Forex Momentum Trading

Post on: 28 Апрель, 2015 No Comment

When youre trading forex, the first thing you need to understand is that the markets are bigger than you as an individual. This may at times seem obvious, but in actual fact many traders end up with skewed research data that implies the reverse, and causes them to back markets that might actually be in decline, and vice versa. Momentum trading is essentially following market trends, trading on the wider momentum of the market by looking at the bigger picture. Generally thought to be a longer-term strategy as far as forex trading is concerned, momentum trading looks to capitalise on events and announcements that reflect a wider image of the currency pairing youre trading, in order to help you cut down the risk and maximise the rewards in simply following the crowd.

What Youre Looking For

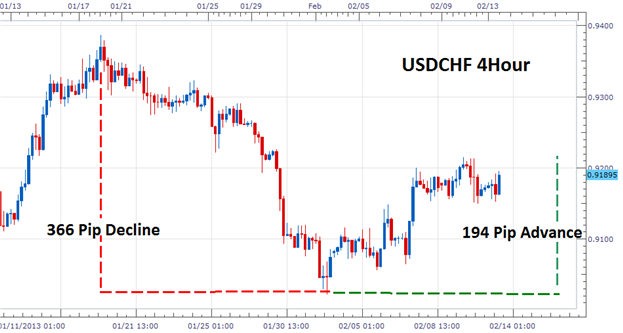

With momentum trading strategies, youre obviously looking for momentum as a primary factor in determining when and how to trade. Momentum is effectively the wider trend in pricing, so you should take care to examine the technical analysis and data points thoroughly once you think youve identified a trend. Look at price performance over a period of several months and look at performance over a period of several hours. The pictures being painted could be in stark contrast, and provided youre capable of holding off against minor variations in the market, getting on board a wider momentum shift can be good in terms of allowing you to ride up the price curve as markets continue to move generally in your favour.

Which Trader Does This Suit?

This type of strategy is most suited to the trader with a slightly longer-term outlook. As opposed to day traders who will be concerned with whats happening today, you might be more interested in whats happening this week or this month, and make trading decisions based on that premise. Of course, this means that you might have to weather the storm in the interim, particularly if youre highly leveraged, but the upside comes with larger potential gains from holding positions over a wider momentum arc.

Strengths and Weaknesses

Momentum trading draws its strength in numbers. If the market is moving definitively in one direction, you should too. Being a copycat here isnt something to be penalised, and the quicker you are to identify and leap on a wider trend, the more profitable it will be for you when you choose to close your position. On the downside, momentum trading requires either time or some direct market stimulus, both of which can pose additional risks to your capital. Deciding to what extent momentum trading fits in with your trading style depends on whether you have the risk appetite and capital resources to handle these risks, and some traders might naturally prefer a shorter-term strategy to turnover smaller returns more frequently.

Nevertheless, momentum trading can be a powerful strategy when deployed with forex, particularly in light of forex markets trending more obviously than others. By keeping an eye out for trends developing and looking at the bigger picture, you can use momentum trading to best effect to bring in less frequent but hopefully larger incremental returns.