Forex Indicator Tips The best forex scalping system ever

Post on: 25 Апрель, 2015 No Comment

The best forex scalping system ever

The Best Forex Scalping System

First of all, Forex Morning Trade has very clear and easy to follow instructions,

Best Forex Trading Systems and Forex Scalping trading Methods

top rated forex strategies, news for forex systems best for forex profit, This article is part of our guide on how to use technical forex trading scalping. If you new in forex. we recommend the first part of the series on forex scalping.

Just as important as the basic concepts such as leverage and spreads to forex scalping, they are still minor compared to those associated with the broker, his attitude and preferences. Quite simply, the broker is the most important variable in determining the feasibility and profitability of a scalping strategy for all investors. A scalper is in control of its strategies, stop-loss or take profit orders, and its time frame for trade, but has no say in areas such as server stability, spreads, and attitude of brokers scalping.

Forex Scalping | Forex Strategies & Systems Revealed

Forex Scalping can also be called a quick trading, scalping is the one of the best forex system.

The best scalping strategy Forex Scalping Systems

Forex Brokers that Allow scalping systems. There are hundreds of brokers, who in the Forex market retail, of course, everyone has a technical capacity and business model to another dealer profile. These differences are insignificant for most long-term traders, swing traders, they are useful but not very important, but for day traders and speculators, they are the difference between profit and loss. At the very basic level, the distribution of a tax on gains and losses on the broker is paid for his services, but the relationship is much deeper. Take a look at various issues related to the scalping-broker relationship.

Small differences

A trader can not open and close the scalping or day trading strategies and one or two positions are more in one day. Although the cost is for the spread is an important variable, a trading style easily able to justify the relatively low cost to the broker. The situation is very different, however, for the scalpers. Since the scalp is opened and closed dozens of places in a short period, the cost of its activities are very important in its balance sheet. Here is an example.

Suppose a scalper opens liquidated and 30 positions in a single day in the EURUSD for which the spread is 3 pips in general. Assume also that its commercial dimensions are constant, and that 2 / 3 of its positions are profitable, with an average of 5 pips profit per trade. Let us also say that the average size of its loss is 3 pips per trade. What is his profit / loss excluding costs to contain the spread?

(Positions in Black) — (Items in red) = net income / loss

(20 * 5) — (10 * 3) = 70 pips in total.

This is a significant gain. Now we want to repeat the costs of distribution and calculation.

(Positions in Black) — (Items in red + cost of spread) = net income / loss

(20 * 5) — (10 * 3 30 * 3) = -20 pips total.

A nasty surprise awaits consider our hypothetical trader. The number of profitable trades were twice the number of those he loses, his average loss was about half his average salary. And despite this remarkable track record, collected his activity scalping a net loss. To break even, it would have an average net profit of 9 pips per transaction, everything else remains the same.

Now we want to repeat the same calculation with another broker hypothetical, where the prevalence is only 1 pip on EURUSD. The victory by 5 pips and 3 pips per case (the same scenario that was tested at the beginning) with a gap of one pip give us a result of

(20 * 5) — (10 * 3 30 * 1) = 60 pips in total profit.

Why is there such a discrepancy in the results? While the figures speak for themselves, we want the reader that, while we earn our money only on winning trades, we have to pay the broker for each position as we open, profitable or do not remember. And that’s the problem.

In short, we must ensure that we meet the broker with the lowest spread for the currency pair, we would like to select swap. A scalper, packets of different brokers account carefully before deciding to be a client of one of them a closer look.

Scalping policy

What is the policy scalping? While most established companies with a history of a significant customer base and an official policy of scalpers are thus free of their decisions, some dealers simply refuse to allow scalping techniques for clients. Other orders slow client process, and make an effort scalping unprofitable. What is the reason?

To understand the cause of this, we should discuss how their customer positions broker net before putting them to the banks. Assuming that the majority are the broker’s clients to lose money while trading what would happen if, at a time when the losses were of such magnitude that some triggered margin calls that could not be met to achieve? Since Forex brokers liquidity providers is liable for loss of profits or customers of their banks, they had been periodic crises of liquidity and even bankruptcy. To pay such a situation does not allow brokers on the net positions of the customer by exchanging against them. This is how a client opens a long position, the broker takes a short position and vice versa. As the result is two-fold in the opposite direction, that the overall burden is on the market to zero, the liquidity problem is solved, and the company is not affected by gains or losses in the merchant’s account.

But there is a problem with this situation. We mentioned that the dealer’s clients, the positions against the trades, and what if the client a profit by closing a long position, for example. The broker must inform the trade that have been opened to the net to close the trade trader long, and while he suffers a loss. And also, is not it a great encouragement for forex brokers to ensure that their customers continue to lose money?

