Evaluate the arguments for floating and fixed exchange rates

Post on: 15 Июль, 2015 No Comment

Evaluate the respective arguments for floating and fixed exchange rates. Your answer should include an exploration of theoretical issues and evaluation of historical and contemporary experiences of alternative international monetary regimes.

Historical Overview of the International Monetary System (IMS)

The International Monetary System refers to the institutional framework within which International payments are made, movements of capital are accommodated and exchange rates are determined. An appreciation of the international monetary system is essential for the understanding of the flow of international capital or currency [1 ] .

The exchange rate regimes that have been practised for over a century have taken the forms of fixed and floating mechanisms. Floating exchange rate is that which allows exchange rate to vary in accordance with the changes in the supply and demand for foreign exchange. Fixed exchange rate refers to a currency price that is intentionally prevented from fluctuating by means of specific government policies that influence the supply and demand for foreign exchange [2 ] .

Reviewing the principal international monetary systems that nations have practised over the past century, it would be seen that each mechanism carries with it a set of rules which are sometimes explicit in the form of laws or regulations and sometimes implicit in the form of conventions or customs that are in the parlance of international finance termed ‘the rule of the game’ [3 ] .

Ronald McKinnon (1993) describes the operations of he principal international systems of the last century and noted that the period from 1914 to 1945 reflected the global turmoil of two World Wars and the Great Depression that no uniform system could be ascribed to the period.

Mckinnon (1993) organises his review into seven different episodes except the inter-war period, each having own set of rules [4 ]. McKinnon’s categorization appears to have been rendered outdated by more recent development in the international monetary system. From my own point of view, I would rather classify the metamorphosis of the international monetary system into eight episodes that are discussed below:-

1. Bimetallism Period Before 1875:-

Commodity money system using both silver and gold which are precious metals for international payments and for domestic currency because they possessed the features of a means of exchange such as intrinsic value, portable, recognizable, homogenous, divisible, durable and non-perishable [5 ]. Under a bimetallic standard (or any time when more than one type of currency is acceptable for payment), countries would experience Gresham’s Law which is when bad money drives out good money [6 ] .

2. The International Gold Standard –(1879-1913)

For about 40 years most of the world was on an international gold standard, ended with World War II when most countries went off gold standard. London was the financial centre of the world, most advanced economy with the most international trade.

Rules of the Game I — The International Gold Standard –(1879-1913)

Fix an official gold price or ‘mint parity’ and allow free convertibility between domestic money and gold at that price;

Impose no restriction on the import or export of gold by private citizens, or on the use of gold for international transactions;

Issue national currency and coins only with gold backing, and link the growth in national bank deposits to the availability of national gold reserves.

In the event of a short-run liquidity crisis associated with gold outflows, the central bank should lend freely to domestic banks at higher interest rates.

If Rule (i) is ever temporarily suspended, restore convertibility at the original unit parity as soon as practicable.

As a result of these practices, the worldwide price level will be endogenously determined based on the overall world demand and supply of gold.

Source:- All the Rules of the Game were adapted from Ronald I. Mckinnon, ‘The Rules of the Game:- International Money in Historical Perspective’, Journal of Economic Literature, Volume 31 (Mar 1993)

Arguments in Support of the Gold Standard

Price Stability – through the tying of money supply to the supply of gold, central banks are unable to expand the money supply. The only ways in which they can do so are by acquiring more supplies of gold through production or by running balance of payments surpluses with other countries [7 ] .

Facilitates Balance of Payment adjustment automatically – this was first described by David Hume and is referred to as Hume’s specie flow mechanism [8 ] .

Arguments Against the Gold Standard

The growth of output and the growth of gold supplies needs to be closely linked.- For example, if the supply of gold increased faster than the supply of goods did there would be inflationary pressure [9 ] .

Volatility in the supply of gold could cause adverse shocks to the economy [10 ] .

In practice, the monetary authorities may not be forced to strictly tie their hands in limiting the creation of money, so some of the theoretical advantages may not hold up. For example, the Central Bank could issue more currency without having acquired more gold, and the public may not become aware of what is going on [11 ] .

Countries with respectable monetary policy makers cannot use monetary policy to fight domestic issues like unemployment.

