Forex Futures Trading With the Trend

Post on: 8 Июнь, 2015 No Comment

Forex and Futures markets offer excellent trend following opportunities for income on a daily basis. These opportunities occur most often at areas of confluence (an area that multiple trading methods agree with one another) which increases the probability of each trade’s outcome. Some of these probabilites would include: supply and demand zones. fibonacci retracements / fibonacci extensions. trendline. support and resistance and many others including trading indicators like stochastics, bollinger bands, keltner channel, RSI and MACD to name a few. Supply and Demand Zones in combination with Fibonacci Retracements are among the best and statistically hold a very high profitability factor for both futures and forex markets.

Trend Following offers Larger Profit

Trading With the Trend is a very important factor for every trade. Trend following will allow for larger profit margins and statistically have a higher win to loose ratio. Often traders get confused as to what the trend direction is, and which time frame they should be analyzing to determine if they are trading with the trend (trend following ), or trading against the trend (counter trend trading ). The direction should be determined dependant upon your style of trading including intraday, swing to long term. If you are looking for scalp intraday trades perhaps a 5min chart is sufficient. If you are looking to hold your positions throughout the day and/or overnight you would want to analyze the 60min chart for trend direction. The longer you plan to hold the trade the higher the time frame you should analyze for trend direction , supply and demand zones. and fibonacci retracements. It is good practice to remain consistent with the time frame you choose, otherwise confusion will once again become a factor.

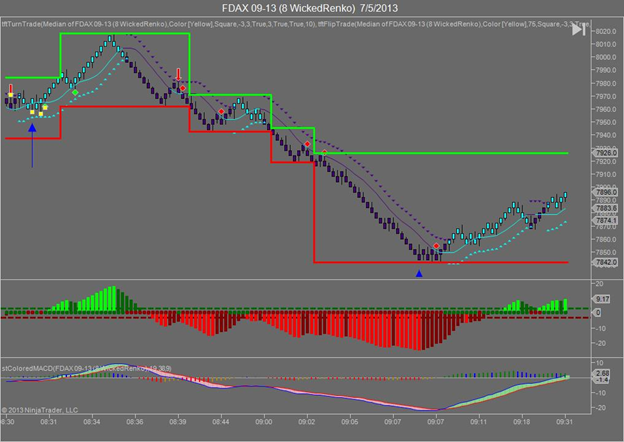

Trend development is is broken into segments: beginning, middle, and end. It is best to place your trades at the beginning and remove them at the end while remaining neutral in the middle. Using reversion to the mean, with market structure will provide the beginning and end of each trend. Below see how the break of the trendline along with market structure is used to develop the beginning of an uptrend.

20formation.jpg /%

After the beginning of an uptrend has been determined, look for a buying opportunity. Applying supply and demand zones with fibonacci retracements will give us a high probability entry point. Approximately %80 of trends give us these entry points, however in the event that the setup is not clearly shown, practice patience and wait for the next trading opportunity. The first step after the trend development is locating the supply and demand zone. Supply and demand zones are very different from support and resistance zones and should be treated as such. The supply or demand zone will give the actual entry for the trade. See the image below:

20Zone%20formed%20within%20Uptrend.jpg /%

To add proabability to the trade setup apply a fibonacci retracement into the supply and demand level. Using the fibonacci retracement tool pull from the origin of the move, to the most recent pivot. This gives you the calculations or percentages of how far price has retraced from the most recent pivot point, back to the origin of the move. If the supply and demand zone lines up with a common fibonacci retracement number, the probability of the trade has increased and has met all criteria to become an entry. The entry takes place in the supply or demand level and has given a potential trend following trade from the beginning. As discussed, trend following offers a higher profit margin which tells us to hold our trade.

20Retracement%20into%20Demand.jpg /%