Well, not really. First, the majority of the compensation is performed in-house, where the individual trader positions against each other, without the broker should not have their own funds calculated to commit. And position of the small remaining net (the net long or short position which, according to brokers net customer orders against each other remains), is generally a losing position, the cons-productive exchanged safely through the broker because it is a good established that the overwhelming majority of forex brokers lose money.

Now we understand that scalping is not necessarily a problem for a competent broker (and the occasional winners are not a problem for casinos), we are ready to understand why some brokers do not like so much scalpers. As I said, the broker must ensure the network stations traders against each other that their responsibility is minimal compared to banks. Scalpers interfere with this plan by the business in every sense, at times uncomfortable with sizes difficult celebrating not only forces the broker’s equity at certain times, but also ensures that the system is bombarded with a crowded store. Then there is the possibility that the broker’s servers is not just a flash, or modern enough to cope with the rapid flow of orders, and there you have scalpers profitable than the worst nightmare of a broker with a slow system outdated. Because scalpers provide a lot of small, fast positions on a short time, a broker of incompetence is not effective to hedge its exposure, and sooner or later, the dealer goes through the termination of his account or access to the system slows down so that the scalper must own statements leave because of his inability to act.

All this should make it clear that speculators need a broker with innovative, technologically competent and alert one that has the expertise and technical capacity of the large volume of orders trading scalping have traction. Without dealing desk broker is almost a must for a scalper. Like most jobs in the system of non-dealing desk (NDD) brokers are automated, the risk of external manipulation, as the system remains to be clarified, customer orders on its own (yet profitable, of course).

Strong technical aids

Scalping involves technical trading. In the very short period of fundamental preferred scalpers will have no impact on trade. And if they do, the market reaction to them is unpredictable and completely unpredictable. As such, a very sophisticated technique that includes a sufficient number of technical tools is a clear need for supplies for each scalp.

In addition, since the trader has received a significant amount of time, want to spend to view the display reads quotes, open and close positions, it’s a good idea, an interface that does not tire to choose for the eyes. A bright, graphically intensive platform to use and is pleasant to look at first, but after several hours of intense concentration, the look is more of a liability than an asset.

In addition, a platform that supports the simultaneous display of multiple time can be very useful for scalping, as it monitors price movements on the same screen. Although scalping includes short-term trading can raise the price action over time periods longer than beneficial to money management and strategic planning.

No sliding, no misquotes, the timely execution

We in the section on brokers scalping strategies, we must always try Scalper a competent, modern mentioned broker to ensure that their trading style and practices are welcome. But the rapid and accurate bids are to ensure that the trader with a major profit scalping strategy. Since scalping trades often in a short period of time, it must receive timely, accurate quotes on a system that provides a quick response.

Forex Scalping System How Does an FX Scalping Strategy Look Like? Scalping strategies. The Best Forex Strategy: 3 Things You Should Know, If it slips, the scalpers are not the most trade. If he is misquoted, it is lost so often that trade will suffer as impracticable. And we should not neglect the emotional stress that can be caused by such stress, the difficult market environment and inefficient. Scalping is already a stressful activity for the nerves, and we should not accept to suffer the extra effort to broker incompetence on top of other problems we have.

To conclude this section, we will add that scalping is a method of trading-intensive technique that requires a competent and effective broker with the state of the art tools. Nothing less will reduce profits and increase your problems.

Forex Scalping. NEW Tested Forex trading Systems or $600

How we make 600usd per day. Best forex trading. Only if you need Top forex trading systems tested on all brokers, New forex training courses and forex education.

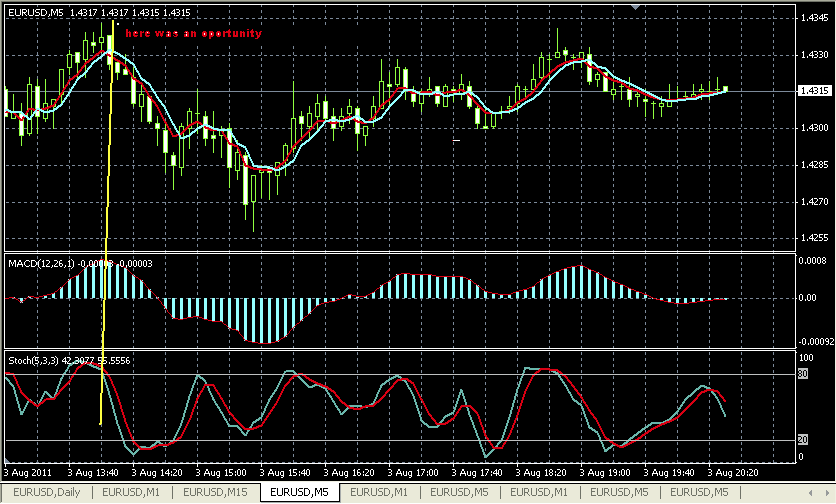

And bellow is one of the best forex scalping system. here is how to trade :

Trade between 3am est time till 11am est time

S/L 10 pips

Indicators and templates