Forex Indicator Tips heiken ashi strategy

Post on: 10 Апрель, 2015 No Comment

heiken ashi strategy

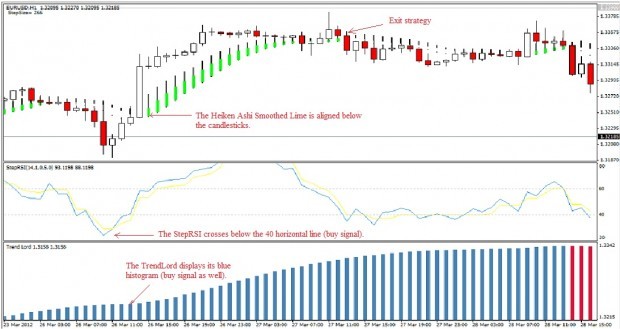

This is the second article in our series Heiken ashi. If you have not already recommend you check the first article on Heiken ashi indicator. In this article, I covered the background of Heiken ashi indicator, as calculated, and how it looks on the table. Heiken ashi is said to remove noise from candlesticks and behave much like the leveling properties of moving average. Traders use Heiken ashi to determine the relative strength of the trend and to pinpoint key turning points in price behavior.

The Heiken ashi indicator / application tool is essential beacon information, open, close, high and low, then smooths the unpredictable parts of the table in the same way as you move average. Merchants can then make better informed decisions, without distractions caused by the volatile price action.

How to Read Chart Heiken ashi

Note: in the past is not indicative of future results.The Heiken ashi candlesticks application reconstructed based on mathematical calculations that are fixed smoothing. Red means that bars retailers dominate the market, and white bars indicate that buyers are dominant. The Heiken ashi bars overlap in terms of traditional candle holders to give a complete presentation. Although it may take time to become familiar with the new presentation scheme, one can immediately recognize the cost of building momentum each of the three crises that tested the obvious support level of 82.54 USD / JPY chart for 15 minutes.

The key reference points when the color changes occur, which means a change in the dynamics between buyers and sellers. Trends are easier to follow and stick with, especially when one indicator is used for confirmation. The Heiken ashi indicator works well when support and resistance levels are evident.

As with any technical indicator, Heiken ashi scheme will never be 100% accurate. False signals can occur, but positive signals are consistent enough to give the Forex trader to edge. Skill in interpreting and understanding Heiken ashi bars must be developed over time, and recharge the tool with Heiken ashi another indicator is always advisable for another confirmation of potential trend changes.

In the next article on Heiken ashi indicator, we will put all this information together to illustrate a simple trading system Heiken ashi analysis.

Advanced strategy#12 (Heikin-Ashi-two-Bar-Strategy) | Forex.

Nevertheless Bollinger Bands are one important factor to Heikin-Ashi-two-Bar-Strategy mentioned above. Thank you for investing your time. So I know Heikin-Ashi-two-Bar.

The Heikin-Ashi technique is extremely useful for making candlestick charts more readable—trends can be located more easily, and buying opportunities can be spotted