Forex Exit Limit Price

Post on: 30 Июль, 2015 No Comment

What Is Your Forex Exit Strategy?

In forex trading your exit strategy is the last part of your trade. First we dealt with the forex entry point strategy . After the entry point, we dealt with the management of a trade. If you have not read the money management page, then I urge you to do so at forex money management . If you have cover the entry and money management aspects of trading then you can proceed to the last part, which is exit strategy.

Forex Exit Strategy -Pivot Points

When do you take your profit? Forex market is very volatile. So I use the pivot points to plan in advance for my profits. The forex exit Limit Price can be placed in both a sell or a buy trade. This limit price is placed closed to one of the pivot points. Let us look at an example using a chart. The chart below shows a 15 minute time frame for a full day. There are 3 trade signals. The first was a sell signal that occurs below the pivot point M3. The target for this trade was the main pivot point P. This target was hit after 1hour 15 minutes. That is 5-15 minute candles. The second trade occur above the main pivot point and close to M3. So my target for this buy trade was the next pivot point resistance which was R1. This target was also hit about 1 hour 30 minutes later. The third signal (A sell signal) occured later in the day between M5 and R2 as seen on the chart. My target for this was R1 and it was hit a few hours later. Not visible on the chart. So that is how I use pivot points to place my forex exit limit price. No guess work. These pivot points are known at the close of the previous day trade. So you know them in advance. This helps a great deal. So use it to your advantage. Examine the chart carefully.

Click here for clearer picture

All you need now is discipline to follow these simple exit strategy, using clearly defined price targets.

Forex Exit Strategy -Using MACD

You can strengthen your exit strategy by using MACD, Signal Line and MACD Histogram. I use the settings (40,50,20). Lets look at a chart example of how using MACD can help in your exit strategy. On this chart, there were also three trading signals. The first was a buy signal that occured between pivot points M2 and the main pivot point P. So the target for this trade was M3 which was hit a couple of candles later. A second trade (a sell signal) occured between pivot points M3 and P. However, this trade was not confirmed, because if you look at the MACD indicator, you will notice that Macd histogram was still positive and MACD was still above signal line. This help to keep me out of the false sell signal. And surely, a few candles later, another buy signal occured between M3 and R1 with forex exit limit price at M4. And this price target was also hit.

Click here for clearer picture

Examine the chart in details and learn. This is simple, just follow the rules. Make them your own and test them until you are comfortable with the rules. Once that happens, you will begin to gain confidence in trading. It feels beautiful.

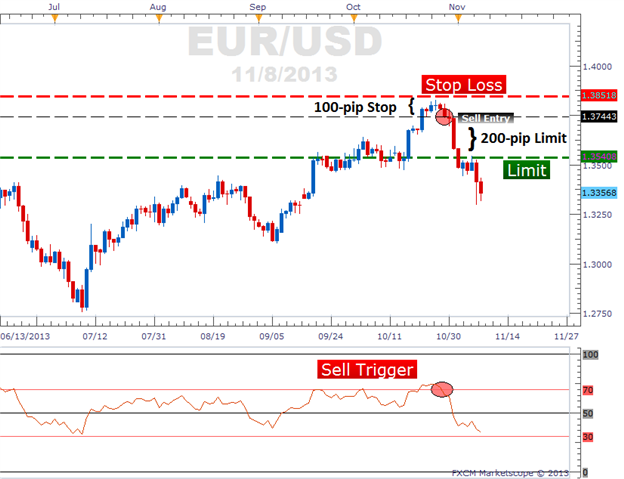

Forex Exit Strategy: Initial Stop Loss

Initial stop loss is your insurance as a forex trader. This is an exit strategy that enable you to limit your losses automatically. Small losses is the hallmark of successful traders. So focus on maintaining your initial stop loss as seen on the chart. Never change or move your initial stop loss.

See the chart below for an example of buy entry point and an initial stop loss.

Click here for clearer picture

*Important tip: Charts don’t lie. Never move or change your initial stop loss. It will save you when disaster strike.

See the chart below for an example initial stop loss on multiple sell trades.

Click here for clearer picture

Forex exit strategy: Conclusion

Don’t worry about those trade that move far beyond your target point. Stay focus on making consistent profits by following your daily forex exit strategy and the small profits will add up before long. If you use the 15 minute chart, you can get at least two trades pair currency pair. So there are 4 major currency pairs, you can add two crosses. If you take 2 trades, a pair that will mean about 12 trades a day. So you many trades to decide on. Choose the best and your should be fine. Follow your exit strategy.

If you came directly to this page from the search engines, then I encourage your to goto Forex Trading Tutorial . Get started with Trading Basics Menu. Forex Trading System