Forex Pivot Points TradingTools

Post on: 21 Октябрь, 2015 No Comment

20pivot%20points%20example.png /%

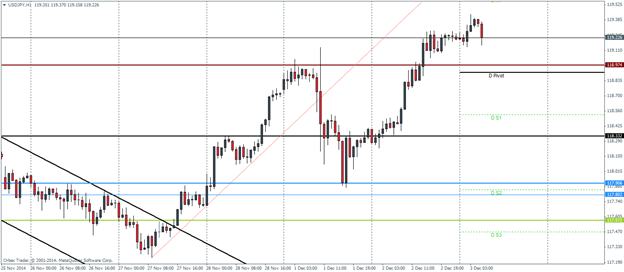

Forex pivot point is yet another and quite popular trading tool in technical analysis. Daily pivot points are derived from the previous days price action and are used to estimate the various resistance and support levels for the current days price action.

A pivot is defined as the central point on which something rotates or oscillates. In trading markets with continuously changing prices, the pivot of the price action means the samethat is, the center point on which the price action is expected to turn on either direction.

Daily Forex pivot points are calculated on the basis of the previous days price action. The most significant price points for any days price actions are the low, high, and closing price. A pivot is nothing but the average of these most significant price levels.

The pivot, calculated based on the previous days price action, itself is the first level of resistance or support. If the days price is below the pivot level, then a minor resistance would be expected at that level. On the other hand, if the days price is above the pivot point, then this level would be expected to act as the minor support. Pivot points are not calculated as stand-alone points but are associated with additional levels of resistances and supports. These associated levels are considered to be the main resistances and supports and support levels.

Pivot points also help in indicating the overall market sentiments. Bullish sentiments are indicated if the price action continuously remains over the pivot point, and bearish sentiments are indicated if the price action stays below the pivot point level.

Pivot Point Trading

- Determining the price when the currency pair may change the direction of movement.

- Possible resistance and support levels for the prices of the currency pair.

- Trend identification by comparing the current prices with respect to the current and previous days pivot points.

Support and Resistance Levels

When we calculate pivot points, we get three types of values, which are as follows:

- Pivot point price: If the price has been staying below the pivot point and suddenly breaks over it, then a change of direction toward the upside is indicated. Similarly, if the price action has been above this level and breaks below the pivot level, then further downward moves are indicated.

- Resistance levels: The resistance indicated by the pivot point is the minor one. As mentioned above, the pivot points are associated with additional resistance levels, and hence, even if the price action breaks the pivot points resistance, these additional levels are considered to act as the resistances. There are three resistances associated with the pivot point: resistance 1, resistance 2, and resistance 3.

- Support levels: Similar to resistance levels, we get three support levels, which are considered to act as supports if price breaks the assumed minor support of the pivot point level.

Trend situation and resistance and support levels

We have seen that the calculation of pivot points give us 3 resistance levels and 3 support levels. Now the question is that out of 3 support and 3 resistance levels which you should select as your stop-loss and take-profit levels? Here you need to analyze the strength of the trend. Le’s say the market is in uptrend and the trend is very strong then, you may like to use R2 as your first profit target and here you may like to take profit on half of your positions to target the next R3 as the next target. In such strong trends you may like to use S1 as your stop-loss by putting the stop-loss order slightly below the R1. In weaker trend we may like to use S2 as the stop-loss and R1 as the profit target. However such a position will go against the trading principle of having a good risk-reward ratio, as the risk will be higher than the expected reward. Same logic would be true to decide for stop-loss and take-profit targets for short-selling positions. To measure the strength of the trend we can use ADX indicator or even Ichimoku cloud .

Bullish and Bearish Sentiments

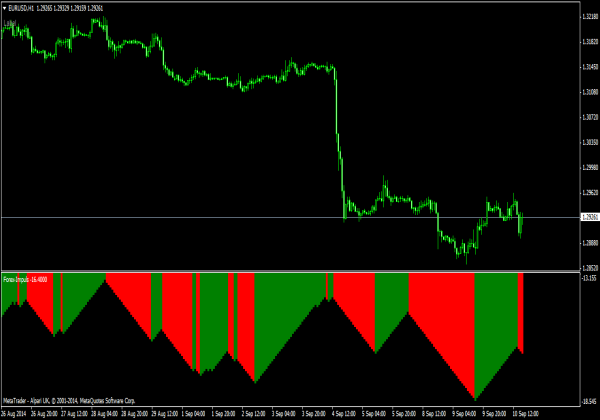

Bullish and bearish sentiments can be ascertained by noting the divergences on the subsequent periods’ pivot points.

Pivot point divergence

If the subsequent pivot points are going higher than the previous pivot points, then a bullish trend is indicated. On the other hand, if the subsequent pivot points are going lower than the previous ones, then it indicates bearish sentiments.

Time Frames for Calculating Forex Pivots

Since, unlike the stock market, the Forex market is a 24-hour market, there is always a debate on deciding at what time we should take the open, close, high, and low from each trading day. From a common point of view, the times that produce more accurate predictions are taking the open at 00:00 GMT and the close at 23:59 GMT.

Types of Pivot Points

Apart from the standard pivot points, which were the original ones, three other kinds of pivots are used in estimating the resistance and support levels. These different types of pivots have different formulas. You can see the formulas and also calculate the pivot points yourself using our online pivot point calculators.

The four types of pivot points are as follows:

- Standard Pivot Points

- Fibonacci Pivot Points

- Woodie’s Pivot Points

- Camarilla Pivot Points

Caution

As the daily pivot points are based on just the price action of the previous day, they do not tell us about the overall trend. It is always better not to use the pivot points in isolation. For better trading decisions, these can be used by first knowing about the overall trend situation by using other indicators, trend lines, or pure price actions.

Further Resources

You may check daily pivot points updates, including the resistance and support levels, on our daily Forex technical analysis pages. We update these on the basis of closing prices of 00:00 GMT. The same also gets updated daily at the bottom of this page. You may also use following online calculators to calculate the pivot points yourself:

Daily Updates of FX Pivot Points

You may check the daily updated pivot points and the associated support and resistance levels for various currency pairs on the following pages: