ETF Sector Rotation and Sector Allocation Focus on Financials Notes From Morningstar s ETF

Post on: 16 Март, 2015 No Comment

Sector Rotation Strategies

The panel kicked off with a quick overview of the different flavors of sector rotation strategies: strategic, tactical, and global.

Larry Cao, senior consultant with Ibbotson Associates, offered an explanation of strategic rotation strategies, which are one of the firm’s areas of expertise and the flavor of choice for most of Ibbotson’s long-term asset allocation strategies.

The strategic approach is based on an analysis of historical risk-return characteristics over long time periods. Based on that analysis, an investor would select the asset classes or sectors that demonstrate the most attractive valuations and risk-return prospects, relative to their historical averages.

Strategic allocation strategies are most suitable for investors with long investment horizons. It is a low-turnover strategy that fits the mold of: buy, hold, and rebalance. At rebalancing time, the investor could adjust which asset classes or sectors will be under- or overweight in the portfolio, or simply adjust the magnitude of the strategic bet.

Rob Stein, president of Astor Asset Management, discussed tactical rotation strategies, which typically focus on shorter-term trends that influence the performance of sectors, countries, or styles.

The third type of rotation strategy—global—which has been getting tossed around more and more recently, is similar but open to investment opportunities across the globe.

Stein went on to offer more detail on his tactical rotation strategy. His firm selects sectors based on the macroeconomic landscape, particularly employment. Stein and his team dissect employment reports and invest in sectors that show above-trend employment or output growth. The idea is to try to catch inflection points in those sectors; firms typically start to hire workers in response to increased demand.

Mark Scheffler, of Appleton Group, also employs a more dynamic approach based on price movements (that is, momentum). Scheffler believes in efficient markets and has structured his strategy to follow the wisdom of crowds under the assumption that all information is disseminated by market participants and will be reflected in the market’s price action.

The discussion evolved into some of the other factors that might affect how well these strategies would work in practice, such as investor behavior, mispricing of risk, and projected correlations.

All three panelists were early adopters of ETFs and major proponents of the structure in general. The growth and proliferation of ETFs, which has democratized asset classes such as commodities and currencies (to name a couple), has helped make dynamic rotation strategies possible for all investors. Stein even went as far as to say that he believes that the ETF is the best financial innovation since the put option.

—John Gabriel

Tactical: Sector Focus—Financials

In Friday morning’s sector focus breakout session, senior vice president at KBW, Sid Jain, provided an overview of financial subsectors and offered plenty of timely and actionable investment ideas.

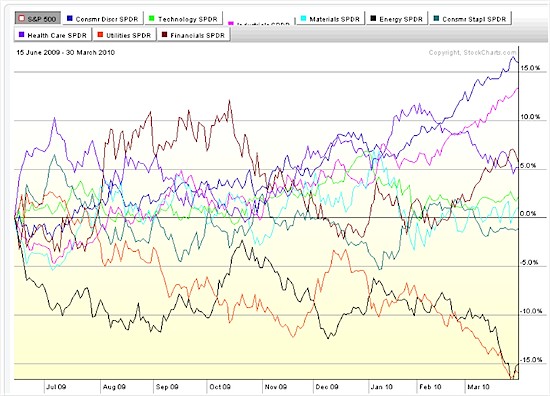

Jain kicked things off by dissecting the historical performance of all the industries that make up the financial sector. The point was that performance gaps can be very significant among sectors. For example, in 2009 capital markets (NYSEARCA:KCE ) was up about 40% while regional banks (NYSEARCA:KRE ) fell roughly 24%. Volatility among industries also varies greatly. The KBW subsector financial SPDRs allow investors to implement more precise and flexible strategies in order to capitalize on the wide divergence in performance within the sector.

Even investors who aren’t making explicit bets to have an overweighting in financials in their portfolio should be cognizant of what’s happening in the sector with respect to fundamentals and regulation. Jain reminded us that exposure to financials is difficult to avoid, as the sector represents 16% of the S&P 500.

Jain then provided us with a couple investment ideas for the current environment. In a more tactical play—for the next six to eight months—he recommends investors consider a position in SPDR KBW Bank KBE, for exposure to the large-cap money center banks. For those with a longer horizon—two years or so—Jain thinks SPDR KBW Regional Banking KRE is the more attractive place to be. According to the research performed by Jain and his team at KBW, he also declared that the regional banking model is not broken.

There have been concerns that smaller regional players would be disproportionately impacted by reform policy. The point Jain made here is that regional banks earn the bulk of their profits through interest income, not fees. It’s the fee businesses, which are a much bigger piece of the pie for the large-money center banks, which are under the most scrutiny (think NSF, or non-sufficient funds fees).

On the regulatory front, Jain noted that expectations were that financial reform would be too strenuous. In hindsight, he thinks it might not have been strict enough. Furthermore, Jain dismissed concerns about the 8% tangible common equity ratios proposed in Basal III. He believes that the 8% mark is quite reasonable, and even helps level the playing field between the large and small banks.

Looking ahead, Jain expects to see more bank failures, which represent attractive acquisition targets for well capitalized regional banks. This could be a boon to the acquiring banks, as these federally assisted transactions are done at extremely attractive valuations, which often means they are immediately accretive to earnings. As far as M&A goes, Jain expects to see the consolidation wave continue. This goes beyond failed bank acquisitions and extends to banks making non-bank acquisitions to diversify their businesses. This would include things like banks picking up asset managers or other service providers.

Topping off an excellent and extremely informative session, Jain offered attendees a host of other investing ideas, including individual stock picks and pair trading strategies. He also shared which firms he believes are the most likely take-out targets. Stay tuned for a follow up discussion, where we’ll share Jain’s investment tips and ideas.