Forex Chart Patterns

Post on: 21 Май, 2015 No Comment

Chart pattern formations can give forex traders an early indication of a trend reversal, trend continuation or breakout. The best chart patterns to trade currencies are listed below.

Chart Patterns Index:

Chart Patterns | Written by Aboutcurrency

Triple Top formations are reversal patterns with bearisch bias, this pattern is not often seen in the forex market. Triple Tops are identified by three consecutive highs of similar (or almost) height with 2 moderate pull backs in between (neckline).

Chart Patterns | Written by Aboutcurrency

Triple Bottom formations are reversal patterns with bullish bias. Triple Bottoms are identified by three consecutive lows of similar (or almost) height with 2 moderate pull backs up in between (neckline peaks).

Chart Patterns | Written by Aboutcurrency

At it’s most basic level, Rising Wedge formations are bearish continuation patterns and look similar to triangle patterns (ascending triangle, descending triangle, and symmetrical) because of the converging trendlines( support and resistance) and narrowing price ranges(forms a cone).

Chart Patterns | Written by Aboutcurrency

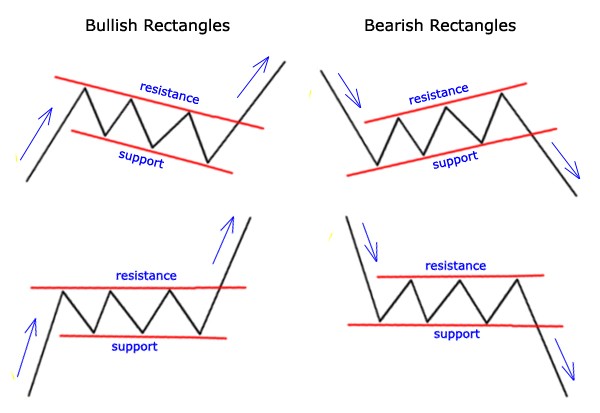

A Rectangle or Box is a continuation pattern and describes a price pattern where supply and demand seems evenly balanced for an extended period of time. The currency pair moves in a tight range, finding support at the rectangle’s bottom and hitting resistance at the rectangle’s top.

Chart Patterns | Written by Aboutcurrency

The Head and Shoulders Top marks a reversal pattern in an uptrend market and is extremely popular among currency traders. The pattern consists of 2 Shoulders, 1 Head and the Neckline (support).

Chart Patterns | Written by Aboutcurrency

Pennants and Flags are short-term continuation patterns and are among the most reliable of all continuation patterns, they are formed when there is a sharp price movement followed by a consolidation phase (sideways action), thereafter the previous up or down trend is expected to resume.

Chart Patterns | Written by Aboutcurrency

At it’s most basic level, Falling Wedge formations are bullish continuation patterns and look similar to triangle patterns (ascending triangle, descending triangle, and symmetrical) because of the converging trendlines( support and resistance) and narrowing price ranges(forms a cone).

Chart Patterns | Written by Aboutcurrency

Double Top formations are reversal patterns and often seen to be among the most common (together with double bottom formations) patterns for currency trading. Double Tops are identified by two consecutive peaks of similar (or almost) height with a moderate pull back in between (neckline).

Chart Patterns | Written by Aboutcurrency

Double Bottom formations are reversal patterns and often seen to be among the most common (together with double top formations) patterns for currency trading. Double Bottoms are identified by two consecutive lows of similar (or almost) height with a moderate pull back up in between (neckline peak).

Chart Patterns | Written by Aboutcurrency

The ascending triangle chart pattern shows two converging trendlines (support levels & resistance levels) and is a bullish formation that usually forms during a currency pair uptrend as a continuation pattern.

Chart Patterns | Written by Aboutcurrency

This pattern is similar tho the ascending triangle chart pattern but reverse, it shows two converging trendlines (support levels & resistance levels) and is a bearisch formation that usually forms during a currency pair downtrend as a continuation pattern (downtrend will continue).

Chart Patterns | Written by Aboutcurrency

This pattern shows two converging trendlines (support levels & resistance levels) and is (1) a bearisch formation that usually forms during a currency pair downtrend as a continuation pattern (downtrend will continue) or (2) a bullish formation that usually forms during a currency pair uptrend as a continuation pattern. (uptrend will continue)

Divergence is a term which often comes back in forex technical analysis, it occurs when the price of the underlying currency pair and the indicator move in opposite directions. A bullish divergence can predict future upturns, while a bearish divergence can predict future downturns.