Exchange Traded Funds (ETFs)

Post on: 16 Март, 2015 No Comment

Course Instructor

Course Description

Identifying an interesting investment opportunity is only half of the battle. You also need to know how to implement it quickly and in a cost efficient manner.

This masterclass will teach you how to act on your insights and investment views with the speed, control and efficiency that was once the preserve of the smartest hedge fund managers.

The masterclass analyses and explores all the components of the ETF structures, from how they work, to their creation and construction, to how they can be used in a wide range of investment strategies. The programme will also help you to understand the role of the different players in the structuring, administration and marketing of ETFs. Finally, the ingredients for a successful ETF launch are covered and the steps to follow in designing an ETF operational platform and infrastructure.

Course background

ETFs offer access to some of the most important investment themes in global financial markets. Since ETFs were first introduced in 1993, they have broadened the investment opportunity set for both institutional and retail clients. Many commentators believe that ETFs have the power to change the way we go about investing and they have the potential to usher in a new era of low cost, flexible investing. The Global ETF landscape has undergone significant change in recent years and this dynamic industry is likely to evolve further as more and more investors embrace the increasing range of applications that this investment structure can be used for.

This unique new masterclass will help you navigate the rapidly evolving world of ETFs and understand the role of the different players in the structuring, management, administration and marketing of ETFs.

At the end of the course, you will be better able to:

- Understand the growth dynamics of this rapidly evolving industry

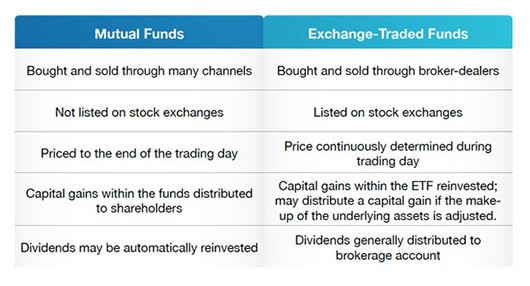

- Understand the various ETF structures and ETF operations

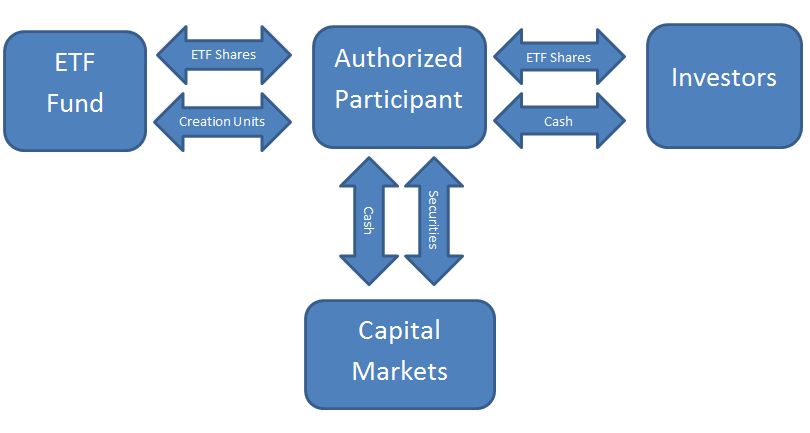

- Understand the arbitrage transactions critical to an ETF’s successful operation

- Devise an asset allocation strategy using ETFs

- Construct more efficient equity and fixed income portfolios using ETFs

- Use tactical asset allocation frameworks to trade ETFs

- Design an ETF with staying power

- Understand the role of the different players in the structuring, administration and marketing of ETFs

- Prepare the registration work for a successful ETF launch

- Establish an ETF operational platform and infrastructure

- Embark on a successful ETF Launch

- Market and position ETFs correctly with your clients

Who should attend?

The course will be of value to professionals in the following areas:

- Asset Allocators/Portfolio Strategists

- Portfolio Managers

- Investment Advisors

- Product Developers

- Marketing and Distribution Professionals

- Private Bankers/Wealth Managers

- Equity and Fixed Income Analysts

- Hedge Fund Analysts

- Fund Structurers

- Fund Administrators

- Family Office Managers