Currency Pairs

Post on: 12 Апрель, 2015 No Comment

Currency Pairs

Important: This page is part of archived content and may be outdated.

Currency Pair Example: EUR/USD 1.1000 indicates that a trader needs 1.1000 USD to buy one euro. At the same time it indicates that a trader can sell one euro to get 1.1000 USD.

Say for instance the euro’s value increases against the USD and the exchange rate is now at EUR/USD 1.1100. For every one euro that the trader bought, he/she has earned 1 USD cent. On the other hand it could be for every euro the trader sold, he/she lost 1 USD cent. This is because the trader ‘bought’ back the euro for 1.11 at a higher rate than originally purchased, making a loss.

Below we have provided an explanation regarding currency pairs in the Forex industry.

Currency pairs explained

Forex trading involves buying one currency and selling the other at the same time whilst monitoring each value the currency has.

The buying and selling of currencies in the foreign exchange market presents countless opportunities for a trader to gain huge profits.

Every currency is traded in pairs. Pairs are always kept together due to the fact that the currency pair’s rate is based on the valuation of those two specified currencies.

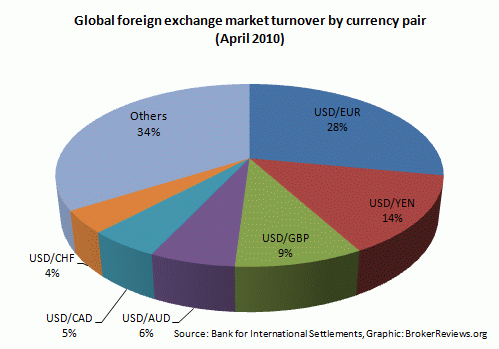

The ‘major’ currencies in Forex are the United States dollar (USD), the euro (EUR), the British pound sterling (GBP), the Japanese yen (JPY), the Swiss franc (CHF) and the Australian dollar (AUD). These are the most commonly used currencies traded within the Forex market. These six major currencies amount to 90% of the forex trading market.

Moving on, most trades tend to trade against the USD. The most common currency pair in the market is often the EUR/USD.

The rate at which a currency pair is traded is called the ‘exchange rate’. In Forex, this exchange rate is constantly changing and it is affected by currency supply and demand.

So how does ‘buying’ and ‘selling’ actually occur?

Well in general, a currency pair holds a ‘base currency’ and a ‘quote/counter currency’. The first currency of the pair is the base currency while the second is the quote/counter. For example, GBP/JPY GBP=base and JPY= quote.

A trader is either buying or selling the base currency in exchange for the quote currency.

With the exchange rate, a trader will determine how much of the quote currency they require to buy one of the base currencies.

When referring to a ‘quote’ in Forex we are talking about the rate of which you are buying or selling with your chosen currency pair. Bear in mind that this is different from an ‘indication’ as this is where the price given by the market maker is merely informational.

The two types of quotes in the market are direct quotes and indirect quotes. A direct quote is the price for one US dollar referring to another currency and an indirect quote is the price for one UNIT of another currency referring to the US dollar.

Something all traders should keep in mind is that most currencies are quoted against the USD- direct quote; while the EUR, GBP, NZD and AUD are indirect quotes.

In Forex, there are two prices for a currency. There is the buy price which is referred to as the ‘BID’ price and there is there sell price which is referred to as the ‘ASK’ price. With these two prices, a ‘spread’ is created. A ‘spread’ is the difference between the ‘bid’ and ‘ask’ price. By looking at the spread, the trader will determine the difference between what the market maker is offering to buy from a trader and what the market maker is taking to sell to a trader.

Take this example:

EUR/USD bid/ask rate is 1.1100/1.1200.

The market maker offers $1.11 when buying from the trader. However he/she takes $1.12 when selling to the

trader.

The traders many buy and sell without any change in the exchange rate. This may cause a loss of money.

This is due to the spread. Traders pay more to buy the currency than that of what they receive when they sell it.

The spread is in fact the commission for the market makers (Forex Brokers), that is earned from the traders on each placed forex order.