FOREX Money Management_4

Post on: 29 Апрель, 2015 No Comment

Money management in FOREX trading is very important. You can not be a successful trader long-term, if you do not apply the basic principals of money management to your trading strategy, and every time you make a trade.

Money management is all about managing risk. A lot of books on FOREX present money management as a complicated matter, supporting it by complex hard-to-understand formulas. But, in the real life trading, its as simple as 1, 2 and 3.

You dont need these formulas to stay successful. All you need to understand is the basic reward/risk proportion. With every trade you risk a certain amount of money and you expect to get a certain predicted reward. Lets say you expect to win $100 and want to risk not more than $30 in this trade. Just divide 100/30 and you get 3.33:1 called profit/loss ratio.

When you test your strategy, you can get another number. The probability of winning over loosing. If this probability is between 55% and 60%, then you should enter the market only if the profit/loss ratio of your trade is greater than 2:1. Otherwise you will be loosing your money over a long term.

Also, before you start using your strategy on your life account, you need to know what your average profit/loss ratio is. You need to test your strategy and calculate the average profit and average loss. The average profit/loss ratio for the mentioned above probability of winning trades (55% 60%) should also be not less than 2:1, otherwise youll loose your money.

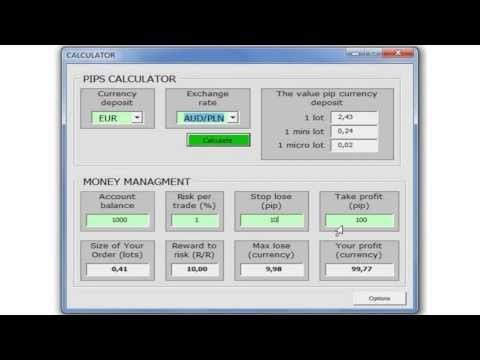

The last and very important thing is the percentage of your deposit that you can risk per trade. To calculate it, you need to test your strategy and find out the largest drawdown (several consecutive losses), and then multiply it by 2. Thats your risk. Then you can calculate lot size in such a way that in case of this large drawdown doubled, youd still have some money left on your deposit to cover the losses.

I found out that for most of intraday strategies, 2% of the deposit per trade is a golden rule of thumb. Of course, this number can be more, but in this case your strategy has to provide you with a lower drawdown and higher probability of winning trades.

If you want to learn more on how to apply money management to your strategy, maximize your profits and minimize losses, watch my video tutorial by clicking on the button below.

[button type=big link=http://go.tradingsignalsfx.com/how-to-calculate-take-profit-targets/ color=green]Watch Video [/button]