capital exposure parameters out the window because they “know” this trade is the big winner. It isn’t and they end up taking a huge hit to their trading account and their beliefs about themselves.

One thing when you learn about Forex trading risks that isn’t covered enough is the risk of you not being a professional. It is not enough to know what to do if you do not implement them every time you take a trade. If I could break risk down into one word it would be discipline. Managing risks while Forex trading demands the discipline to follow sound trading practices and risk management.

I will leave the final words to Peter Bernstein. Understand this and you will grasp the importance of risk management: The fundamental law of investing is the uncertainty of the future.

PREVIOUS ARTICLE:

NEXT ARTICLE: