ETF (r)evolution

Post on: 11 Июль, 2015 No Comment

No longer are exchange-traded funds (ETFs) merely another way to invest in equity or fixed-income indexes. ETFs have evolved, branching into new frontiers that offer traders more ways to participate in nearly any financial arena.

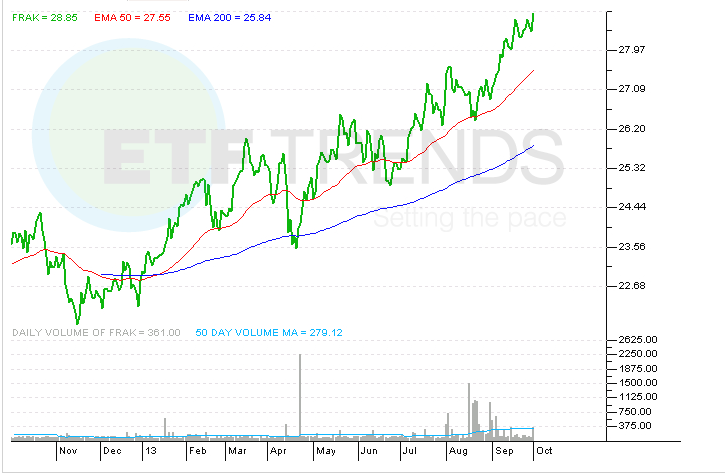

ETFs are big business. According to the Investment Company Institute, a national association representing U.S. investment companies, U.S. ETFs had combined assets of $572 billion in November 2007 and while that was down a bit from October, its a huge jump from 12 months earlier (see Growth market).

While well-established ETFs, such as Standard & Poors Depository Receipts (SPDRs, pronounced spiders, which track the S&P 500) and QQQQs (pronounced Qs or cubes, which track the Nasdaq 100) continue to contribute to this rapid growth, new products are leveraging the familiarity ETFs have achieved. ETFs based on commodities, such as oil or gold; foreign exchange products, including both individual currencies and indexes; and small baskets of individual equities are now viable options for investors of all sizes.

While impressive, this growth and expansion is not unanticipated, according to the man who invented them.

From 1986 to 1993, Ivers Riley was a senior executive vice president at the American Stock Exchange (Amex) and in charge of all derivative activity. When Amex launched ETFs in the early 1990s, Riley says his original vision encompassed products beyond the major stock indexes.

In the last six months it has gone beyond that, but certainly things like Street Tracks, the gold and all of that were in our vision, Riley says. If you remember the name S&P Depository Receipt, depository receipt was really the equivalent of a warehouse receipt like they use for delivery in commodities, so the thought of commodities was clearly there.

More important to the individual investor, thanks in many ways to the original products having broken down past barriers to public acceptance, the new ETFs are experiencing rapid retail penetration.

COMMODITY EXPOSURE

Certainly, one of the most interesting developments has been the surge in commodity ETFs, whether they invest in commodities directly or via companies that are active in commodity-related business. Of those that typically trade more than 50,000 units per day, half of the top 10 in terms of net assets are tied to energies (see Futures 2008 ETF guide).

However, dont let the energy-heavy breakdown at the top fool you. There also are highly liquid instruments based on precious metals, base metals, agriculture and even water. Many of the most widely traded products, though, are broad-based.

We have seen consistent success in ETFs that offer broad, diversified exposure to energy, metals and other commodity sectors, says Kevin Rich, CEO at DB Commodity Services LLC, which develops commodity funds for Deutsche Bank AG. Among the sector ETFs, we see rotations occurring between the sectors based upon investor sentiment.

Rich says that the appeal is clear. Commodities experience price movements that are largely independent of stock and bond markets, with which most investors are familiar. Positions in commodity-linked ETFs, therefore, help balance out the fluctuations in these other markets.

We see most investors using commodity-based ETFs as diversifiers, Rich says. (They are) allocating a portion of their portfolios to commodities, usually through a diversified index, to take advantage of the low to negative correlation commodities have shown vs. equities and fixed income.

Whos using commodity-linked ETFs? Rich says its primarily three categories of trader:

You have ETF traders who look for arbitrage opportunities between the ETFs and the underlyings.

We also see investors who have been active in commodities or currencies and recognize the ETFs as cost effective, liquid and transparent.

Then, there are investors just recognizing the benefits commodities and currencies can give to their portfolios, and using ETFs as a way to gain that access.

