Elliott Wave Principle

Post on: 12 Май, 2015 No Comment

13.1. What is the Elliott Wave Principle?

Elliott Wave Principle is based on the fact that prices usually move in fives waves in the direction of the larger trend and in three waves contrary to it. In an up trend a five wave advance will be followed by a three wave decline; in a down trend a five wave decline will be followed by a three wave advance. Five-wave patterns are called impulse waves. three-wave patterns are called corrective waves.

Elliot waves show up on all types of charts, ranging from the monthly to the one-minute charts. Any wave is formed by waves of lower degree and is also a part of a higher degree wave. When using Elliott Waves for the currency trading it is best to take into account waves of only three degrees. minor (fully visible on the 15-minute charts), intermediate (fully visible on the hourly charts) and major waves (fully visible on the daily charts). Intermediate waves will be formed by minor waves and the major waves will be formed by intermediate waves. In general, use major impulse or corrective waves to determine the long-term market direction, enter your trades at the start and exit them at the end of intermediate impulse waves of the major waves using minor waves of the intermediate waves for timing your trades. More specifically, if you wish to trade hourly waves you should use the daily waves to establish the direction of the prevailing trend and the 15-minute waves for timing your trade entries and exits.

Ideal wave pattern

Relationship between Minor, Intermediate and Major Waves

Click to Enlarge.

Note: The reason different degree waves on the currency market tend to follow the same principles of construction can be because the same psychological forces are governing behaviour of separate groups of market participants — each of which operate on a different time horizon than the others (e.g. short-term traders involved more in creation of the minor waves while long-term investors being the major shapers of the major waves). This makes it important to stay alert to those moments when waves of different degree complete at the same currency price level — because more market participants will be closely watching it.

Elliott wave principle works best on markets with the largest public following. The forex market as a result of its enormous size, liquidity and diversity of participants very often displays clear wave patterns which can be used to a trader’s advantage — providing him or her with high-reward/low-risk. high-probability entry points in accordance with the prevailing trend. The usefulness of the Elliot wave analysis for the forex trader is also highlighted by the fact that the major waves on the currency markets usually develop in close correspondence with the interest rate cycles specific for the currency pairs that he or she is trading. Potentially profitable Elliott wave setups occur 50% of the time on the currency markets which makes it important for the forex traders to be at least aware of the basic principles of recognizing them.

Quote: The forex markets are so extremely volatile so that for any trading method to survive for long, it must be able to precisely measure profit objectives against expectable losses; at the same time, the method must also be able to define the time parameters within which the trades have to take place. the Elliott Wave Principle can perform this multi-faceted task admirably, Robert Balan, in his book, Elliott wave principle applied to the foreign exchange markets .

13.2. Impulse Waves

Impulse waves are five wave patterns. Impulse waves always unfold in the same direction as the larger trend — the next higher degree impulse or corrective wave. Waves 1,3 and 5 within an impulse are themselves impulse waves of lower degree which should also subdivide into a five-wave pattern. One of the impulse waves within an impulse wave will usually be extended or much longer than the other two. Most extensions in the currency markets occur in wave three. When one of the impulse waves extends the other two will frequently be of an equal size. Waves 2 and 4 within an impulse waves are corrective waves. Once an impulse wave is completed it will be followed by a corrective wave. An impulse wave is always followed by a corrective wave of the same degree unless the impulse wave completes a higher degree wave.

