Dow Jones Industrial AverageElliott Wave update for week ending 12

Post on: 16 Март, 2015 No Comment

Dow Jones Industrial Average

Elliott Wave update for week ending 12/26/2014

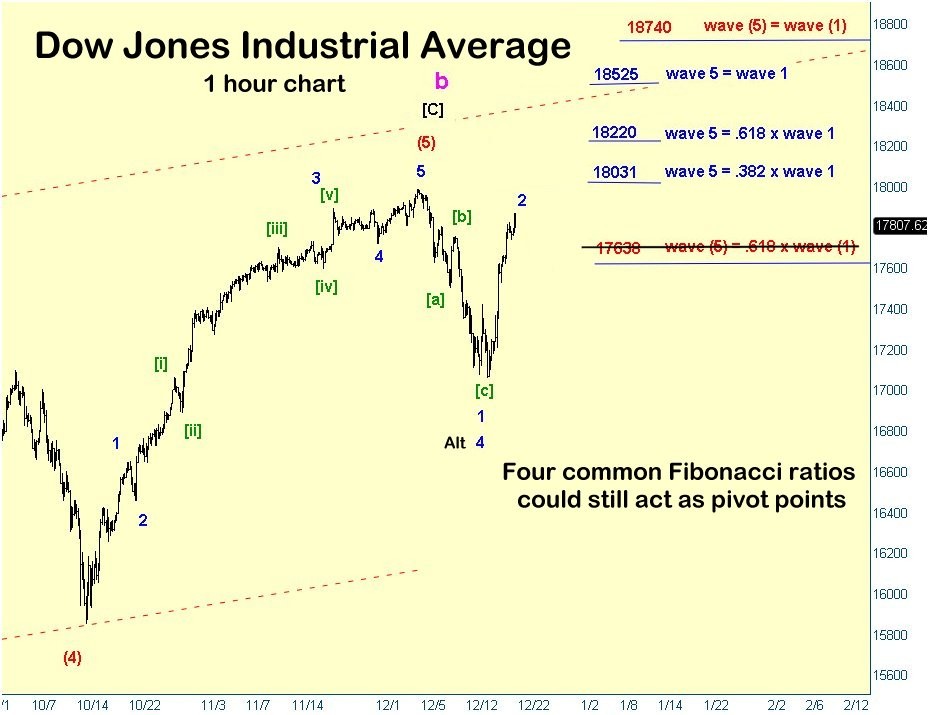

The new high in the Dow Jones Industrial Average this past week has made the short-term picture a little foggy until more waves play out. The Dow was able to glide upward on the lowest volume of the year, trending ever-so-slightly with the seasonal bias expected.

As I talked about in last weeks update, the wave labels have been adjusted to reflect the new high. As we wait for more clarity, I have speculated on a possible ending structure that makes sense both from a Fibonacci perspective and a social mood perspective. A very good candidate for a final topping pattern would be a contracting ending diagonal at Minor degree.

Ending diagonals occur when a market has moved too far too fast. Subsequently, it slows its pace and just ambles quietly upward in a series of zigzags that add little to the price as it marks time for participants to realize that the ride is over.

There are several characteristics that identify ending diagonals that we will look for over the coming weeks. Each leg should form an a-b-c zigzag . Wave [iv] should pull back enough to overlap wave [i]. a condition which is only allowed in a diagonal. Wave [v] may throwover the upper trend line of the diagonal, a characteristic that is common but not required. Notice also that the throwover would additionally breach the upper trend line ( red dashed line ) marking the entire Primary wave [C] move up from October 2011.

We will also be looking at the two areas of Fibonacci ratios as price points where a major reversal could take place. The first will be the area where Minor wave 5 = wave 3 at 18600. The second is where Intermediate wave (5) will equal wave (1) at 18740. Either of these areas could fit into an ending diagonal scenario. Our initial target range . then, for a reversal zone will be the area between 18600 and 18740 .

Because of the zigzag nature of ending diagonals, volatility should be expected for the entirety of the move. The feeling of being on a roller coaster for the next few weeks or months should help sway the publics decision to move away from the stock market. The stock market is the last of the asset bubbles to burst. Every other asset class has already turned down some, like precious metals, oil and commodities, significantly so. It is now time for equities to join them.

Naturally, it is too soon to know for sure what pattern is playing out. There are enough legs countable to call the top at todays levels. So, it is alternately possible that the ride is already over and the anticipated wave [ii] correction from the primary scenario will simply keep on going south. It seems I have been better lately at calling the alternate scenario than the primary. We will soon know.

Subscribe to our e-mail list for timely notification of newly posted news articles, charts and editorials.