Forex Markets Using the Bollinger Band Technical Indicator

Post on: 20 Июнь, 2015 No Comment

Bullish Join Date Feb 2008 Posts 41 FXO Shares 0 FXO Bonus 0.000 Thanks 0 Thanked 0 Times in 0 Posts

Forex Markets — Using the Bollinger Band Technical Indicator

The foreign exchange, or forex, markets are defined as the trading of world currencies. Entities such as large banks, governments, corporations, financial markets, and even individual investors trade over $1.9 trillion every day in international currencies. It is a growing market that is open 24 hours a day except on weekends, and it is unique in its global reach.

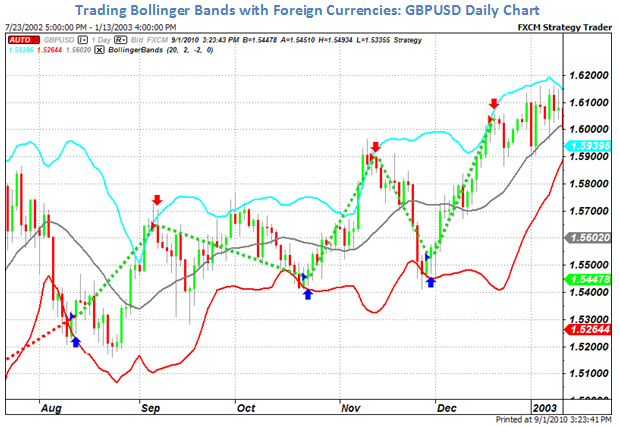

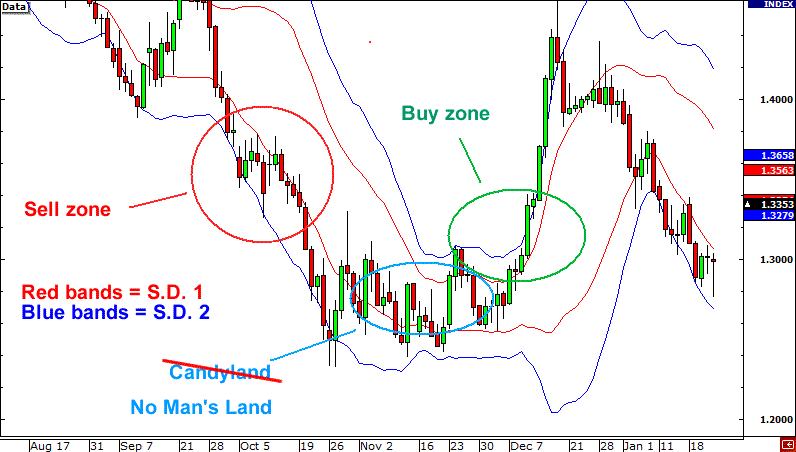

A tool on which some forex traders rely to tell them when to buy and sell is the concept of Bollinger Bands. Created by John Bollinger in the 1980s, this technical indicator was developed to define what is high or low relative to the current price of an investment. Bollinger Bands consist of three lines, the middle one being a simple moving average of past prices, usually calculated at 20 periods, which represents the trend during the immediate term. The upper band takes the values of the middle band and adds the product of the standard deviation, calculated out from the same number of periods as the moving average, and a set factor, typically 2, and the lower band is the difference of the middle band value and that same standard deviation product. These bands set a high and low range for each price represented on the chart, and are useful in determining patters based on any indicators that may have occurred.

As the standard deviation of the current price over a period of past data is used in calculating the upper and lower bands at a given point, the width of the distance between the two is a measure of volatility. In other words, the more the price of the investment changes over the short term, then the wider the band will become, telling the trader to expect big swings in price for the near future. This measurement of width is usually expressed as the bandwidth, and is calculated by subtracting the lower value from the upper value, and dividing by the middle value. The bandwidth of the bands is most often used to identify a particular trading opportunity called The Squeeze.

Because most liquid investments that are purchased and sold on open markets alternate between periods of low volatility and high volatility, a trading opportunity can be pinpointed by determining when the Bollinger Band for that investment has reached its lowest bandwidth in a set period of time. For equities this is typically six months, although in the forex markets it may be different. This six month low in volatility is known as a Squeeze, and traders should either buy or sell at that point, because a price breakout is likely to occur in the near future after this indicator. While the trader has now determined that the price is going to most likely move in one direction, the trick is to determine whether the price is going to rise or fall. This is somewhat more challenging, but other indicators can be relied on to help determine the direction, such as the relative strength index, the intraday intensity index, and the accumulation/distribution index. Once an educated guess has been made, the trader can either buy or sell the investment, in this case currency, for a nice profit.

By paying attention to a currency’s volatility, one can often determine when the price will be making a big move in the near future. Bollinger Bands can be a good measure of this indicator, and are a useful tool that many investors rely on when making trading decisions in the forex markets. By buying or selling when volatility is at an extreme low, a trader can take advantage of price breakouts that occur at times after these periods of price stability.