Forex forecast

Post on: 22 Апрель, 2015 No Comment

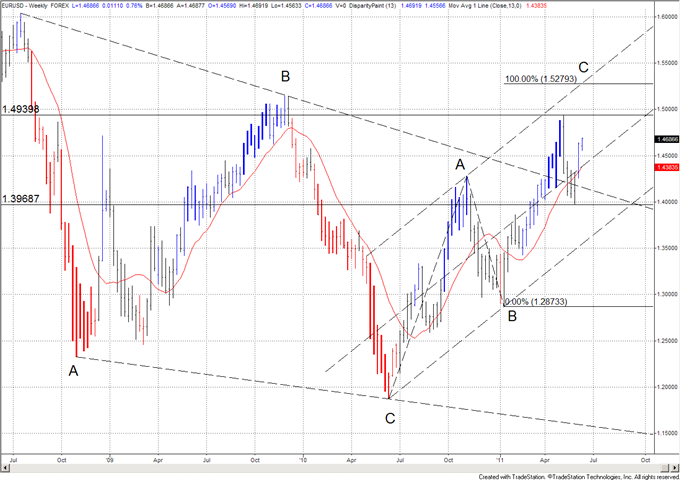

Daily Forex Analysis Euro vs Dollar 1st Septembet 2009

Forex Technical Analysis

With the UK market closed yesterday for a national holiday, trading volumes in the euro vs dollar were relatively thin, and as a result we saw a volatile day of forex trading on little news, with the candle ending as a doji, and perhaps more significantly and inside day or the Japanese term harami. This is often the first signal that a reversal is likely, although given the fact that we are in effect consolidating sideways, the signal probably has less weight on this occasion. Indeed the low of yesterdays candle seemed to find support from the 14 day moving average, with the close of the trading session balanced on the 9 day, both of which suggest that the euro vs dollar will continue to edge higher in trading once again. The key to the medium term remains the new resistance level now in place at 1.4450, and only a break and hold above here will signal a breakout and sustained move higher. With all three moving averages providing solid support my trading suggestion for today is to attempt small long positions intra day, but only as far as the initial target outlined above. Should we subsequently clear this level in due course then longer term trend trades may well profit from the move.

Fundamental Forex Analysis

The new month of fundamental news for Europe kicks off with German Retail Sales forecast to show an improvement from last time at -1.3% to a positive 0.7%, and if met will once again confirm that the recession is beginning to flatten as the long slow recovery begins. This is followed later in the morning with the German Unemployment change which is also expected to provide further good news for Europe with a forecast of +33k against a previous of -6k, although this good news story may be counterbalanced by the Unemployment Rate for Europe which is expected to show an increase once again from 9.4% last time to 9.5% today, although being a lagging indicator this fundamental news may not surprise the forex markets .

Two items of fundamental news dominate the US economic calendar this afternoon with ISM Manufacturing and Pending Home Sales, the first of which is expected to nudge over the psychologically important 50 level, indicating an economy in contraction to one in expansion, with a figure of 50.6 forecast against a previous of 48.9, but once again ( as in Europe) this good news may be balanced by Pending Home Sales which are forecast at half last time at 1.7% against a previous of 3.6%, but given we are still in the summer, this number may not concern the forex markets unduly. The day ends with several minor news items all of which are covered in more detail on the econimic calendar.

You can keep up to date with all the latest fundamental news on the economic calendar, latest currency news and live currency charts by simply following the links. I have also included details on an excellent ECN broker.