Economic Calendar

Post on: 15 Май, 2015 No Comment

Forex Calendar

Which are the most powerful upcoming market-moving events? When is a bullish or a bearish trend likely to set in and how will that affect the market?

For traders decision making is all important. Setting up an investment goal and choosing a particular financial instrument to trade on can only bring the expected return on investment if you know what moves the market and when it is the optimal time to enter or exit your trades. With trading decisions that you make in the context of upcoming economic events you have a potentially bigger chance for profit and this is where an economic calendar comes in handy.

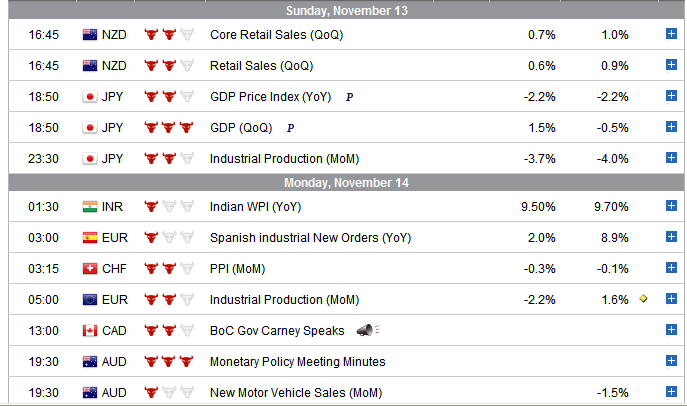

The XM economic calendar provides useful information on upcoming macroeconomic events by means of pre-scheduled news announcements and government reports on economic indicators that influence the financial markets. This will help you not only follow a wide range of major economic events that continuously move the market but also make the right investment decisions. Because market reactions to global economic events are very quick, you will find it useful to know the time of such upcoming events and adapt your trading strategies accordingly.

In both bullish and bearish markets there are good chances for profit – as long as you know which one is likely to set in and what changes it will bring along. This is where the XM economic calendar will definitely help you.

Attention to Detail Pays Off

With the regular use of the XM economic calendar, you can follow the release schedule of numerous economic indicators and get ready for significant market movements. Economic indicators help you consider trades in the context of economic events and understand price actions during these events. By following indicators for GDP, for instance, or inflation and employment strength, you can anticipate market volatility and gain potential trading opportunities in good time.

Below you can see the most important economic indicators at a glance.

Consumer Confidence Index (CCI)

A monthly release formed from the survey results of over 5,000 households. It measures average consumer confidence and spending power (for instance, a drastic decrease in consumer confidence can indicate a weakening economy).

A monthly released key indicator of future manufacturing activity with indications to new orders placed with domestic manufacturers for the upcoming delivery of durable goods.

A quarterly economic series that indicates the rising and falling tendencies in employment costs. It measures inflation in salaries, wages and employer-paid benefits in the US.

It indicates the economic growth of a country, and it is determined by product output, income and expenditure. GDB is often correlated with the living standard. It is the market value of all services and goods produced in a country during a certain time period.

A measure of price levels for all goods and services in an economy. The use of the deflator helps you calculate the difference between nominal and real GDP.

An indicator for the changes in output in the industrial sector (e.g. manufacturing, mining). It indicates the industrial capacity of a country.

It is released by the US Federal Reserve every month and it measures economic activity, showing data for the previous month about the total amount of US industrial production. The IPCU encourages buying or selling in certain industries.

It measures the difference imports vs exports of all goods and services. Changes in imports and exports, together with the level of the international trade balance, indicate market trends.

A business survey based on the latest economic data of over 7,000 German business leaders. It provides assessment of the current and upcoming economic climate in Germany and Europe.

It measures economy in general, and the manufacturing sector in particular. It sums up the survey of over 250 companies in all US states, and it calculates data of production, new orders, and employment.

A monthly report released by the US Department of Labor that provides statistical data about the current state of the US labor market. It is also used to forecast future levels of economic activity.

A frequently used economic indicator that measures the average changes in selling prices received by domestic producers in manufacturing, mining, electric utility, and agriculture.

A monthly report that measures consumer expenditure (an essential indicator of GDP in the US). As a timely indicator of broad consumer spending patterns, it can be used to assess the immediate direction of an economy.