Dollar At 11Year Highs Can The Rally Continue Fx Empire Network

Post on: 8 Апрель, 2015 No Comment

Category:

Forex Market

Get Forex buy/sell signals directly to your email and by SMS.

Dollar At 11-Year Highs Can The Rally Continue?

When we look at the financial markets, one of the most surprising trends over the last year has been the renewed strength in the US Dollar. This strength has been seen across the board, but some of the most pronounced buying activity has been seen against the Euro. The EUR/USD currency pair is now trading below the 1.11, and the more broadly traded Dollar Index has now risen to peaks not seen since 2011. So, the real question for traders in all of the financial markets is: How much longer can this continue?

“As always, the first place to look when making these types of assessments is the price chart itself,” said Rick Bartlett, analyst at 4K Research. “But there are also some fundamental factors that should continue to support the prospects for the Dollar and for the US economy as a whole.” Most specifically, recent employment data has shown continued strength in the employment sector. This week’s release of the ADP employment report showed that the private sector added 212,000 new jobs for the month. By some assessments, this was below the market’s consensus expectations of 220,000. But when we take a step back and view these numbers in a more objective way, there is clear long-term strength in these figures that points to continued rallies in the Dollar as we head into the second half of the year.

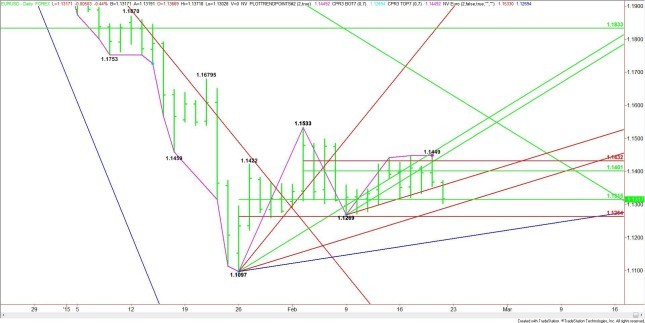

EUR/USD Euro vs. US Dollar

Critical Resistance: 1.1480

Critical Support: 1.10

Trading Bias: Bearish

Dollar At 11-Year Highs — Can The Rally Continue?

(Chart Source: CornerTrader)

EUR/USD Forex Strategy: Bearish momentum prevails in the EUR/USD, so there is little reason to start initiating longs until this completes. Next support rests at the 1.10 psychological level.

The downtrend in the EUR/USD is undeniable, and there is little reason to start expecting forceful reversals in the near future. Contrarian traders should be looking for evidence of reversal and this is highly unlikely until we see buy order tested at 1.10. When market moves occur like what has been seen in the EUR/USD, critical turning points tend to occur near the big round figures that mark psychological lines in the sand. The 1.10 level is a good example of this, so we can expect some heightened 2-way volatility once prices start to approach this level. Daily MACD readings suggest that momentum is rolling over once again and we are already in negative territory. This makes long positions excessively risky.

_______________________________________

USD/JPY US Dollar vs. Japanese Yen

Critical Resistance: 122.10

Critical Support: 116.80

Trading Bias: Bullish

USD/JPY Forex Strategy: The picture is flipped for the USD/JPY, which shows very strong bullish momentum, suitable for long positions. Watch for entries at support of 116.80.

The USD/JPY is showing the exact opposite picture, with bullish momentum that is still suitable for establishing long positions. This should also be encouraging for traders that are looking to implement carry trade strategies as there is also yield value that is associated with betting against the Japanese Yen. Watch for drops of support back into the 116.80 level before buying back into this pair.