Differences Between Venture Capital and Angel Investing

Post on: 16 Март, 2015 No Comment

Obtaining Equity Financing for Your Startup or Existing Business

You can opt-out at any time.

During the Great Recession, both angel investing and venture capital investments plummeted due to the dire state of the U.S. economy. Few startups were happening and entrepreneurs were mostly sitting on the sidelines. During 2010, both angel investors and venture capitalist started to get interested again as positive economic signs appeared. Both surged right into 2011. It’s time to talk about companies starting up and needing funding again, which is good news for our economy.

As an entrepreneur, you don’t have to worry about the market for Initial Public Offerings (IPOs) being down. You won’t be ready for that for awhile, chances are. There are steps to take before that happens. First, look at the differences between angel investors and venture capitalists and we’ll move on from there with regard to obtaining financing .

The Differences Between Angel Investors and Venture Capitalists

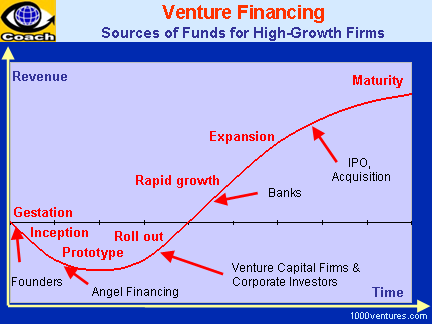

Contrary to popular belief, venture capitalists seldom provide start-up funding to entrepreneurial ventures. Angel investors. on the other hand, exist to provide seed financing to start-up ventures. Angel investors are willing to take on the risk of a brand new firm, where venture capitalists prefer to become involved a little later down the line.

Angel investing is perhaps the more mysterious of the two forms of equity financing. Angel investing is a very old term harkening back to the 1920’s and rich patrons of the arts who financed the first of the Broadway plays. One recent related angel investor was Goldie Hawn in the movie Private Benjamin.

Unlike venture capitalists, angel investors typically use their own money to fund an entrepreneurial venture they find interesting and potentially profitable at start-up. Venture capitalists, on the other hand, do not use their own money as a rule. They use institutional money from college endowments or large pension funds and they hold a fiduciary or trust responsibility to make a good investment that will earn a high rate of return. Venture capitalists are also charged with the responsibility of demanding board positions and exerting veto rights to affect the company’s direction as they see fit.

Angel investors are a bit more benign. Just like with the Broadway plays, angel investors get into a project because it appeals to them personally. That doesn’t mean they don’t want a nice rate of return. They certainly do and will not invest if their own financial analysis does not lead them to believe that is exactly what they will get. They are often wealthy, retired business people who look for interesting project that are too young for banks to take a chance on and for venture capitalists to be interested in. In an angel/owner relationship, you often also find a mentor/owner relationship.

Where Does the Venture Capitalist Enter the Picture and How Does This Differ From the Angel Investors?

We already know that seldom do venture capitalist provide seed money for a start-up company and that is the role of an angel investor. Venture capitalists step in later, after the start-up firm is off the ground and they can see that it may make it. At that point, the venture capital firm could invest as much as $7 million (an average) in the relatively new start-up. In contrast, the angel investor usually invests a relatively small amount — around $30,000. However, to deliver a pitch to a venture capitalist and obtain acceptance is no small feat.

Of course, if an angel investor becomes interested in your start-up, you must research them and deliver your pitch. However, the venture capitalist is a tougher audience. They will be easier to find and research than the angel investor. Find out everything you can about them and try to pick the one that fits best with your company.

Craft the pitch about your company that you want to give to them, the shorter the better. The pitch is slang for the sales pitch and you need one for angel investors and a shorter one for venture capitalists. Five minutes is good — you have to capture their imagination immediately. Twenty minutes is the absolute maximum in finance. It might be worth it to buy a few hours of a public relations firm time to help you put a short pitch together.

If you can get a venture capitalist interested in your company, good work! The venture capitalists differs from the angel investor in one more way. They will never want any say in the day-to-day operations of the firm and, as stated above, the angel investor is often interested in a mentoring relationship with the owner. However, the venture capitalist always wants and requires a seat on the Board of Directors in exchange for the funding.

One Last Comment

Keep in mind that with both venture capitalists and angel investors, you are giving away part of the equity (ownership) in your firm. That is a decision you should think carefully about.