3. The Inter-War Period – (1919-1939)

After the eruption of the World War I, each warring country after the other put the gold convertibility on hold and embraced the floating exchange rates. However, the United States which joined the battle late, upheld gold convertibility but the dollar floated effectively against other currencies that had ceased to become convertible into dollars.

Many exchange rates fluctuated sharply after the war and in the early and through mid-twenties as a lot of currencies experiencing massive devaluations against the dollar but the United States currency had greatly improved its competitive strength over the European currencies during the war in tandem with the stronger relative position of the United State economy [12 ] .

Sequel to a prolonged internal debate, the United Kingdom restored the gold convertibility at the pre-war parity against the United State dollar [13 ]. It was not surprising to see other countries emulate Britain and returned to the gold but in many cases at devalued rates and what was the impact of this action on those countries’ economy?

The anomalies and disequilibria created during the war were not well manifested in the par values that were established in the mid-twenties [14 ] .

The exchange markets were characterised by turbulence and chaos during the 1930s. Under a condition serious global depression and erosion of confidence, the international monetary system broke down into rival currency blocs, competitive devaluations, discriminatory trade restrictions and exchange controls, high tariffs and barter trade arrangements. Several efforts geared at re-establishing order proved abortive. [15 ]

4. The Spirit of the Bretton Woods Agreement – (1945)

In July, 1944, the International Monetary and Financial Conference organised by the United Nations attempted to put together an international financial system that eliminated the chaos of the inter-war years. The terms of the agreement were negotiated by forty four nations, led by the U.S. and Britain. The British delegation was led by John Maynard Keynes, perhaps the most famous economist of the twentieth century [16 ] .

In essence, the Bretton Woods Agreement sought a set of rules that would remove countries from the tyranny of the gold standard and permit greater autonomy for national monetary policies. The negotiators recognised the historical shortcomings of other systems and the trade-offs they would face in trying to balance ‘stable yet adjustable’ exchange rates.

Rules of the Game II:- The Spirit of the Bretton Wood Agreement – (1945)

Fix an official par value for domestic currency in terms of gold or a currency tied to gold as a numeraire;

In the short run, keep the exchange rate pegged within 1.0% of its par value, but in the long run leave open the option to adjust the par value unilaterally if IMF concurs;

Permit free convertibility of currencies for current account transactions but use capital controls to limit currency speculation;

Off-set short-run balance of payments imbalance by use of official reserves and IMF credits, and sterilize the impact of exchange market interventions on the domestic money supply.

Permit national macroeconomic autonomy; each member pursuing its own price level and employment objectives.

The IMF was created with the specific goal of being the multilateral body that monitored the implementation of the Bretton Woods agreement. Its role was to hold gold reserves and currency reserves that were contributed by the member countries and then lend this money out to nations that had currency difficulty meeting their obligations under the agreement. [17 ]

Currencies had to be convertible:- central banks had to exchange domestic currency for dollars upon request. However, certain countries were also allowed to institute capital controls on certain types of transactions. Only current account related transactions were required to be fully convertible and countries were allowed to impose restrictions on the exchange of capital account related transactions. [18 ]

The Asymmetric Position of the Reserve Centre Country – In a world with N countries there are only N-1 exchange rates against the reserve currency. If all the countries in the world are fixing their currencies against the reserve currency and acting to keep the rate fixed, then the reserve country has no need to intervene [19 ] .

The Collapse of the Bretton Woods System

Bretton Woods faltered in the 1960s because of a U.S. trade and budget deficits. Nations holding U.S. dollars doubted the U.S. government had gold reserves to redeem all its currency held outside the U.S. Demand for gold in exchange for dollars caused a large global sell-off of dollars [20 ]. In 1971, the U.S. government ‘closed the gold window’ by decree of President Nixon. The world moved from a gold standard to a dollar standard: from Bretton Woods to the Smithsonian Agreement [21 ]. Growing increase in the amount of dollars printed further eroded faith in the system and the dollars role as a reserve currency. By 1973, the world had moved to search for a new financial system – one that no longer relied on a worldwide system of pegged exchange rates.(Levich, 2004)

5. The Floating Rate Dollar Standard – (1973-1984)

The floating rate system that developed after the fall of the Bretton woods was not devoid of rules and the rules which were of two folds, one set of rules for countries other than the United States and the other set for the United States. The US dollar remained the centrepiece of international financial markets. To assess the external values of domestic currency, officials would typically refer to an exchange rate in US$. And when intervention was called for, it was generally conducted in U.S. dollar.

