Forex Hedging Strategies

Post on: 13 Май, 2015 No Comment

The Perfect Hedge Strategy

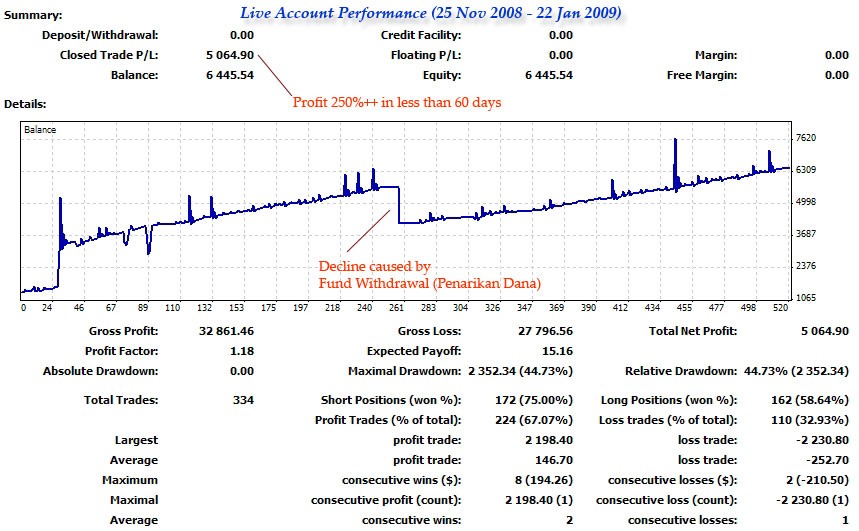

For those who loves to hedge like me, I’m sure that you already know about this popular Perfect Hedging Strategy where there’s almost zero risk involve. But for the sake of the newbies, I will going to explain here how to use this kind of method to trade the forex market.

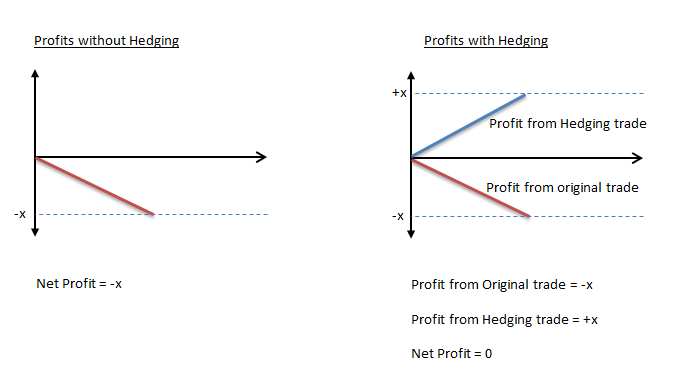

Another term for this strategy is known as The 100% (percent) hedge because both of your positions are going against each other — meaning you have an open position which is a BUY and a SELL at the same time. By doing this, you will never lose or win but you have to pay only for the spread. Take note that every online broker has a different rules and policies where some my charge lesser amount of spread than the others. If you are able to find a good broker that charge less spread then I suggest that you open an account but provided that you have done some researches regarding about their services.

The most preferred currency pair for this hedging method is the GBP/JPY pair because it pays the highest rate of interest. Going for the LONG order will accumulate you a positive overnight interest while going SHORT will charge your account with a negative. There are other currency pair which is better than the GBP/JPY and your assignment is to look for them.

The first important requirement that we need to have for this perfect hedging strategy is a good broker that pays a good amount of overnight interest rate. Second, we need to find another different broker that doesn’t charge an overnight rate on our opened position (this type of account are commonly known as Interest Free Account). What we are going to do for this two different types of broker is to open an opposing position which is a BUY for the broker that pays for holding your position while SELL on the non paying interest broker that you have.

All that remains for you to work is to balance the amount of invested capital on each of those two brokers to maintain an available margin. We need to avoid margin call that causes our opened position on the losing side to be automatically closed. The danger here is that the winning side is currently opened and it might suddenly change in direction.

Perhaps there’s still a risk for this strategy but it can only be avoided if you properly maintain the balance on each side of your account. So your broker’s transaction process on your withdrawal and deposit must be fast and without any delayed problems.

Perfect Hedge Strategy is really a wonderful and profitable method to trade the forex market but the problem is that most brokers are now trying to prevent traders from using this kind of system. There are numerous claims that a broker has closed and put on hold the trader’s account due to the issue of doing this kind of hedge.

If you know what you are doing and clever enough to cover your tracks, you will be making a huge potential of making money from your forex investment .

Posted by Richard at 1:24 AM