Fast Stochastic (REI Substitute) Setup

Post on: 16 Март, 2015 No Comment

These contributions are from Mike Bruns, world class trader. Mike’s clear thinking and charts have allowed for many traders to finally get it. His generous sharing and teachings have helped me raise my level of trading. Reinforcing the concepts of trading with the trend, his knowledge of the bond market and other markets. Mike also gives after market hours seminars for members, they are exceptional. My personal thanks Mike. NQoos ![]()

If this is still you. choose today to change. This chat room is now closed

Fast Stochastic (REI Substitute)

Location: With the Trend

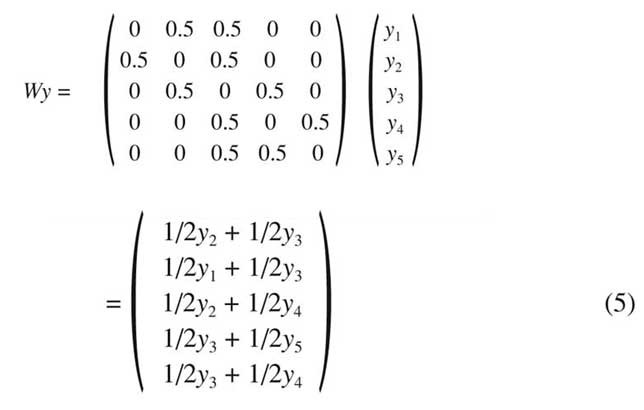

Much has been written about stochastic and how to trade them. In this case, we are interested in having an indicator duplicate the action of the DeMark REI as much as possible and to be reliable. I am not interested in where the indicator turns over or crosses over. I want the entry into buy and sell zones to be as accurate as possible and let the price action control the trade entry using the same techniques as the REI.

The values are 5, 2, 2; overbought is 60 and oversold in 35. Midpoint is 48.

Additionally, I am only interested in the K line (slow line), not the D line (fast line).

So if you can blend the D line into the background, all the better. I would use this arrangement only in the direction of the Moving Average. Personally, I would never trade against the Moving Average with this. As in the Range Expansion Index, there are two types of the entries. They are the Market-On-Bar-Close and Buy/Sell Stop Method. Refer to the section on the REI for the specifics.

We are looking to take the trade in the direction of the Moving Average (30WMA).

With price bars and Moving Average going in the same direction, the stochastic will reach an extreme zone. On any retracement or consolidation, the indicator will pull back in a direction opposite the Moving Average. Once the indicator enters the zone to initiate a trade in the direction of the Moving Average, we initiate the entry methods outlined in the earlier REI Section. This would be a conservative entry.

There is a school of thought on the use of stochastics that enables a more aggressive entry. One can get on moves that the conservative entry misses but will have some additional failures as well. In a rapidly trending market, this aggressive entry may be the only one you get due to the retracement of only a bar or two. This setup begins when the indicator has retraced to midpoint (48) between the values of 60 (overbought) and 35 (oversold). At this point, the aggressive zone of opportunity has been entered. The entry methods are the same as in the conservative.

To illustrate how this works the following charts will show both the REI and the fast Stochastic. The REI will be below the fast stochastic (5,2,2).

Here we see the Fast Stochastic above the REI and the Moving Average is up. We want to go long. When the indicator drops into the Buy Zone, we begin to look for the opportunity to enter long. We have three examples. Note that the second one would have resulted in a loss. Here is where it takes conviction to reenter three bars later. And if you examine the second entry closely, you’ll see that it really did not qualify as an entry. The reason it did not meet the qualifying condition is discussed in the REI Section. But some will be lulled into taking #2 just because the indicator dropped into the buy zone.