While the system was called floating, it was far from a freely floating laissez-faire system. Policy makers were unwilling to let private market forces be the sole determinant of exchange rates. This is not surprising given the importance of exchange rates to an economy. Richard Cooper (1984) reminds us that ‘it is inconceivable that a government held responsible for managing its economy could keep its hands off the exchange rate. And sure enough, they are not left alone.’

The IMF also recognised that each country saw its exchange rate as an important policy variable and that the exchange rate policy of one country could have significant negative spill-over effects on other countries. Therefore, in 1974, the IMF enacted a set of guidelines designed to limit the potential for conflicts regarding exchange rate policies [22 ] .

While these guidelines are not binding, they show that the IMF sanctions intervention as a method to promote orderly conditions in the foreign exchange market [23 ]. Essentially, the foreign exchange rate was left to play the role of a residual variable that did a great deal of the adjusting to offset the macro-economic policy differences across countries. With little coordination of these policies, one would expect exchange rate volatility to increase sharply.(Adam Bennett, 1995)

Rules of the Game III – Industrial Countries Other Than the United States.

Smooth short term variability in the dollar exchange rate but do not commit to an official par value or to long term exchange rate stability;

Permit free convertibility of currencies for current account transactions while endeavouring to eliminate all remaining restrictions on capital account transactions;

Use the US$ as the intervention currency (except for transactions to stabilise European exchange rates) and keep official reserves primarily in U.S. Treasury Bonds;

Modify domestic monetary policy to support major exchange rate interventions, reducing the money supply when the national currency is weak against the dollar and expanding the money supply when the national currency is strong.

Set long-run national monetary and price targets independently of the United States; let the exchange rates adjust over the long run to off-set those differences.

Rules of the Game – The United States.

Remain passive in the forex market; practise free trade without a balance of payment or exchange rates target. No need foe sizeable official foreign exchange reserves;

Keep the U.S. capital markets open for borrowing and investing by private residents and foreign sovereigns;

Pursue a monetary policy independent of the exchange rate or policies in order countries, thereby not strong for a common stable price level (or anchor) for tradable goods.

7. The Plaza-Louvre Intervention Accords & the Floating Rate Dollar Standard-(1985-1999)

The US had held a fairly passive stance toward exchange rates during first 10-years of float. In 1981, the induction of an expansive US fiscal policy combined tight monetary control (supported by President Ronald Reagan) combined with tight monetary control (guided by Federal Reserves Chairman, Paul Volcker) started the US dollar on a prolonged appreciation.

By early 1985, the US$ had appreciated nearly 50% (relative to 1980) in real terms against an average of the world’s other major currencies. As the US dollar rose higher, some economists characterised its price behaviour as a ‘speculative bubble’ — (meaning a movement greater than, and progressively greater than justified by macroeconomic fundamentals) and predicted that the foreign exchange value of the dollar was not sustainable. [24 ]

The entire episode convinced policy makers that:-

exchange rates were too important to be left to market forces, hence intervention was deemed appropriate to smooth disorderly markets and halt market excesses, and

exchange rates were too important to be the residual from uncoordinated economic policies, so better policy coordination was required to establish a set of economic fundamentals that in turn would produce a smother path of the exchange rate.

As a result, since 1985, a new set of rules has evolved emphasizing the role of exchange market intervention and macroeconomic policy coordination. The first part of the policy change, the easy part, was foreign exchange intervention. Although, the appreciation of the US$ peaked in early March, 1985, the dollar did not initially fall by much and the use Congress continued to favour import restrictions (Barry Eichengreen, 1996).

7(a) The Plaza Accord

On September 22, 1985, officials from the Group of Five (G-5) countries – Britain, France, West Germany, Japan and the US – met at the Plaza Hotel in New York City, where they issued a communiqué announcing that they would interfere jointly foster dollar depreciation. The dollar fell sharply on this news and continued to decline through 1986.

