Failure Swing

Post on: 22 Июнь, 2015 No Comment

( Relative Strength Index )

Failure Swing is one of Relative Strength Index trading strategies (it is more of a case or condition that it is a strategy). Lets first quickly review what Relative Strength Index (or RSI Indicator) is.

Relative Strength Index (also referred to as RSI) is a Forex indicator, it falls under the oscillator category so it consists of 100 points that reflect the position of the market.

The market is sometimes considered OVERBOUGHT, meaning there has been too much buying going on lately and the market cant take more buyers, so it tends to get less buyers and and more sellers, thus the market falls. A market is considered overbought when it reaches the 70 level on RSI.

On the other hand sometimes the market goes OVERSOLD, meaning there has been too much selling going on, so the market starts to get less sellers and more buyers, thus the market rallies. The market is considered oversold when it reaches the 30 level on RSI.

The idea behind RSI is that it shows you when the market is overbought or oversold, thus it helps you locate good entry points to trade. Click here to read more about RSI in details. Or continue reading about Failure Swing:

What is Failure Swing?

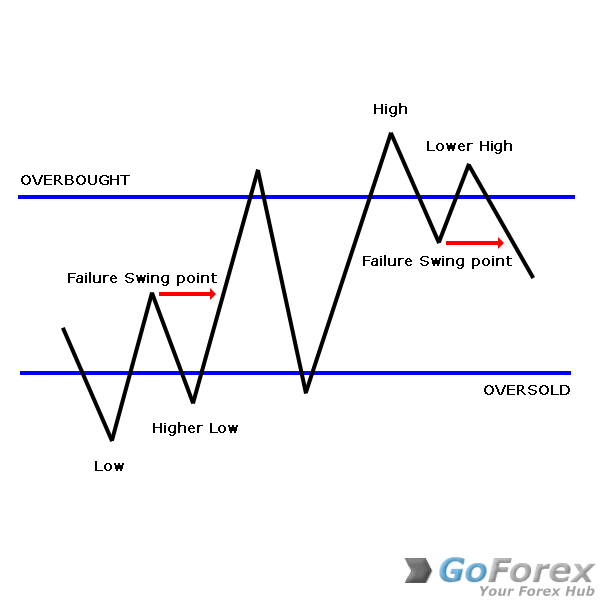

A failure swing is a term given to the instance when the market tries to rally above 70 and it cant, so it makes another try and it fails again. So it swings around the 70 line and it fails to break up. Or it tries to fall down below 30 and it fails, and then tries again.

There are two types of Failure Swing:

Bearish Failure Swing

Here is what happens during a bearish failure swing:

1: The market rallies up to the RSI overbought level (over 70.) It marks a high.

2: The market fails to go higher or even to stay on the same level, so it falls down below 70.

3: The market rallies up again and scores another high, but this one is lower than the high number 1.

4: The market goes down again and scores another low, this one is lower than the one in point number 2.

The market is expected to strongly take a bearish bias right after that.

Bullish Failure Swing

Here is what happens during a bullish failure swing:

1: The market falls to the oversold territory (below 30) and scores a low.

2: The market goes up to 30 or above and scores a high.

3: The market falls down again and forms a new low, however not lower than the previous low.

4: The market rallies up again to another high, higher than the previous high (2).

The market is expected to strongly rally now.