Fear And Greed Drive Trade Cycle

Post on: 16 Март, 2015 No Comment

Published in the Herald Sun, Melbourne — November 2012

By Karina Barrymore

Ever get deja vu that feeling youve experienced something before or youre going around in circles? Dont be too surprised to realise that you probably have been at this point more than once, depending on your age.

The good news is, if you learn to spot the patterns, you can outsmart even the deepest investment or cyclical downturn, taking advantage of the lows and profiting at the highs or at least not losing all your money when the big one hits.

According to AMP Capitals head of investment strategy. Shane Oliver, cycles are crucial information for investors.

Investors ignore cycles at their peril, Mr Oliver says. Periods of poor returns invariably give way to periods of good returns and vice-versa. Cycles are endemic to economics and investment markets. Some are regular, some just rhyme. Despite attempts to end or subdue them via economic policy and regulation, the cycle lives on. Most cycles take their lead from the current economic conditions but they are then either magnified or minimised by investor sentiment, Mr Oliver says.

Dale Gillham chief analyst at private investment company Wealth Within, says people have the greatest impact on cycles with fear and greed the key drivers of how good or bad a cycle will be.

One of the questions I get asked a lot is when is the best time to invest. This question correctly implies that there are both good and bad times to invest in the share market, Mr Gillham says.

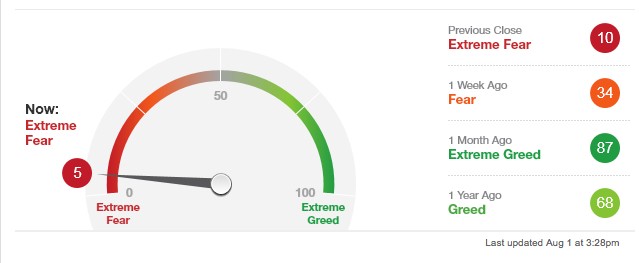

All markets, not just share markets, run in cycles from low to high and back again, and quite simply all cycles are dictated by the human emotions of fear and greed.

These emotions have caused cycles to expand or contract in both time and price. Although industry experts suggest you cannot time the market, tracking cycles can be just as beneficial The exact timing of a high or low is not something that is consistently achievable by even the best experts, Mr Gillham says.

Rather, the study of cycles allows investors and traders to determine the likely direction and when that direction may change.

If you are prepared, you can indeed time your entry and exit into and out of a market. Investment and economic cycles Long-term cycle Share markets typically go through long term, or secular, bull and bear phases, between 10 and 20 years.

Secular bull markets are where the trend is for shares to increase, secular bear markets, where the trend was for shares to provide poor or volatile returns.

Business cycle-This is the most talked about, typically three to five years.

After a few years of expansion, inflation or a similar economic hiccup leads policy makers to raise interest rates, to slow spending and tighten money supply.

This slows economic growth.

To overcome this, interest rates are cut again to encourage spending.

Short-term sentiment within the typical three-to-five year business and investment cycle there are also short term swings, often referred to as corrections.

Learn how to gain the required knowledge to ensure your success in the share market click here .