Ideal Impulse Wave

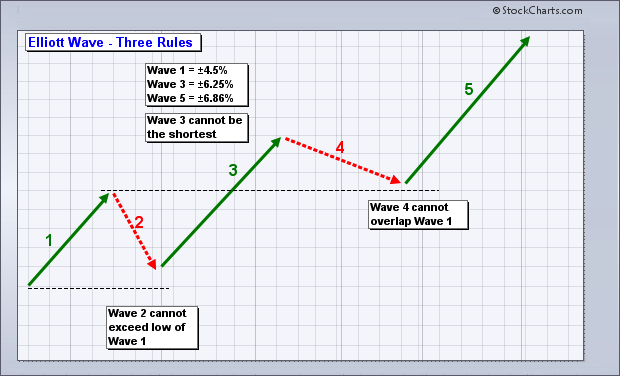

There are three rules which should hold true for an impulse wave to be valid: 1) wave two cannot move past the start of wave one; 2) wave three cannot be the shortest wave of the three impulse waves (1,3,5); 3) wave four cannot move past the end of wave one. If any of these rules is violated you should try a different wave count. In some cases the wave count can still be considered valid if the currencyprices violate any of the above rules but not on a closing basis.

Impulse Wave Rules

13.3. Corrective Waves

Corrective waves are three wave patterns. Corrective waves always unfold in the opposite direction to the larger trend — the next higher degree impulse or corrective wave. There are two different groups of corrective waves: simple corrective waves (zigzags, flats and irregulars) and complex corrective waves (triangles, double and triple threes). Corrective waves have much more variations than the impulse waves which makes it less easy to identify them while they are still being formed.

13.3.1. Zigzags, Flats and Irregulars

These corrective waves are broadly called ABC corrections. They differ by the distance their subwaves move in relation to each other and by the way they subdivide. A zigzag consists of a 5-3-5 sequence in which wave B doesnt move past the start of wave A and wave C moves far beyond the end of wave A. A flat is formed by a 3-3-5 sequence in which all the three subwaves are of the same length. An irregular is made up of a 3-3-5 sequence in which wave B exceeds the start of wave A and waves C moves close to or beyond the end of wave A.

It is useful to know that in all the three ABC corrections wave C subdivides into a five wave pattern. or an impulse wave. This information can be very helpful when making timing decision for entering your trades at the start of the higher impulse waves. ABC corrections most commonly act as the second subwaves of the impulse waves.

Ideal Zizgaz, Flat and Irregular

13.3.2. Triangles

Triangles are complex corrective waves which are formed by five progressively smaller three-wave patterns (a 3-3-3-3-3 sequence). Elliott wave theory uses the same method for classifying and measuring triangles as does the traditional technical analysis. Under the Elliott wave principle triangles most often act as the fourth subwaves of the impulse waves, preceding the final move in the direction of the larger trend. Therefore, if you see a triangle in the fourth wave of an impulse wave you can apply the standard price objective calculation method used for triangles to calculate the possible end of wave five (completion of the whole impulse wave) — in addition to the projection methods described below. If a triangle occurs in the wave B of an ABC correction you can project the end of wave C by using the same technique.

Ideal Triangle

13.3.3. Double and Tripple Threes

Double and triple threes are complex corrective waves which are made up from two and three simpler types of corrective waves respectfully — including zigzags, flats, irregulars and triangles. Simple corrective waves within double and triple threes are connected by a three wave pattern. Triangles usually appear only once and most often act as the final wave in the double and triple threes. Whenever the market starts to unfold in a double or triple correction, a trader is advised to rely more on traditional price analysis methods (e.g. trendlines breakouts, indicator divergencies ) for the signals that the corrective wave is ending.

Ideal double and tripple threes

Click to Enlarge.

Note: If the wave count on one currency pair is not very clear you can look at other currency pairs which are closely correlated to it (e.g. USD/CHF for EUR/USD) to clarify its wave structure. Alternatively, whenever a major currency pair that you are trading is not developing in a clearly defined impulse sequence you can leave it for the time being and look for more clear impulse patterns on the other unrelated crosses.

13.4. Principle of Alternation

According to the principle of alternation the second and the fourth corrective waves within an impulse wave will alternate in form and depth (i.e. will stop at different fibonacci retracements of the preceding impulse waves). If the second wave is a simple corrective wave (e.g. zigzag) the fourth wave is likely to be a complex corrective wave (e.g. triangle). If the second wave has retraced 61.8% of wave one, then the fourth wave will most probably retrace only 38.2% or 50% of wave three. If the second wave has corrected 38.2% or less of the wave one, then the fourth wave should correct 61.8% or more of wave three. On the forex market the law of alternation works more consistently in the depth of corrections rather than in their pattern. You can use the principle of alternation to determine what level of fibonacci retracemet to expect (or rather NOT to expect) in the fourth corrective wave, which should be different from the retracement level shown by the second wave.

