Forex Chart Patterns Popularity

Post on: 2 Июнь, 2015 No Comment

December 19, 2011 (Last updated on December 2, 2013)

Price action Forex trading, which doesnt involve any technical indicators other than the price chart itself, is rather popular nowadays. Even indicator traders sometimes refer to the chart formations in their analysis. Personally I trade mainly the chart patterns (in my manual trading account). So I would like to know what are the most popular chart patterns among the FX traders. Before proceeding to the poll, Id like to describe the possible variants briefly. I wont include a detailed description with chart examples for each pattern, but will just describe it with few words and will provide some useful links for further digging.

Head-and-Shoulders one of the most popular trend-reversing patterns. Appears at the top/bottom of the trend and consists of a left shoulder (a distinct top on the chart), a head (a higher top) and a right shoulder (a top at the left shoulders level). All three parts of the pattern should share the same neckline. Read more about Head-and-Shoulders :

Double Top/Bottom is another popular and reliable trend reversing pattern, which is similar to the Head-and-Shoulders pattern but lacks the head part. More info about Double Top/Bottom:

Triple Top/Bottom is a rarer version of the previous pattern. Some traders also believe that its more reliable than the double version. It can also be described as Head-and-Shoulders where the head part is of the same size as the two shoulders. Some information on trading Triple Top/Bottom chart formations can be found here:

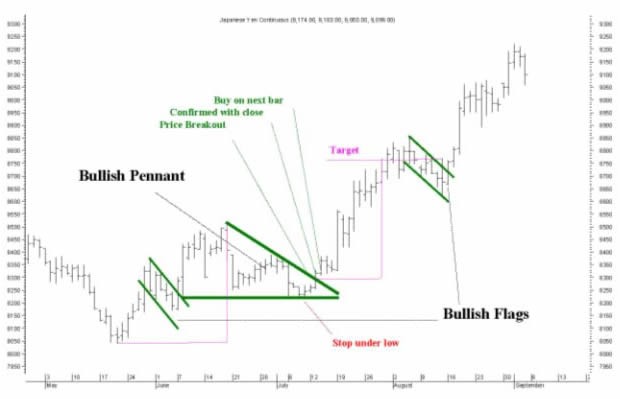

Channel is one of my favorite chart patterns, although not many traders find it a reliable signal generator. Channels can be horizontal, ascending and descending and are made of two roughly parallel lines that frame the price action for a given period. Some traders prefer to use the channel breakouts, others trade inside the channel, trying to capture the bottoms and the tops. More details about this pattern:

Ascending/Descending Triangle is a worthy trend continuation pattern, which, if broken on the correct side, offers a reliable trading opportunity, in my experience. Its formed when a price action creates a horizontal resistance line (support for Descending Triangle) and an ascending support line (resistance in Descending version). Obviously, there should be some previous trend to continue. Youll find more information about these triangles here:

Symmetrical Triangles are formed by two symmetrical ascending and descending triangles coincidental in time. Its a continuation pattern that may advance both bullish and bearish trend. Although it may be considered reliable, the breakout point is usually very tricky in symmetrical triangles. More info on it:

Wedge can be formed by a bullish or bearish trend and is a common reverse pattern. Its main difference from the Triangles is that its formed by two sloping (in one direction) lines. Please refer to these sources for details:

Horn is a trend reversal chart pattern described by Thomas Bulkowski. Its formed by two protruding chart bars that resemble a letter H. Its not a very popular pattern, but Thomas claims that it can be quite successful. Heres more on it:

Cup and Handle. as well as the inverted Cup and Handle, is a tend continuation pattern with a great level of reliability but a low frequency of occurrence. Its formed by a rounded ( U-shape ) bottom (top for an inverted version) followed by a short-term correction. See more about Cup and Handle:

Diamond chart pattern takes a form of a rough diamond a symmetrical rhombus. It needs to be located either at the trends bottom or top, because its a reversal formation. Personally I think of it as a rather unreliable figure, but many successful and professional currency traders (including Peter Brandt and Thomas Bulkowski) consider it a significant reversal signal. More info on this chart pattern can be obtained here:

Inside Bar is probably one of the simplest, yet one of the most effective and, finally, the most misused candlestick chart patten out there. Its a trend reversing pattern and it requires a previous strong trend to reverse it. The pattern is composed of a container bar and the actual inside bar, whose low and high should be higher and lower than the low and high of the container bar, respectively. More info on trading the Inside Bar pattern:

Hikkake a failed Inside Bar pattern. This chart pattern consists of two bars one Inside Bar and the following HHHL or LLLH bar. Sometimes this pattern works wonders, sometimes it fails several times in a row. More about Hikkake can be learned from the following resources:

Pin-Bar or Pinocchio bar is a reliable, but barely definable, formation of three candlestick bars. The first bar is called the left eye, the second bar is the actual pin-bar and should have a protruding wick far behind the left eye. The third bar is the right eye and thats where the pattern trading happens. Some resources on Pin-Bars :

Shooting Star/Bullish Hammer one of the basic reversal Japanese candlestick patterns. The Shooting Start is formed by a long bullish bar at the end of an upward trend followed by a candle with a long upper wick, small body and no bottom wick. The Bullish Hammer is similar: a bearish trend should end with a long bearish bar that is followed by candle with a long bottom wick, short body and a non-existent top wick. If you are interested in this patter, you can browse the following webpages:

Evening/Morning Star is trend reversing candlestick pattern. Evening Star requires an upward trend, ending with a long bullish candle, followed by a rather small bullish candle and finally reversed by a long-sized bearish candle. Morning Star is an inverted Evening Star. Read more about both of them:

Evening/Morning Doji Star is a candlestick pattern that is extremely similar to the Evening/Morning Star but the middle bar is a Doji a very small candle with no body at all, but with some short wicks. Its still a reliable reversal signal. Learn more about this pattern:

Dark Cloud/Piercing Line is another popular reversal candlestick pattern. Its formed at the end of the trend. Dark Cloud is ending the bullish trend. The last rising bar is followed by a candle that opens above the previous close but is bearish and closes below the mid-point of the previous bar. The Piercing Line is simply an inverted version of the Dark Cloud. See more about them:

Bearish/Bullish Engulfing is detected when a trend is ending with a candlestick that is completely engulfed with an opposite pattern. Bearish engulfing means that the last candlestick should have an open below the previous bars low and a close below the previous bars high. Bullish engulfing means a candlestick that opens below the previous low and closes above the previous high. More explanation here:

Gap is a concept describing a difference between the previous bars close and the current bars open. Usually, its assumed that the bigger is the difference, the more reliable is the signal. The market will try to fill the gap by rising or falling to reach the previous bars close level. Weekly gaps are particularly reliable signals in Forex. More on gaps: