Elliott Wave_1

Post on: 12 Май, 2015 No Comment

The Elliott Wave Principle is a form of technical analysis that some traders use to analyze financial market cycles and forecast market trends by identifying extremes in investor psychology, highs and lows in prices, and other collective factors. Ralph Nelson Elliott, a professional accountant, discovered the underlying social principles and developed the analytical tools in the 1939. He proposed that market prices unfold in specific patterns, which practitioners today call Elliott waves, or simply waves. Theory is based on the analysis of the psychology of crowd, in other words human behavior as a factor that has been shaping the market prices. Elliott wave analysis method is a mathematical sequence of the Fibonacci numbers. Elliott wave principle is used for the analysis of the stock and currency markets.

Elliott Wave basis and characteristics

The human behavior changes are major factors that affect the market fluctuations, so this is a cornerstone of this theory. Let’s do not get into details and just note that the change in supply and demand in one way or another is effectively connected with the psychological expectations of the people.

According to Elliot, the market price fluctuations can be clearly identified and provide a cycle of eight waves that is called the super-cycle. This cycle has 2 phases, such as a bull market in equities and a bear market. The wave patterns are defined below.

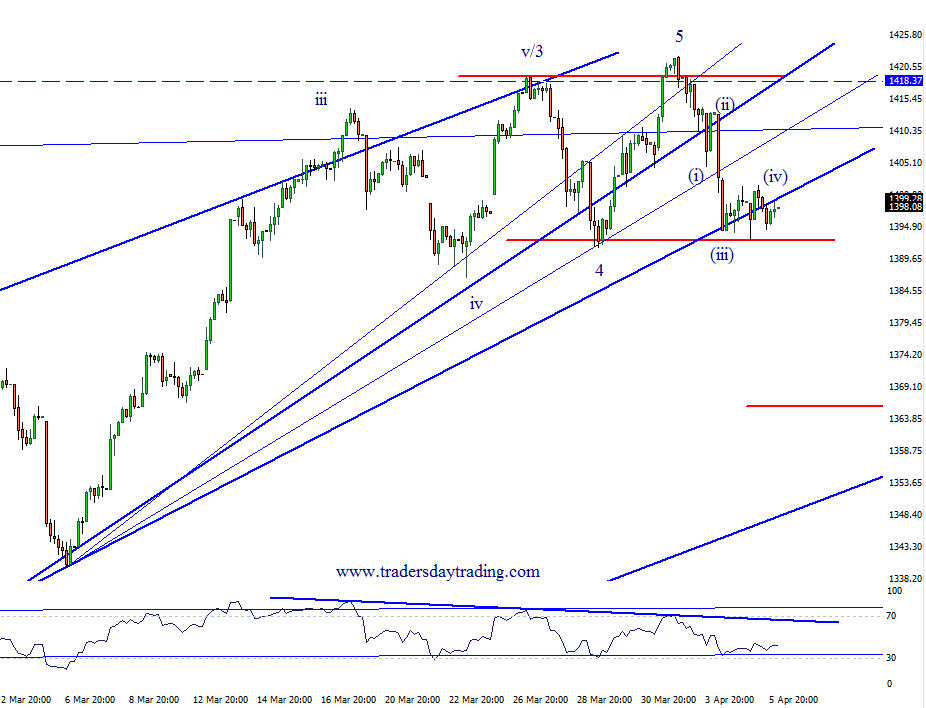

The Elliott classic cycle consists of a scheme 5 +3.

- The first bull phase has five waves, namely three upward waves (impulsive waves) and two corrective waves (consolidation waves) that smooth the effects of the first three waves. The second bear phase has two downward waves and one corrective wave.

If the first phase of the cycle moves in the direction towards the trend, then the second shows the opposite direction. Each cycle has 5 impulsive waves and 3 corrective waves. The impulsive waves form significant fluctuations in the direction towards the main trend, and the corrective waves move against the trend. Each large wave consists of the smaller waves. It is also worth noting that one whole cycle fits into two waves of longer duration cycle.

One of 3 impulsive waves will have a longer duration of time, namely it will be stretched. Nine waves of shorter length make up the stretched wave of the impulse. As a rule, the third impulsive wave is stretched.

A full Elliott cycle is completed at the end of the eighth wave.

The role of corrective waves is very important in the market, as after the full cycle is completed, the corrective waves lower the prices to the level of the fourth wave. The corrective waves may have the different duration and form.

Elliott Wave calculation

Elliott Wave analysis method is a mathematical sequence of the Fibonacci numbers. The Fibonacci sequence defines the number of waves and their correlation with height. For the adjacent impulsive waves the correlation is 1, 618. The height correlation of corrective wave to the previous impulsive wave can be different like 38%, 50% or 61.8%.

Elliott Wave Theory and Forex market

First, this theory was used for the analysis of the stock market. Over time, there was revealed the main feature of the Elliott Wave Theory. This type of analysis is very well suited to those markets in which the psychological factor of human behavior plays an important role. Forex foreign exchange market is precisely the right one. The psychological expectations of buyers and sellers are just the driving forces that can have an impact on the exchange rate in the market.

We should consider the full range of cycles to get the right analysis, including the short-term and the long-term cycles. For example, it is better to consider the long-term changes using the long-term cycles.

There are many different opinions about usage and accuracy of the forecast using Elliott Waves. However, there is one thing that is certain, namely this method is very profitable and reliable, and for sure the proper use gives good results in trading in Forex market.