For Higher Stock Returns Vote Republican Or Democrat

Post on: 16 Март, 2015 No Comment

Conventional wisdom in the United States suggests that stock returns are better when a Republican president is in office. This belief is fostered by the Grand Old Party’s traditionally pro-business, anti-tax platform. Democrats, on the other hand, are traditionally associated with an anti-business, tax-and-spend platform based on using taxation policies and welfare programs to redistribute wealth from affluent individuals and large corporations to people at the lower end of the socioeconomic scale. Despite these well-established characterizations of each party’s position, a 2003 study conducted at the University of California’s AndersonSchool produced numbers that reveal significantly better stock market returns when the nation’s highest office is held by a Democrat. Read on to find out more. (To learn more, read Do Tax Cuts Stimulate The Economy? )

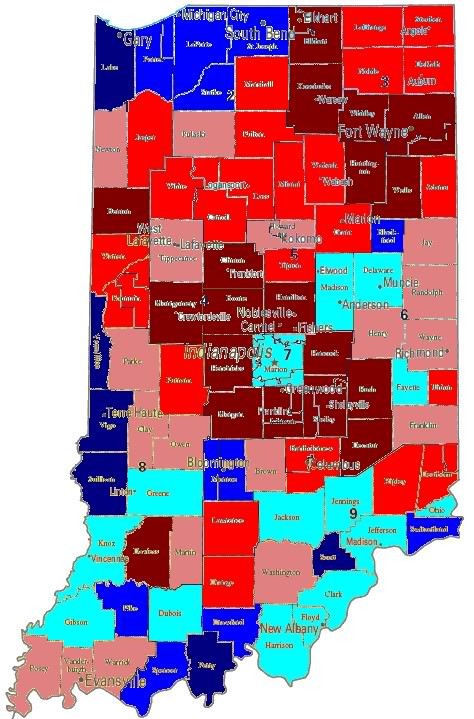

Figure 1: Excess returns of CRSP indexes versus three-month Treasury bill, 1927-1998

Further investigation reveals the results were generated by higher real returns and lower interest rates under Democratic administrations. Business cycle fluctuations showed no correlation to the results, demonstrating statistically significant outperformance for the Democrats regardless of underlying economic conditions. Value-weighted portfolios posted a steady 10% premium in favor of the Democrats, while equal-weighted portfolios came in at around 20%. (Read more about recognizing business cycles in Understanding Cycles – The Key To Market Timing .)

Examination of additional business cycle variables revealed that expected returns (those anticipated by the markets) were 1.8% higher under the Republican administrations analyzed in the study, while unexpected returns were 10.8% higher when Democrats were in power, suggesting that stock market results may be driven by Democratic policies that surprise investors. Interestingly, the results do not show up in close proximity to election dates, but rather grow over time during the president’s term.

Coincidence?

Could it really be that the so-called anti-business party actually generates better results for business than the business boosters? Analysts, experts, soothsayers and sages have used everything from Super Bowl winners to women’s skirt lengths to predict stock market performance — does using the political party in power to predict the market fall into the same category of off-the-wall (and generally unreliable) indicators?(Read about more supposed market predictors in World’s Wackiest Stock Indicators .)

It’s tough to say. President Eisenhower (from 1953-1961) was the only Republican to hold office during a statistically significant period of market outperformance, while President Roosevelt (1937-1941) was the only Democrat to preside over a massive underperformance. Furthermore, an equal number of presidents from each party (two and two) held office when the numbers came in roughly at par with the benchmark index. Overall, the small size of the sample (just 18 administrations) brings the results into question.

Similarly, the study’s authors cite data mining as another potential flaw. While the stock market return results hold true for the president, there is no similar correlation based on which party holds a majority in Congress. However, despite the potential flaws, extensive testing of the data suggests a legitimate connection between the data and the returns.