Forex Pivot Point

Post on: 17 Июнь, 2015 No Comment

By greg22, January 24th, 2010

What is pivot point and how does it affect forex trading? Over the years they have assumed a lot of significance as traders and individuals haves used the concepts to determine resistance levels and critical support used for trading purpose.

The pivot point is said to be the level in which the market direction changes during the course of a trading day. It is through the use of arithmetic calculations along with the corresponding previous day high, low and close that these points are calculated.

The points so arrived at are critical support and resistance levels and both these together are known as pivot levels. These levels are a very popular way of ascertaining the way market will move during the day.

Past performance is used to determine the future course of action and in most cases the analysis give an accurate account of the forex trading to be done during the day.

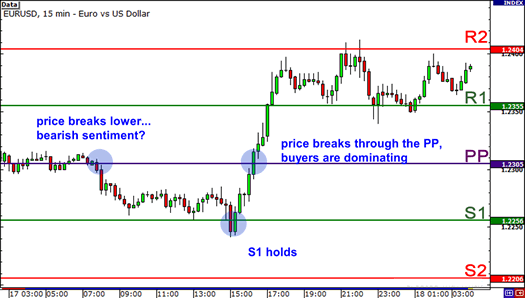

The level so arrived at is used to ascertain the first resistance and first support and second resistance and second support levels. Growing number of traders use the pivot point trading method as it has many advantages over the conventional way of calculating future trading.

Based on the pivot point you can determine if it is a long trade or a short trade. Let us look briefly at both these terms and what they mean. If the market for the day opens above the pivot point then it is said to be long trades and if it opens below the pivot point it is said to be short trades.

Using these points you can determine the exact time when you can exit the market and make a profit and avoid a loss. The resistance levels and critical support are known as breaks and they occur as soon as the market opens and a usually high amount of trading is done by traders all over the world.

The usual practice among traders is to look at the pivot points closely and then adjusts their respective portfolios accordingly. Sometimes the prices remain at the same level which could be between the pivot points level and resistance or support levels.

There are many strategies that have been developed using the pivot points but one of most popular one which is usually considered very accurate is the Japanese candlestick formation. This sort of formation is said to happen when the market trades below the pivot points for most part of the day then suddenly trades above it which forms a reversal formation. The brokers usually sell short at this point of time assuming that the price will fall below the pivot point once again.

An equally popular strategy of brokers is to see whether the prices obey the pivot point and thus confirming the importance of its use. In this you see whether the price breaks the pivot point level and then reverse back towards it. If the price passes through the pivot point then it is assumed that the pivot level is not strong enough and trading is not done based on these levels.

Pivot point trading in forex is an extremely popular way of trading and brokers all over the world swear by its effectiveness and accuracy.