ElderRay Bull Power

Post on: 16 Март, 2015 No Comment

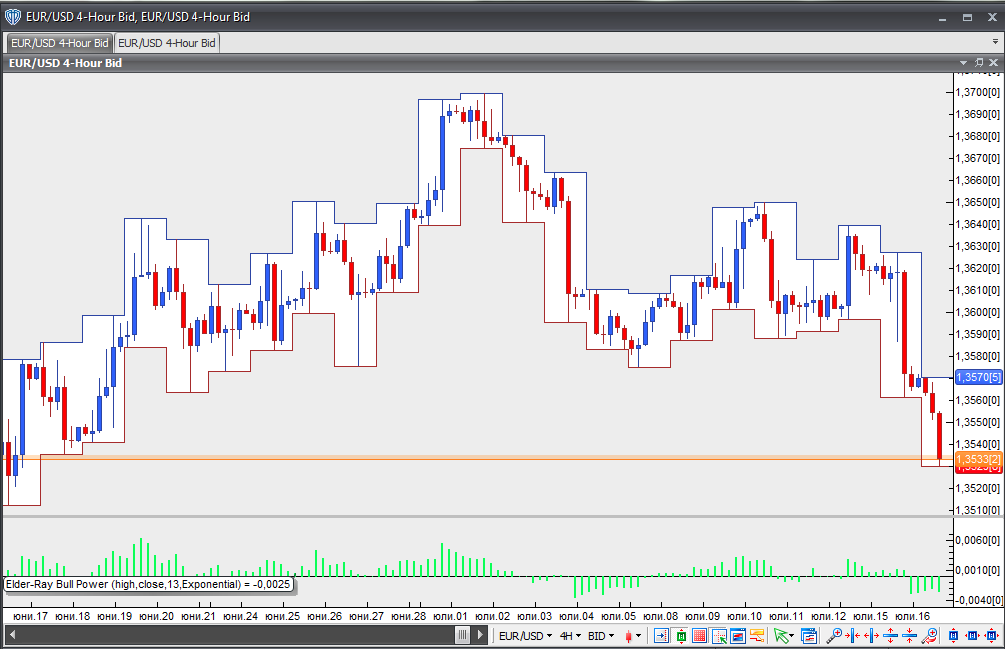

Elder-Ray Bull Power

Developed by Dr. Alexander Elder in 1989 and described in his book Trading for a Living, the Elder-Ray indicator consists of three components: Bear Power, Bull Power, and a 13-periods exponential moving average.

Bull Power is calculated by subtracting a 13-periods exponential moving average from the High price.

Bear Power is calculated by subtracting a 13-periods exponential moving average from the Low price of the bar.

The High price of any bar represents the maximum power of the bulls and the Low price of any bar represents the maximum power of the bears. Elder refers to the exponential moving average as the average consensus of price value. Therefore, Bull Power represents the ability of the bulls to raise prices above the average consensus of value and Bear Power represents the ability of the bears to push prices below the average consensus of value.

Interpretation

According the Elder, Bull Power should normally remain positive and Bear Power should normally remain negative. However, if Bull Power turns negative it means that the bears have gained control of the market and if Bear Power turns positive it means that the bulls have gained control. You should not buy when Bear Power is positive and you should not sell when Bull Power is negative.

Elder suggests using the exponential moving averages slope to determine the market trend direction. He describes the best buy signals as being when bullish divergence occurs between Bear Power and price (i.e. lower lows in price and higher lows in Bear Power) and the best sell signals as being when bearish divergence occurs between Bull Power and price (i.e. higher highs in price and lower highs in Bull Power).

Elder described four basic conditions for buying and selling using only the Elder-Ray method, but also recommended combining it with the Triple Screen method.

Buying Conditions:

(Essential)

1. Prices are trending upwards according to the 13-periods exponential moving average

2. Bear Power is negative, but rising

(Optional)

3. The latest Bull Power peak is higher than its previous peak

4. Bear Power is rising from a bullish divergence

Selling Conditions:

(Essential)

1. Prices are trending downwards according to the 13-periods exponential moving average

2. Bull Power is positive, but declining

(Optional)

3. The latest Bear Power trough is lower than its previous trough

4. Bull Power is declining from a bearish divergence

Elder mentions that if you want to increase your position, you should:

- Increase your long position whenever Bear Power declines below zero and then rises back into positive territory.

- Increase your short position whenever Bull Power rises above zero and then falls back into negative territory.

Elders Triple Screen method suggests identifying the price trend on a higher chart interval (like Weekly charts) and applying the Elder-Ray on a lower chart interval (like Daily charts). Signals are taken according to the Elder-Ray, but only in the direction of the price trend in the higher chart interval. A Trailing Buy Stop and Trailing Sell Stop technique can then be used to pinpoint entry points. For example, if the weekly trend is up and the daily oscillator is declining Elder suggests placing a buy stop order 1 point above the previous bar’s High. If the market reverses you will be stopped in long. However, if the market continues to decline, you must adjust your buy stop order so that it is always 1 point above the previous bar’s High. The buy stop order remains active until it is either triggered or the weekly trend reverses (at which time you would cancel your order). If the weekly trend is down and the daily oscillator is rising Elder suggests placing a sell stop order 1 point below the previous bar’s Low. If the market reverses you will be stopped in short. However, if the market continues to rise, you must adjust your sell stop order so that it is always 1 point below the previous bar’s Low. The sell stop order remains active until it is either triggered or the weekly trend reverses (at which time you would cancel your order).

The materials presented on this website are solely for informational purposes and are not intended as investment or trading advice. Suggested reading materials are created by outside parties and do not necessarily reflect the opinions or representations of Capital Market Services LLC. Please refer to our risk disclosure page for more information.