In terms of forex, ETFs are making considerable gains there as well. CurrencyShares Trusts, sponsored by Rydex Investments, was a pioneer in forex ETFs. CurrencyShares ETFs are available on the Australian dollar, Canadian dollar, British pound, euro, Japanese yen, Mexican peso, Swedish krona and Swiss franc, with the yen and the euro products trading hundreds of thousands of units per day.

For broader exposure, PowerShares has its DB G10 Currency Harvest Fund, which is based on the Deutsche Bank G10 Currency Future Harvest Index, managed by DB Commodity Services LLC. The PowerShares U.S. Dollar Index Bullish and Bearish Funds allow traders to play both sides of the U.S. Dollar index.

BUILT-IN LEVERAGE

Commodity and foreign exchange are only two ways that ETFs are making inroads into new areas. Another involves a concept traditionally synonymous with exchange-traded derivatives: leverage.

Integrated-leverage ETFs really came of age in 2007, particularly in bear funds, which appreciate when the index to which the ETF is linked depreciates. Of the dozen bear-market ETFs that trade more than 50,000 units per day, 10 of them are UltraShort ETFs from ProShares. These ETFs are designed to double the inverse of the drop in the relevant index, before all fees. Of course, as futures traders know, leverage cuts both ways. When the base index rises in value, the UltraShort ETF loses twice that amount.

The bears dont get all the fun, though. ProShares Ultra ETFs offer the same leveraged performance on the long side. There are liquid integrated-leverage ETFs available in the small-cap, mid-cap and large-cap sectors. Slightly less liquid ETFs are available for specific sectors and international indexes.

While the obvious caveat is clear leverage can be expensive if used haphazardly integrated-leverage ETFs raise a couple other concerns. One is a higher expense ratio. For example, the expense ratio on the UltraShort QQQ ETF from ProShares is 0.95%, which is considerably more than the 0.20% expense ratio of the PowerShares QQQ on which its based. The other consideration is liquidity. Although they have experienced rapid growth, integrated-leverage ETFs are not quite as active as other ETFs; however, for most of these products, that should only be an issue for the largest traders.

The narrow nature of some of the sector products also might be a concern, which applies to all narrow-based ETFs, not just integrated-leverage or bear-market products.

We didnt think it would get down to such a thin segment of the market as some of these have, Riley says. We really didnt think we would get some of these very small ETFs where you divide bio-technology into a subset of bio-technology. You start slicing things too thinI dont know how to determine what too thin is, but some of the stuff I see now sure seems to have reached it.

Still, managers keep trying, carving up the market ever smaller as they strive to uncover the next big growth segment for these products.

LOOKING AHEAD

Remember X-funds? These short-lived products offered by the Chicago Board of Trade were, in summary, a basket of futures products that was actively managed on a weekly basis by a single advisor. An X-fund was bought or sold as a unit. Basically, you could bet with or against the manager, taking advantage of the simpler, cheaper and nimbler qualities offered by a single, exchange-traded futures contract.

Despite an ambitious marketing and educational blitz, X-funds ultimately went nowhere. They were yet another case of an innovative product failing to reach a critical mass of liquidity before the initial burst of interest ran its course.

While actively managed ETFs in the purest sense arent available just yet, they are starting to take shape and are, in many ways, cut from the X-fund mold. Actively managed ETFs wouldnt passively track an index, but the advisor (or advisors) would select component securities in an attempt to meet some investment objective that is independent from any index composition.

While actively managed ETFs seemingly have been just around the corner for years, it appears the industry is about to make the plunge. In late 2007 and early 2008, AdvisorShares Investments LLC, Grail Advisors LLC and PowerShares Capital Management all joined the growing list of firms to petition the Securities and Exchange Commission for regulatory relief to offer actively managed ETFs.

Of course, one big hurdle for this new twist on ETFs wont be regulators, but what many feel led to the lack of success for X-funds: the lack of actual market history. While the historical data of an index itself can be considered a reliable proxy for a passively managed ETF tracking that index, that isnt necessarily the case for an actively managed ETF, which may or may not have been traded as any historical estimate data might assume.

As for Riley, he suggests the industry may have matured. They (ETFs) are here to stay, without doubt. I just think their ranks are going to thin out from where they are right now, Riley says. It will still be a growth game because the overall volume in the ones that are doing well will increase. There just wont be as many new ones.

Regardless of where ETFs go next, one thing is clear. Retail investors have accepted them. As such, these products are introducing new investors to markets, such as commodities and forex, that they might not have considered before. Not only does that result in more institutional money flowing into traditional exchange-traded derivatives markets as investment firms manage their risk, but for long-time futures and forex traders, retail ETF investment creates liquidity in yet another instrument for hedging, arbitrage and outright market exposure.