Forex dark cloud cover candlestick pattern

Post on: 9 Апрель, 2015 No Comment

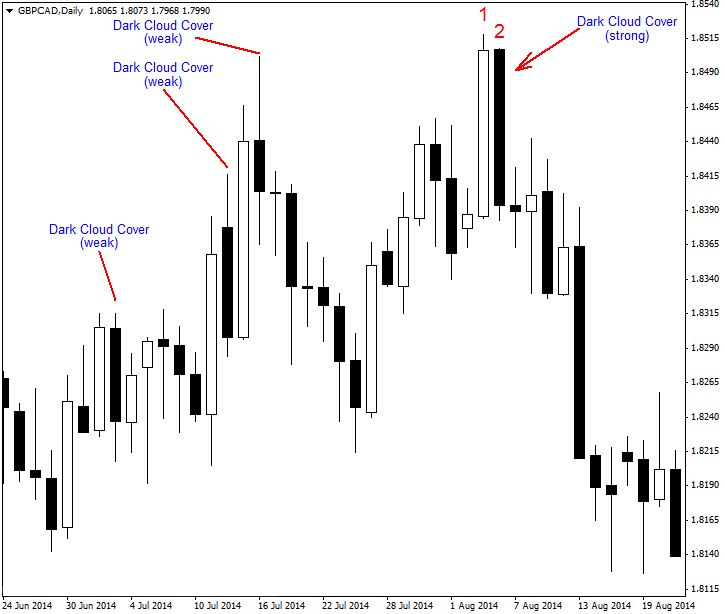

In this article we are going to explain one more pattern from candlesticks. Dark cloud cover pattern consists of two candles, one of them is long bullish body which is followed by another bearish candle. This is two candles pattern, it stands for reversal point and appears in upside trend.

The first candle has strong bullish body, the second candle should close below the midpoint of the previous bullish candle. That is why this pattern is called dark cloud cover, because the bearish candle covers the first white candle. Below you can notice how dark cloud cover looks like.

Reliability is high for dark cloud cover, traders depend on this pattern because this is a warning sign for bullish side and possibility for trend reversal remains strong. However, as you probably remember, you need to confirm the dark cloud cover before executing a trade. Alone candlestick pattern is just a signal for possible trade, this possibility we need to convert to higher possibility, if we can’t do it we just skip dark cloud cover candlestick and wait for other forex market situations.

Forex dark cloud cover

Support and resistance can help you out to define whether dark cloud is worth strong attention or not. When resistance barrier is strong and doesn’t let bullish strength to improve, you can note dark cloud cover as higher potential signal. We can expect, that bearish movement can bounce again from resistance level back to support level.

When dark cloud cover shadows are low (short), then a rate for candlestick pattern stands higher. The best option is when both candles doesn’t have shadows at all.

How to recognize forex dark cloud cover:

- bullish candle is followed by bearish candle;

- bearish candle closes below the midpoint of the previous candle;

- candlestick pattern appears in upside trend;

It is needed to mention one flaw for dark cloud cover pattern, in forex market it is very hard to find the perfect candlestick pattern. There is a gap requirement between first and second candle. It is very rare to find such situations in Forex market, there is a possibility when market closes over weekend and reopens after weekend, there might be a gap. You can ignore this recommendation for gaps or remove such pattern from your strategy.

Forex dark cloud cover

Trading with dark cloud cover we can set stop loss above candles highs, this is to be on safe side if pattern fails. Take profit should be set according to your strategy. Support and resistance levels can help you to deal with stop and take profit levels.

Take a look at EURUSD 1 hour chart below.

Forex dark cloud cover pattern

Support level was formed due to consolidation, then bullish initiated strong positive movement towards new highs. Upside trend is established. Resistance barrier still remains after previous market’s movements. You can notice how (2) dark cloud cover is formed near resistance barrier, bulls strength managed to breakout a little bit above resistance level. However, bears declined a price and later bears overcome bulls side.

This article is basically to become familiar with dark cloud cover pattern. Good luck in trading!