Ideal Alternation Pattern

13.5. Using Elliott Waves in the Forex Trading

Elliot wave analysis allows to enter your trades at low-risk points (when the larger trend has a high probability of resuming) and exit them at high-reward points (when the larger trend has a high probability of ending or halting). You can make the most of these two advantages of the Elliott wave analysis by entering at the start and exiting at the end of the intermediate impulse waves of the major impulse or corrective waves. More specifically, you should enter the market on confirmed termination of the intermediate corrective waves of a major impulse or corrective wave. You should exit the market on confirmed termination of the intermediate impulse waves of the major impulse or corrective wave.

Click to Enlarge.

You can also trade minor impulse waves within intermediate impulse waves of the larger impulse or corrective waves — by entering at the start and exiting at the end of the minor impulse waves of the intermediate impulse waves. An example of an entry strategy using the minor waves — is to open a position at the start of the third minor impulse wave of the third intermediate impulse wave, which is also called entering on the third of the third. An example of an exit strategy using minor waves — is to close the position at the end of the fifth minor impulse wave of the fifth intermediate impulse wave, which is also known as exiting on the fifth of the fifth. When an intermediate wave completes a major impulse wave the last minor wave in this intermediate wave is also called the fifth of the fifth of the fifth. You can use the same methods for confirming the completion of the minor waves as those use for the intermediate waves, as described below.

13.5.1. Entering at the End of Intermediate Corrective Waves

Entering the market at the end of intermediate corrective waves (waves two and four) of the major impulse waves is a low-risk entry strategy because your entry occurs after the prices have already corrected and are ready to move in the direction of the larger trend .

Due to potential complexity of the corrective waves it is best to confirm their end by using other technical analysis tools. Some of the methods used for confirming the end of corrective waves are: 1) fibonacci retracements of the preceding impulse waves (of wave one when entering at the end of wave two and of wave three when entering at the end of wave four); 2) Oscillator Divergencies and Candlestick signals 3) Trendline breakouts.

ABC corrections often subdivide into a five-wave impulse sequence in the final C wave. Entering the market on the completion of the fifth minor impulse wave of the C wave of an intermediate ABC correction can be very precise timing technique. You can also use the fifth wave projection method (as well as other confirmation techniques) described below to calculate the probable end of the fifth minor impulse wave of wave C if the corrective wave is an ABC correction.

Quote: How a market reacts against retracement percentages will often indicate the position of the market. Currencies have a very high reliability of finding support and resistance at Fib retracements. This is probably because the currency traders of the world are very Elliott wave oriented, Robert C. Miner, in his book, Dynamic Trading: Dynamic Concepts in Time, Price & Pattern Analysis With Practical Strategies for Traders & Investors.

13.5.2. Exiting at the End of Intermediate Impulse Waves

Exiting the market at the end of intermediate impulse waves (waves three and five) of the major impulse waves is a high-reward exit strategy because your exit occurs after the prices have already completed the move in the direction of the larger trend and are ready to correct. You can take partial profits on the completion of the third intermediate impulse wave but you should close ALL of your positions at the end of the fifth intermediate impulse wave — because the entire major impulse wave will be completed at this point.

Due to potential extension of the impulse waves it is best to confirm their completion with the help of other technical analysis tools. You can use any of the following tools to confirm the completion of the impulse waves: 1) Fibonacci and Price Channel projections (described below); 3) Oscillator divergencies and Candlestick signals ; 4) Trendline or Moving Average breakouts. The best exit signals are given when completion of an intermediate impulse wave is also confirmed by the completion of its own fifth minor impulse wave (e.g. exiting on the fifth of the fifth ).

