Dollar Cost Averaging for STI ETF ~ Moneytalk

Post on: 16 Март, 2015 No Comment

Dollar Cost Averaging for STI ETF

This post is part of a series of posts that discuss about the STI ETF in detail. To access the other posts in this series, click here

There are other methods of choosing when to buy the STI ETF. Dollar Cost Averaging or in short, DCA is one such method. DCA is the buying of the investment with a fixed amount of money at regular intervals. This method aims to eliminate the guesswork of knowing when to buy the investment and emotions such as the fear of buying the investment. However, the purchase of the STI ETF is slightly different from that of unit trusts. This is because one can only purchase the STI ETF in terms of the number of lots as it is traded over the stock exchange as compared to unit trust, where one can buy it at any amount. For example, if the STI ETF is trading at $2.00, one can only purchase in terms of the number of lots i.e. 1 lot, 2 lots, 3 lots and so on and the contract value will be $2000, $4000 and $6000 respectively.

So how should one go about implementing DCA ?

1) Decide and set aside a sum of money at every regular period for the purchase of the STI ETF. Make sure that you are financially capable of setting aside this amount of money as this plan requires consistency.

2) Decide on how long that period should be. Do take note that the period should not be too long apart as this will decrease the effectiveness of averaging the cost of the investment. A suggestion would be every 2 to 3 months although that will depend on how much money you are willing to set aside.

3) At every regular interval, use the amount of money that you have set aside to purchase the STI ETF. It will be advisable to choose a fixed date at every regular interval to carry out the purchase. For example, one can choose the 1st day of every month or the day which your pay is credited into your account.

For example, the period that I have choose will be a 3 months interval. Assuming I am willing to set aside $1500 per month for the purchase of the STI ETF, I will have $1500 * 3 = $4500 for each period.

Asumming that the STI ETF is trading at $1.70. Since I have $4500 to begin with, I can buy 2 lots of STI ETF at $3400. Assuming the commission cost $30, I would have spend a total of $3400 + $30 = $3430. Thus I will be left with $4500 — $3430 = $1070 which I will accumulate over to the next period.

Assuming that the STI ETF is trading at $1.40. Since I have a total of $4500 + $1070 = $5570, I can buy 3 lots of STI ETF at $4200. Assuming the commission cost $30, I would have spend a total of $4200 + $30 = $4230. Thus I will be left with $5570 — $4230 = $1340 which I will accumulate over to the next period.

Assuming that the STI ETF is trading at $2.50. Since I have a total of $4500 + $1340 = $5840, I can buy 2 lots of STI ETF at $5000. Assuming the commission cost $30, I would have spend a total of $5000 + $30 = $5030. Thus I will be left with $5840 — $5030 = $810 which I will accumulate over to the next period.

You would have bought a total of 2 + 3 + 3 = 7 lots using a total of $3400 + $4200 + $5000 = $12600. Thus the average purchase price for one lot of STI ETF will be $12600 / 7 = $1800.

In this way, you will be able to average out the purchase price of the STI ETF and reduce the risk of putting all your capital at the peak of the market. You will also be able to achieve a positive return for the STI ETF if you are willing to hold the STI ETF since the STI will rise in the long run.

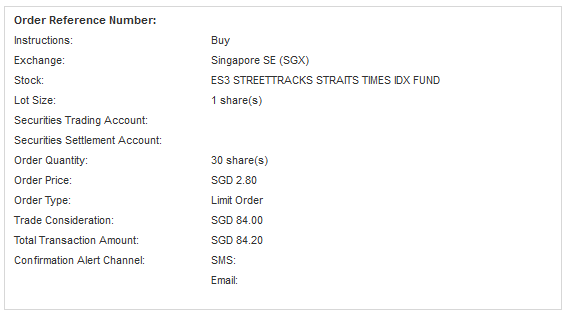

Currently, there is a DCA plan being offered by a local brokerage. You can click here to see a review of it.