Forex Price Alerts Forex Early Warning

Post on: 19 Июнь, 2015 No Comment

The spot forex is a support and resistance market. Whatever tools and indicators you are using to trade the spot market, the experience can be greatly enhanced by understanding near term support and resistance along with longer term support and resistance levels for the currency pairs of interest.

Every currency trader and the major trading institutions are watching critical areas of support and resistance on the various currency pairs. If any major currency pair breaks through a critical support or resistance number it makes news everywhere on the fx news websites and on national and global news shows.

Support and resistance numbers on the currency market can be somewhat repetitive, the major support and resistance numbers on the market to repeat themselves over time as the currency pairs range or trend up and down.

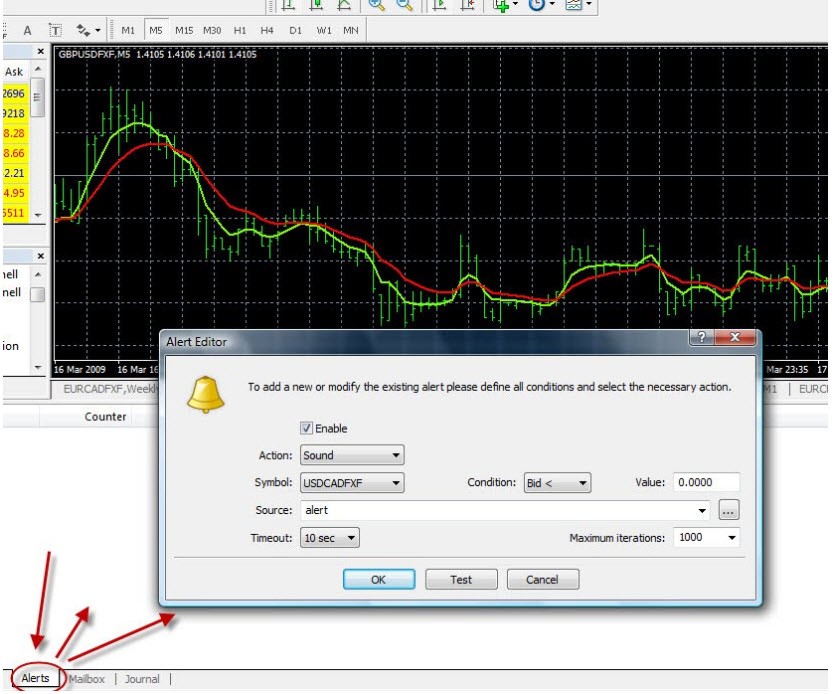

Monitoring the critical areas or levels of short term or long term support and resistance on the spot forex is easy using price alarms/alerts. You can use desktop alarms, alarms to wireless devices, or email alerts when levels are breached. Make sure your broker gives you the ability to set alarms and alerts. They should also provide free alarms or alerts to the desktop or phones on their trading platforms.

Price alarms can be used for the various needs of a forex trader. If a currency pair is currently trending, alerts can be used to notify a trader when the trend is resuming so you can intercept the movement. Another use of price alarms is to set alarms at specific support or resistance levels where the indicators can be reevaluated for profit taking. This assists with money management and on exiting trades.

Another use of price alarms is for setting alarms where double tops and double bottoms can occur, the double tops and double bottoms occur frequently and can represent entry points into complete currency pair reversals after large sell-offs or up cycles.

Alarms can also be set to alert a trader when a currency pair going in your favor. Then you can reset your stops up or down to improve your money management or entry management. Price alarms can also be set at the same price (execution price) of your partial limit orders or entry orders to notify a trader that an order was executed.

Also if a currency pair is not trending but trading in a narrow range a forex straddle alarm can be used to assist in to determining a breakout of the current price range.

In conclusion, the spot forex market knows where these critical short term and long term support and resistance numbers are, the other traders know where these numbers and levels are, and the institutions also know, this means you should know too. Dont waste time staring at the market. Monitor the market with alerts and go on about your business, but still be in the know as to when your favorite currency pairs are moving.

If you liked this article a more detailed disussion of support and resistance and price alarms is also available.