Exchange rate Gap in Interbank and Black Market shrinks as Scarcity looms

Post on: 11 Июль, 2015 No Comment

Exchange rate: Gap in Interbank and Black Market shrinks as Scarcity looms

Thursday, February 12, 2015 5.58PM / Research

A review of prices in the market today, following the activities at the foreign exchange market confirmed the following key developments:

The exchange rate at the parallel market remains at N210/$1 same rate it traded yesterday

The naira at the interbank market hit N206.5 to a dollar following the re-opening of the interbank market; and

A growing level of scarcity of foreign currencies, particularly the dollar, which makes big volume unavailable to willing buyers.

Today, the naira exchanged for N210 to a dollar in the parallel market as the forex market as the gap between the black market and interbank rate shrinks. The naira-pounds differential increased slightly to N312/1GBP in the black market today.

EXCHANGE RATE

Our daily exchange rate monitor of the performance of the naira against the dollar following the devaluation of the Nigerian currency in November 2014 continues to highlight how the naira has fared against the dollar over the months.

Today, the naira traded at N210 to a dollar. The value of the naira has depreciated significantly majorly because of the dwindling oil revenue from failing global oil prices. Some analysts are beginning to call for more devaluation following the initial devaluation of the naira by 8%.

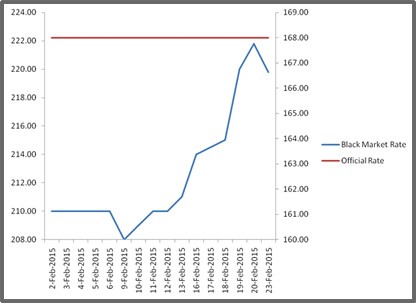

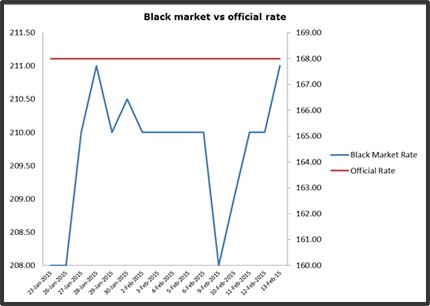

The value of the naira has since the CBNs devaluation traded between N173 and N211 to a dollar in the black market. It however traded at N210/USD1 today. The graph below shows in pictorial form the volatility of the naira against the dollar in the black market for the last 3weeks while the CBN official rate has remained fairly stable at the official rate within the same time period.

OIL PRICE

Oil price has also witnessed heavy decline since the last quarter of 2014. The commodity is however beginning to gain some momentum as it traded for $52.21 on Thursday, February 12th, 2015. The initial huge decline in oil price caused the Federal Government of Nigeria to review downwards its benchmark oil price for 2015 budget.

The benchmark oil price for the yet-to-be-passed 2015 budget is $65. You would recall that the Federal government initially set the benchmark price for 2015 budget at $78 before the first downward review to $73 of which circumstances forced it to review further down to $65 per barrel.

Today, the price of Brent Crude oil (Nigerias crude oil type) was $58.02 while the other variant of crude (WTI) traded at $48.84 per barrel the previous day.