The Plaza communiqué represented a sharp break with earlier policies. Exchange market intervention was often characterised by ‘leaning against the wind’ behaviour to reverse the market trend. The Plaza meeting had the Central Banks leaning with the wind of the recently weak dollar. Further exchange market interventions were often kept secret and were often the doings of a single central bank [25 ] .

7(b) The Louvre Accord

The dollar’s free fall continued into 1987, so much that some European officials began to fear for the competitiveness of their own export industries which prompted policy makers from the G-5 countries plus Canada to make another attempt at exchange rate co-operation in a meeting at the LOUVRE in Paris in February 22, 1987. At the Louvre meeting, policy makers agreed ‘to foster stability of exchange rates around their current levels’.

This was not an unusual statement as part of a press release from a meeting of international finance minister but the Louvre accord was more than an emotional statement in praise of stability.

The substance of the Louvre meeting was a set of target zones, or exchange rate range, that the Central Bankers agreed to defend using active foreign exchange intervention [26 ] .

The Louvre accord has been criticised on the ground that the target zone strategy could have no real force and the decision to keep the zonal boundaries secret was simply a device to prevent any evaluation of the policy’s success.

The Rules of the Game IV-

The Plaza-Louvre Intervention Accords and the Floating Rate Dollar Standard-(1985-1999):-

Germany, Japan and United States (G-3)

Set broad target zones for the US$/DM and US$/Y exchange rates. Do not announce the agreed upon central rates, and allow for flexible zonal boundaries;

Allow the implicit central rates to adjust when economic fundamentals among the G-3 countries change substantially;

Central Banks intervene collectively but infrequently to reverse short-run exchange rate trends that threaten a zonal boundary. Signal the collective intent by announcing rather than hiding intervention.

G-3 countries hold reserves in each others currencies, for the U.S. This means building up reserves in deutsche marks, yen, and possibly other convertible currencies.

Sterilize the immediate impact of exchange market interventions by not adjusting short-term interest rates.

Each G-3 country aims its monetary policy towards stable prices (measured by domestic consumer or wholesale prices or the GNP deflator), which indirectly anchors the world price level and reduces the drift in exchange rate zones.

The Rule of the Game – Other Industrial Countries

Support or do not oppose interventions by the G-3 to keep the dollar within its target zone limits.

Indeed, policy makers have had to adjust the central rate of the implied target zone and be flexible about the precise location of the target zone boundary. Intervention under the Louvre accord seems to be more successful when accompanied by macroeconomic policy changes, and less successful when domestic monetary is preserved through sterilized intervention. Sterilized intervention in the foreign exchange market leaves the domestic monetary base unaffected [27 ] (Krugman, P and Maurice, O, 2000).

The Louvre accord began a process towards greater and, it was hoped, better policy co-ordination. Progress in the coordination process is essential to fundamentally affect the stability of exchange rates in the longer run.

8. The Spirit of the European Monetary System – (1979)

Following the collapse of the Bretton Woods, European Union (EU) nations looked for a system that could stabilise currencies and reduce exchange-rate risk. In 1979, the created the European Monetary System (EMS) to stabilize exchange rates subject to the following guidelines:-

Rules of the Game V – The Spirit of the European Monetary System – (1979)

Applicable to All Member Countries.

Fix a par value for each exchange rate in terms of the European Currency unit, a basket weighted according to country size.

Keep exchange rate stable in the short run by limiting movements in the bilateral rates to 2.25% on either side of the central rate.

When exchange rate threatens to breach a bilateral limit, the strong currency Central Bank must lend freely to the weak currency Central Bank to support the exchange rate.

Adjust the par value in the intermediate term only if necessary to realign price levels, and only with the collective agreement of other EMS countries.

Work toward a convergence of national macroeconomic policies that would lead to stable long run par value for exchange rates.

Maintain free currency convertibility for current account transactions

Hold foreign exchange reserve primarily in ECUs with he European Fund for Monetary Co-operation (EFMC), and reduce U.S. dollar reserves.

Repay Central Bank debts quickly from exchange reserves or by borrowing from the EFMC within strict long-term credit limits.

