EURUSD Forecast Aggressive Rally Coming in the Euro

Post on: 21 Апрель, 2015 No Comment

I was looking at Commitments of Traders (COT) data the other day and I noticed something quite alarmingsomething which could potentially send the EURUSD flying higher over the next several months.

EURUSD Forecast Cycles

First I want to go back to my EURUSD Forecast 2012 published on January 9 . In that article I stated that I thought we would see a bottoming of the EURUSD in late January to early February of 2012and that would likely be the low of the year. I still believe that is the case. That was mainly based on a couple of cycles that are playing out, along with a major support band which extended from1.25 down to 1.1876. I also indicated that the big picture trend was down, but that 2012 would be a bear market rally year, where the Euro appreciated significantly from current levels. This has all been discussed before, and provides a context for my next couple pointswhat could trigger a big move higher in the near term.

EURUSD Forecast Seasonality

The next item I am looking at for a big bull move in the EURUSD is seasonality. I recently wrote an article on EURUSD Seasonal Patterns (also AUDUSD Seasonality ). One of the summary findings of that article is that the EURUSD, for the last (5, 10, and) 15 years, generally bottoms out in early February and then moves higher into mid-March, takes a bit of a breather, and then keeps going higher into April. So based on seasonality, if the last 15 years is any indication, we are in for a couple months of Euro appreciation. But I am seeing something which could tip this from appreciation into a pretty aggressive move upwhich brings me to the COT data.

EURUSD Forecast Commitment of Traders (COT)

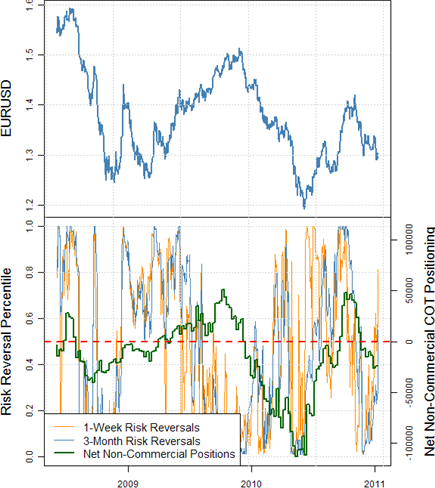

COT data is a figure that is released weekly which shows the net positions of trades in the futures market. The main positions to be concerned about are Commercials, which are usually hedgers and are thus counter-trend traders, and Large Speculators which are generally trend followers and mostly unhedged. Large Speculator positions is what I have noticed recentlythese include hedge funds and the like. At certain times watching these guys can be very good, especially when they move from bullish to bearish as it can mean the start of a new trend. But these guys can also signal reversals when they take on big positions. Why? Because these are the guys that feel pain. Commercials are usually hedged so they can withstand trading against the trend, Speculators cantthey are forced to liquidate.

Right now I am seeing of the largest net short positions I have ever seen in the EURUSD by these large speculators. In fact, it is the largest short position seen in the Euros existence. The largest position prior to this was in 2010, and at that time sparked a 24 cent rally in the EURUSD (forex) from 1.1875 to1.4280 (24 cents). At that point there was a pullback and then it kept going to the May, 2011 high of 1.4939 (more than 30 cents). The last 6 cents or so of that move I cant really attribute to what I am about to share, but once a trend starts the trend gathers momentum and becomes its own beast.

Needless to say when these Large Speculators become to lopsided in the market, and they are currently massively short the EURUSD, there is no one left to sell and keep the price moving down. This is what I believe is happening right now in EUR/USD (moving higher since mid-January), and will continue to happen over the next couple months as these guys havent even really started to unwind their short positions.

This charts tells the tale. Every time these guys positions (Large Speculators) pick up we get at least some sort of move in the opposite direction. And right now the short position is huge, and it looks like it is just about to start to unwind (notice the upticks toward the extreme right of the chart). In other words, I believe we will see further rallying fueled, at least in part, by short covering.

Euro Futures 4 Year Chart with COT Data

For the last 2.5 years I have marked (with rectangles) the turning points as Large Speculator positions hit extreme levels. These extreme levels have been expanding as we can see. We have not seen a position this big before. The next charts shows back to the inception of the Euro.

In 2006 and 2007 admittedly we saw extreme levels, and the EURUSD continued to trend higher. Yet if you zoomed in on this chart each spike in the Large Speculators positions preceded or coincided with at least a short-term decline in the broader trend.

For more information on how to use the COT data in your analysis and for COT Report Forex Strategies see: COT Report Forex Trading – Using the Commitment of Traders Report in the Forex Market

EURUSD Forecast Summary

Before summarizing the points of this article and what I believe the effect will be, I will point out that markets are uncertain and I dont have a crystal ball. I am not here to rally bulls or scare bears. Rather my objective in this article is to simply point out some very large factors I believe to be currently in play in this pair. Factors which, especially the COT data, could propel this market higher simply because the short position is so big I cant see many more shorts being able to pile in to keep downside momentum going. Combine this with cycles and seasonality and I see a high probability this pair continues to go higher. No indicator(s) is perfect though, so ultimately price is the only indicator that really matters.

Also, these are longer term indicators, so I dont advocate plowing long either. Always manage risk and wait for low risk entries on the time frame of your choosing. The factors provided in this article provide a context for the market over the next couple months, and are not precise buy and sell signals (a lot can happen in a week between COT reports). A shorter-term analysis will be published soon which looks at potential entry and exit points.

Cory Mitchell, CMT

Sign up for my free newsletter and get forex analysis and insights in your inbox on the weekend.