Double Your Dividends In Just Six Years

Post on: 16 Март, 2015 No Comment

Malcolm Wheatley

Don’t underestimate the power of dividend growth.

Looking for fast-growing dividends? Consider FTSE 100 (UKX) oil services group Petrofac (LSE: PFC ), which has boosted its payout by 50.3% over the past five years. Or global brewer SABMiller (LSE: SAB ), only slightly behind at a spanking 48.1% five-year dividend growth rate.

Yet income investors are right to be leery of such shares. While the dividend growth may be stellar, the actual starting point — the dividend yield — is often low.

In Petrofac’s case, the yield is just 2.8%, well below the Footsie’s average yield of 3.8%. At SABMiller, it’s even lower: 2.5%.

Past performance

Even so, Petrofac and SABMiller provide a handy reminder that investors shouldn’t just go out and chase high yields. In short, never assume that two companies offering similar yields are largely the same, dividend‑wise. For long‑term income investors, dividend growth matters as well.

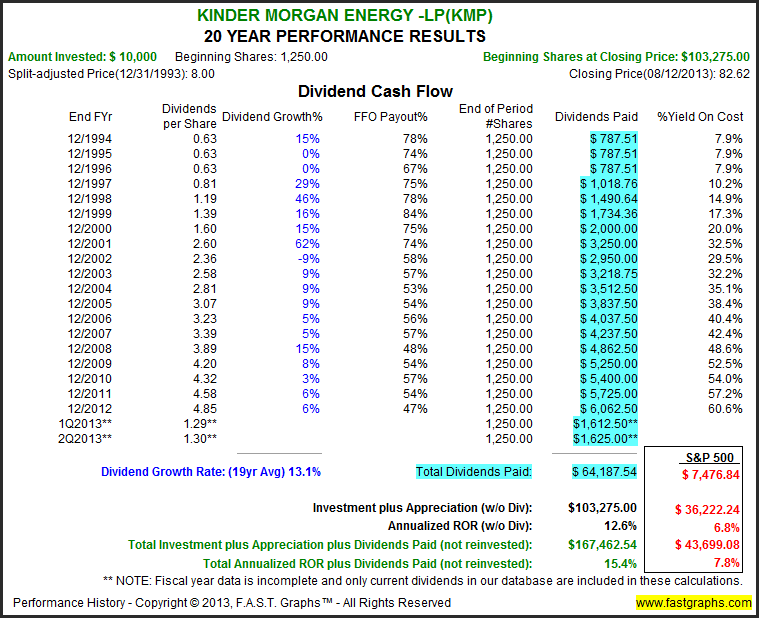

That’s because not only do healthy, growing companies often pay out sizable dividends, they also tend to increase those dividends over time.

So when looking at a prospective high-yield investment, ask these three fundamental questions:

- Has the company a track record of delivering year-on-year increases in its dividend?

- Better still, has it a record of delivering year-on-year percentage increases in the dividend growth it delivers?

- Is the dividend amply covered by earnings?

Such companies are a much, much better bet than a business that happens to be offering a high yield simply because its share price has slumped.

Or — worse — offering a high yield because investors expect its dividend to be cut, and have consequently driven the share price down. As I wrote last week, the yield trap lurks for the unwary .

Sustainable dividends

That said, high-yield investing can be a judgment call at times, weighing yield against other factors. And undeniably, yields of 9-10% — as I’ve written — are worrying, especially when coupled to low dividend cover .

For me, yields of 5%-6% are far more tempting, speaking as they do to the more likely prospect of being sustained over the longer term. In such cases, it’s often short-term worries regarding top-line revenues — or simply a share falling out of fashion — that has seen the share price sag, thus raising the yield.

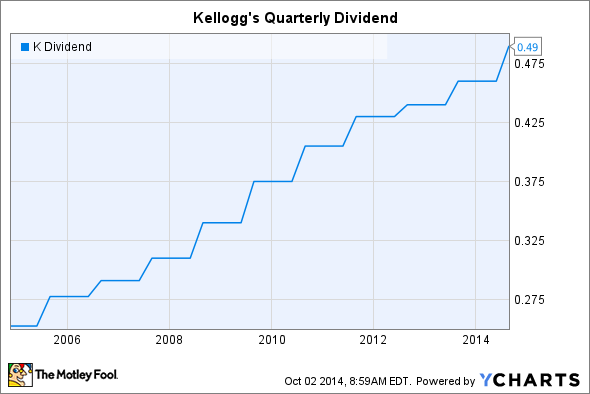

And while the dividend growth posted by such shares may be less than meteoric — certainly not into Petrofac territory — it can still deliver a healthy boost over time.

Here, for instance, are three high-yield picks that do the business for me, and which boast an attractive (and sustainable) dividend growth rate as well. And yes, I hold all three.