No single country’s money serves as a reserve currency nor does its natural monetary policy serve (asymmetrically) as the nominal price anchor for the group.

The EMS was successful, currency realignments were infrequent and inflation was controlled. Problems arose in 1992 and the EMS was revised in 1993 to allow currencies fluctuate in a wider band from the mid-point of the target zone. The system ceased to exist in 1999 when the EU adopted a single currency.

8(a) The European Monetary System as a ‘Greater DM’ Area – (1979-1998)

As earlier proposed, the EMS appears to enshrine the symmetry of the EU member nations in a co-operative process. In practice, the DM was the centrepiece of the Exchange Rate Mechanism (ERM), and German monetary policy formed anchor for the EMS price level.

As a consequence, the operation of the EMS was subject to more strains than might have been foreseen, as the strongest country with the least inflation called the ‘Policy Tune’, rather than some equally weighted average of all the policy presumptions of the member countries. Most of the strains in the EMS over the period arose from the desire by some European leaders to achieve still closer economic and social union.

In 1989, a European Council headed by European Commission President Jacque Delors, presented a plan to establish a European Economic and Monetary Union (EMU). Under the EMU proposal, a single European Central Bank was to set up the monetary policy for a single European money thereby abolishing national monies and an independent role for national central banks.

The Delors Plan [28 ] recommended a three-stage plan process to phase in the EMU as follows:-

Stage 1- Bring all 12 members EC countries into the ERM while bringing tighter convergence of monetary policies to secure the ERM;

Stage 2- Narrow the permissible bands of the ERM and permit a new European Central Bank to exercise more control of national monetary policies.

Stage 3- Replace national monies with a common currency, placing responsibility for the European Central Banks that reflect the interests of all EC countries.

The EMS Crisis of 1992 – 1993

The Delors Plan called for a transfer of national sovereign power over monetary policy and national monies to a new EC institutions. In December, 1991, the EC drafted the Maastricht Treaty – a 250 page document that laid out the procedure for transferring policy making authority and the approval by all the twelve EC countries was required either by national referendum or parliamentary vote. For reason that substantial parts of the treaty were contentious, most of the sponsoring countries became sceptical and the document could not be approved by member nations contrary to expectation, As a result, currency tension persisted throughout 1993.

In the summer of 1993, speculative attacks continued on the French franc and other currencies. This caused Central Banks to intervene heavily but the French resisted devaluation [29 ]. (Richard Cooper, 1984).

The Path to European Monetary Union

Notwithstanding the shocks suffered by the Delors Plan, voting on the Maastricht treaty continued and by November, 1992, it was adopted and the European Union (EU) was born. However, many countries had negotiated the right to opt out of certain key provisions, including the EU’s common monetary and defence institutions.

According to the Delors Plan, countries had to meet various economic targets before joining the EMU [30 ] .

These criteria were very stringent to fulfil that as at February 1997, only Luxembourg satisfied them. Despite the difficulty in meeting the criteria, undaunted EU policymakers proceeded by designing and unveiling new physical coins and notes. Private firms and banks were compelled to follow suit, redesigning their accounting systems and functional software to accommodate the new euro.

8(b) The Spirit of the European Economic & Monetary Union – 1999

In May 1998, the European Council met to make two critical decisions:-

To determine which countries would participate in the launch of the EMU set for January 1, 1999; and

Who would be elected as the President of the European Central Bank.

Many observers had expected a ‘narrow’ ‘EMU” with only six countries going in at the start because requirements on fiscal budget deficits and national debt level. Surprisingly, the European Council elected eleven countries – virtually all EU except countries, those that desired to opt out of the pioneer team such as Denmark, Sweden and the United Kingdom. Greece actually wanted to join but clearly had not met the convergence requirements [31 ] .

On 1st January, 1999, the final and ‘irrevocable’ conversion rates of the eleven legacy currencies versus the euro were announced. The transition went hitch-free in terms of transaction execution in the foreign exchange market and the operation of the EMU payment and settlement system. Financial markets in the EMU countries redenominated all traded financial securities and instruments from their national currencies into euros. A new market for bonds denominated in euros is thriving. The trend toward trans-national mergers and acquisition across firm within the euro started growing.

