Forex Market Economic Indicators That Affect Forex Trading

Post on: 18 Апрель, 2015 No Comment

Economic Indicators That Affect Forex Trading

Economic Indicators That Affect Forex Trading

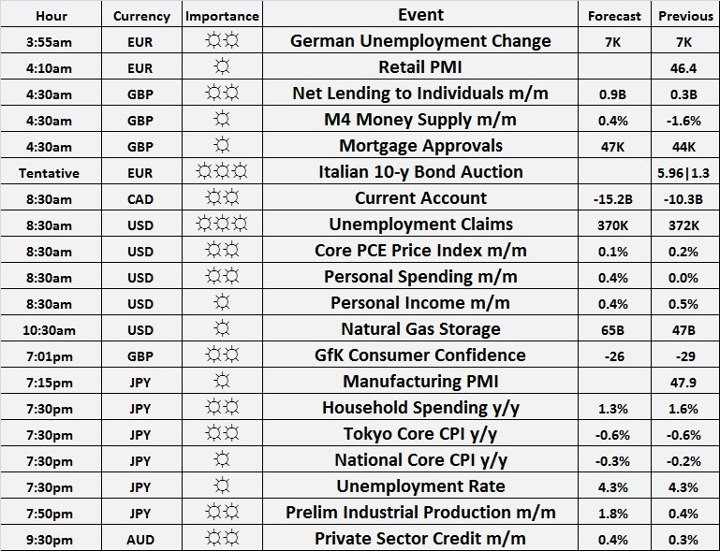

There are many factors that affect forex trading. When learning to trade forex, it is important to know and understand the various factors that cause the forex market to fluctuate from day to day. The foreign exchange market will change depending on the several economic factors that play a role in the movement of currency. Therefore, it is important to stay up to date with the

One of the top economic indicators used when analyzing the forex market is current events and the state of the economy of any given nation. Factors such as unemployment numbers, housing statistics and the stability of a countrys government can all affect the changes in currency markets. When a country is feeling good about the current state of affairs in their country, the foreign exchange will reflect this. When a nation experiences political unrest, large amounts of unemployed workers and inflation, the rate of the currency will also be reflected. Sometimes, this indicator tends to be overlooked, but can serve as an important gauge in the fluctuations of the market.

Another economic indicator that is used when looking at the foreign exchange market is the gross domestic product or the GDP. This is normally considered the widest and broadest measure of the economy in a country. The gross domestic product represents the total market value of all goods and services that are normally produced within any given country. This is usually measured in the time frame of a year, and not in weeks or months. Using a larger time period gives good statistics on the products and services that are produced in the country. This indicator is not used alone when forecasting the forex market. Usually the gross domestic product is considered a lagging indicator, meaning that is a measurable factor that changes after the economy has already began to follow a certain trend.

The third economic factor that is often used is the retail sales reports. This is the total receipt of all retail stores in any country. Usually, this measurement is not every single retail sale, but is a sample of diverse retail stores throughout the country. This is considered a very reliable and important economic indicator because of the consumer spending patterns that are expected throughout the year. This factor is usually more important that lagging indicators and give a clear picture of the state of the economy in any country.

The industrial production report is another reliable economic indicator in the foreign exchange market. This shows the fluctuation in productions in industries such as factories, minds, and utilities. The report looks at what is actually produced in relation to what the production capacity can be over a period of time. When a country is producing at a maximum capacity, it is considered ideal conditions for traders.