Fibonacci Projections. You can use fibonacci ratios to project the end of waves three and five in an impulse sequence. If the third wave extends it should move the distance equal to the height of the first impulse wave multiplied by either 1.618 or 2.618 (as projected from the end of wave 2). If it doesn’t extend it should move the distance equal to the amplitude of wave one (but no less). You can calculate the possible end of wave five by multiplying the height of wave one by 1.618 and projecting the result from the end of wave one. When the third wave is completed you can calculate the second price target for the fifth wave. To do this multiply the height of all three waves (from the start of wave 1 to the end of wave 3) by 0.618 and project the result from the end of wave three (you will need to use the 1.618 ratio instead of 0.618 if the fifth wave extends). The closer the price targets calculated by different methods are to each other the more likely is the price reversal to occur between them.

Note: You can use our interactive Fibonacci Calculator (Please note: This calculator requires that Javascript is enabled in your browser), located in the Forex Tools section, to calculate the probable end of waves three and five in an impulse sequnce (using the guidelines given above).

Price Channel Projections. Price channels can also be used to confirm the end of the third and the fifth waves in an impulse sequence. To project the end of wave three draw a trendline through the start of wave one and the end of wave two, then extend a parallel trendline from the end of wave one. The third wave should complete close to this parallel trendline (either slightly above or below or at exactly the same level).

To project the end of wave 5 draw a trendline through the ends of waves 2 and 4 (also called baseline) then draw two more trendlines parallel to it from the ends of waves 1 and 3. The fifth wave should complete close to one of these parallel trendlines: close to the channel line drawn from the end of wave 3 if it extends and close to the channel line drawn from the end of wave 1 if it doesn’t extend. You can increase the accuracy of the fifth wave projection of a higher degree impulse wave by constructing similar price channels for its fifth subwaves one or two degrees lower. The closer the fifth wave targets derived from different degree channels the more likely the completion of the entire impulse sequence in this area. The decisive break of the baseline (drawn through the ends of waves 2 and 4 or through the start of wave 1 and the end of wave 4) is the final signal that the whole impulse wave is completed.

Note: You can also enter the market on confirmed completion of an impulse wave and exit it when the corrective wave following it has ended. However, you should be prepared for a complex corrective wave after the impulse wave, which will decrease your chances of a profitable exit from such a trade. It is also necessary determine if the impulse wave on whose completion you are entering the market is in itself completing a higher degree impulse wave. If this is the case, the minimum profit target should be set at the 38.2% retracement of the larger degree impulse wave (or the end of its fourth wave). If the impulse wave is not completing a higher degree impulse wave the minimum profit target should be set at the 38.2% retracement of itself (or the end of its own fourth wave). It should be noted that the higher the degree of the an impulse wave the sharper the move in the opposite direction you can expect when it is completed.

Note: Some of the forex newswires (e.g. MarketNews and Reuters) provide Elliot wave commentary (e.g. wave counts and currency price targets).

13.6. Mastering Elliott Waves

To achieve the best results from using the Elliott wave analysis in your forex trading you should always combine this method with the othert technical analysis tools. This practice will often result in uncovering trading setups of exceptional beauty and profit potential. You will find complete instructions on how to recognize and to trade various Elliott wave types in the books on the Elliott wave analysis. that we have found to be the most practical for the currency traders. You might also wish to review some of the automated Elliot wave analysis packages which can evaluate the currency market structure in real-time (e.g. Advanced Get or MTPredictor ) and identify impulse or corrective waves while they are still developing. These software packages make it possible to concentrate on the larger picture without having to spend your time to arrive at the best wave count for the current price action.

Quote. Over many years of experience, I have still to see a method that has consistently beaten the Elliott Wave Principle for its accuracy in the timing of market turns, which it does sometimes with mind-boggling accuracy, Robert Balan, in his book, Elliott wave principle applied to the foreign exchange markets.