Forex Chart Pattern Trading Analysis

Post on: 11 Август, 2015 No Comment

True and False Price Breakout

False First Breakout

The first breakout through a striking level with is most often a false breakout so that not only the stop orders at the striking price level get triggered (stop running) but also the stop orders of some breakout traders, who entered at the breakout of the important chart level. The true breakout might or might not occur depending on the intention of the market manipulator. The false first breakout often occurs with time frames / candle duration of 1 hour and above, where arguably more breakout traders try to catch a breakout than on smaller time frames. But it is usually also visible on smaller time frames. So, the false first breakout is aimed to fool the breakout traders, see also Forex Price Manipulation .

If the first breakout is not immediately retraced back to catch the stops of the triggered limit orders of the breakout traders then most often price is retracing back to the breakout level later, particular after another important stop level got cleared.

The market price manipulation is working against popular trading strategies and ensures that the chances to gain profits in trading remains low (no free lunch). In regards of this, the popular mainstream strategy to let winning trades run and to use small stops seem to be questionable if market often retests the breakout level to clear the stops of the breakout traders.

The false first breakout is also aimed to fool some breakout traders who are using momentum trading strategies/ filter strategies. Momentum traders are often entering the market after a strong surge in momentum/ strong recent candle at the top/ low of the candle with a limit order while often using a small stop. So, a false first breakout through the high/ low of the the momentum candle is aimed to catch the stops of these breakout traders.

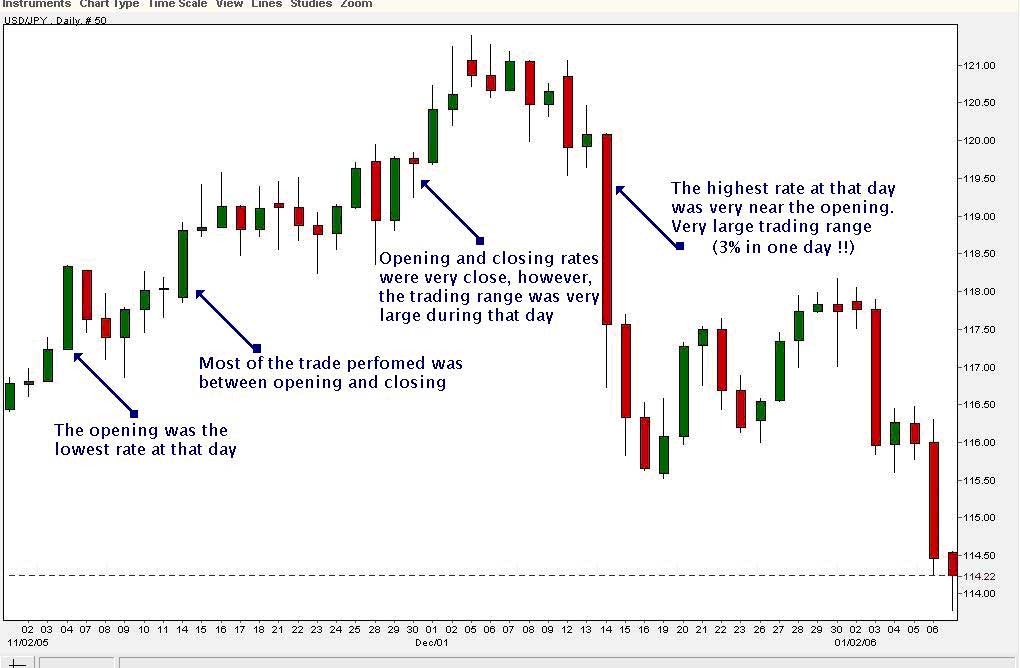

Breakout Timing

Market often breaks Support/ Resistance either for a true price breakout or false price breakout/ shake out (stop fishing) with the beginning of a new candle of the higher time frame particularly if the previous candle of the higher time frame closed at support (with a bearish candle) or at resistance (with a bullish candle). The new candle then often penetrates the level for a new low/ high particularly within the beginning of the new candle (e.g. hourly/ 4-hourly, daily but also 5 min candles..)

In another way, if a strong bullish or weak bearish candle closed at resistance/ support then the next candle is likely to break this level for a true or false price breakout. Before the true breakout occurs market most often retraces back slightly to catch the stops of the breakout traders. A true breakout is more likely to occur if market already cleared the breakout limit orders above a striking level — see also Forex Price Manipulation .

What Time Zone to use

London Time Zone (GMT +0 / GMT +1) is recommended for Forex Trading (Considering 4 hour and daily candle chart) and for the calculation of Pivot Points