Forex Candlestick Reversal Bar Trading Strategy » Learn To Trade

Post on: 28 Июнь, 2015 No Comment

Forex Candlestick Reversal Bar Trading Strategy

Below I talk about a Forex Candlestick Reversal Bar. one of my favorite Trading Strategy I use when trading from horizontal support and resistance areas of the daily charts. Often we see a trading range develop on the major pairs and following the simple laws of market rotation, we can trade reversal bar entry triggers from the higher resistance and lower support points of the trading range. Enjoy the forex video and remember to keep your trading simple as always.

Related Trading Lessons

Video synopsis – Forex Candlestick Reversal Bar Trading Strategy

In this video we are looking at how to trade forex price action horizontal levels and price reversals on the daily chart, nothing intra-day, I discuss how I made a 3 to 1 risk to reward daily time frame trade.

Only clean charts in this video, no indicators, just price bars at significant horizontal levels.

Price action actually means the activity of price or the ebb and flow of price itself, the facilitation of price from a to b then to b to c.

It is very important that people realize that applying anything over their charts is second hand lagging data. A price-only daily chart shows you everything you need to see, which is the raw price data for each day, all you should be thinking about is plain vanilla price action.

Draw levels at the start of each week and leave them on the chart until they are no longer valid.

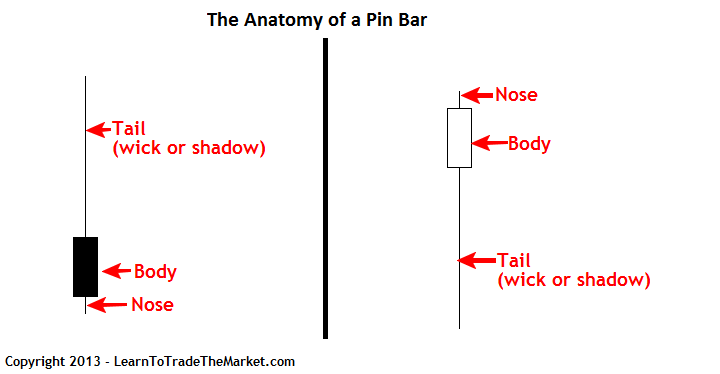

The video shows a price bar reversal at 0.8120 on AUDUSD, we had a false break of this key level, the long tailed candle in the video is a pin bar reversal, this shows us the market is likely to reverse lower or at least consolidate.

When we have a resistance point and a price action sell signal as we did in this video it is called a confluence of sell signals, confluence of signals is what we want to see before entering any trade.

In this video I got filled almost perfectly at the next bars high because I enter certain pin bar setups at the 50% level of the range of the pin bar with a stop above the high of the pin bar. Looking to make 3 times our risk, our risk was 70 so reward is 210.

How you read the market or interpret these signals comes with experience and screen time, price action is a work in progress, you need to spend at least 10-20 minutes a day looking for setups after the daily close. You won’t get good at price action trading without effort.

March Membership Special: This Month I’m Offering 25% Off My Forex Trading Course, Daily Trade Setups Video Newsletter, Live Trading Forum & Support Line, Ends March 31st — Join Here.