The last step on the path to monetary union is the introduction of physical euro notes and coins and the withdrawal of legacy currency notes and coins. This process was scheduled to begin January 1, 2002 and to be accomplished not later than July 1, 2002.

Empirical Evidences of Recent Currency Crises

Despite nations’ best efforts to head off financial crises within the international monetary system, the world has witnessed several unpleasant crises some of which are summarised below:-

Developing Nation’s Debt Crisis

By the early 1980s, developing countries (especially in Latin America) had amassed huge debts payable to large international commercial banks, the IMF, and the World Bank. To prevent a meltdown of the entire financial system, international agencies revised repayment schedules. In 1989, the Brady Plan called for large-scale reduction of poor nations’ debt, exchange of high-interest loans, and debt instruments tradable on world financial markets.

Mexico’s Peso Crisis

Rebellion and political assassination shook investors, faith in Mexico’s financial system in 1993 and 1994. Mexico’s government responded slowly to the flight of portfolio investment capital. In the late 1994, the Mexican peso was devalued, forcing a large loss of purchasing power on ordinary Mexican people. The IMF and private commercial banks in the United States provided about $50 billion in loans to shore up Mexico’s economy. Mexico repaid the loans ahead of schedule and again has a sizable reserve of foreign exchange. The Mexican peso crisis was unique in that it represented the first serious international financial crisis touched off by cross-border flight of portfolio capital [32 ] .

South East Asia’s Currency Crisis

On July 11, 1997, the speculators sold off Thailand’s baht on world currency markets; the baht plunged and every other economy in the region was in a slump. The shock waves of Asia’s crisis could be felt throughout the global economy. Indonesia, South Korea, and Thailand needed IMF and World Bank funding. As incentives to begin economic restructuring, IMF loan package came with strings attached. Crisis likely caused by a combination of Asian style capitalism (lax regulations, loans to friends and relatives, lack of financial transparency); Currency speculators and panicking investors; and persistent current account deficits [33 ] .

Russia’s Rubble Crisis

Russia’s problems in the late 1990s included — the spill over from the South East Asia crisis; Depressed oil prices; falling hard currency reserves; unworkable tax system; and inflation. In 1996, as currency traders dumped the ruble, the Russian government attempted to defend the ruble on currency markets. The government received a US$10 billion aid and package from the IMF and promised to reduce debt, collect taxes, cease printing sums of currency, and peg its currency to the dollar [34 ] .

Argentina’s Peso Crisis

By late 2001, Argentina had been in recession for nearly four years. Argentina’s goods remained expensive because its currency was linked to a strong U.S. dollar through a currency board. The country finally defaulted on its US$155 billion of public debt in early 2002, the largest default by any country ever. The government scrapped its currency board that linked the peso to the U.S dollar and the peso quickly lost about 70 percent of its value on currency markets. There were at least three factors that were related to the collapse of the currency board arrangement and the ensuing economic crisis:- lack of fiscal discipline, rigidity of the labour market, and contagion from the financial crisis in Brazil and Russia [35 ] .

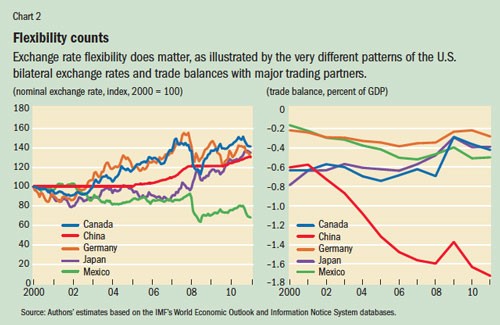

Fixed or Floating Exchange Rate Mechanism – Which is Better?

What are the effects of exchange rate instability? The effects on both the prices and volumes of goods and services in world trade have been surprisingly small [36 ]. The policy implications of unstable exchange rates remain a subject of great dispute. Refreshingly, this is not the usual debate between laissez-faire economists who trust markets and distrust governments, and interventionist economists with the opposite instincts. Instead, both camps are divided, and advocates of both fixed and floating rates find themselves with unaccustomed allies [37 ] .-(Paul Krugman, 2010).