Forex Pivot Point Trading Tutorial Best Forex Indicator

Post on: 25 Май, 2015 No Comment

It is pretty hard to find a book that talks entirely on pivot points. However this does not mean that pivot point trading is not important at all. In fact, the pivot point trading strategy is commonly used by those big dogs commercial traders and it is something that most retail traders miss out on.

So what exactly are pivot points?

The pivot points are actually levels of strong support and resistance that are used by the commercial traders. When calculating these levels, you need to know the pre6ious day open, high, low and close values. Do not worry as you do not need to memorize the formula to calculate these levels, you can simply make use of those free pivot calculator that is available online and then input the values you have collected from your chart and it will automatically calculate the levels for you. Sometime you can even plot these levels easily using your trading platform.

Uses of Pivot Points

Basically I use the pivot points for a few purposes.

1) As an Entry levels . Since these points arekstrong level of support and resistance, I usually use them to predict future movement.

This is how you can use these levels for Entry

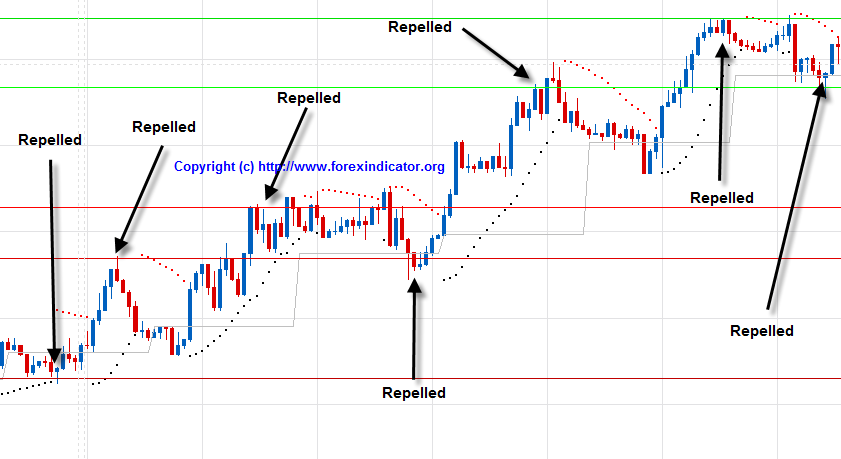

If you are in an uptrend and you see the price breaking above a pivot level, you can enter a LONG position and then place your stop loss below the pivot level.

If you are in an uptrend and you see the price repelled by the pivot level, you can enter a SHORT position and then place your stop loss above the pivot level.

For this method to work better, you can add some indicators like the MACD. CCI or RSI to help you with your entry decision.

2) As an Exit levels: Similarly you can also use these levels for planning your exit.

Now that you know how to enter a trade with the pivot points, I will now show you how I use these levels to exit my trade.

If I enter a LONG trade after the price break above a pivot level, I will usually place my target profit 10 to 15 pips below the next higher pivot level.

However if I enter a SHORT position after seeing the price being repelled by the pivot, I will exit my trade once the price move down to half the pivot length.

Forex Pivot Point Trading Example

In order to help you better understand how to make use of the pivot points in your trading, I have prepared an example to show you how you can integrate these levels into your trading.

In this example, I will be doing a swing trading which happens during the London Open session.

First of all, I will plot a 200 EMA to check the trend of the market. From the chart below, you can see that the trend is UP for this chart.

Pivot Trading Example

Next, I will plot the pivot levels using my platform and then draw the necessary trend line. As you can see from the diagram below, the price is moving toward the R1 level and since I am looking for a swing, I will look to place a SHORT trade.

At 0015hr, you can see the formation of a hammer which is a sign of reversal. At the same time, the price seems to be repelled by the R1 resistance level.

Although the price continues to move down after our targeted profit for this case, we should still stick to our exit strategy every time we trade this kind of strategy as not all trade will unfold the same way as this example.