Currency Correlation

Post on: 19 Апрель, 2015 No Comment

Some currency pairs are correlated and some are not. Lets try to see what currency correlation is. But before talking about Forex correlation, lets start from the macro level.

Every currency has its own characteristics:

- There are safe heaven currencies which attract investments when there are major economic turmoil and risks to global economy is perceived to be high. These currencies are considered to be safe investments when the risk appetite is low.

- There are commodity currencies from countries which are major commodity exporters and the health of those economies and hence the health of their currencies depend on the growth of commodity exports.

- There are low yield currencies with very low inflation rate and hence very low interest rates and then there are high yield currencies.

- There are economies and currencies from nations which are large and net exporters and then there are those who are large and net importers.

The points mentioned above are just on macro level but what these reflect that many of the economies across the globe are correlated. It may be a strong positive correlation or a strong negative correlation or it may be weak ones but if some economies have correlations then it is natural that their currencies would also have correlation. The strength of a currency is nothing but the strength of that economy. So currency correlation basically represents the correlation of those economies.

So when we say that every currency has its own characteristics, we should also say that many of those characteristics are shared with other currencies and are common with some other currencies. This is like families of currencies. The currencies of one family or with similar characteristics would behave similar to each other during various kinds of economic scenarios or market sentiments. For example when there is a perceived risk for global economy, the currencies when may be considered as safe, would become stronger or when there is more risk appetite because of higher confidence in the health of global economy. the currencies with high yield but more risk factor may shine better.

To summarize it, we can say that we do not have to analyze each currency individually but on a macro level we can divided currencies in different groups or families and the initial analysis can be for the individual groups or families and not just the individual currencies. The currencies of on group may tend to behave similarly and move in the same direction normally.

Now to go one step more into detail about currency correlation, lets see what kinds of relationships are possible between currencies:

1) Generally behaving in the similar way i.e. positive correlation.

2) Generally behaving in the opposite way i.e. negatively correlated currency pairs.

3) Not caring about each other or random relationship i.e. no correlation.

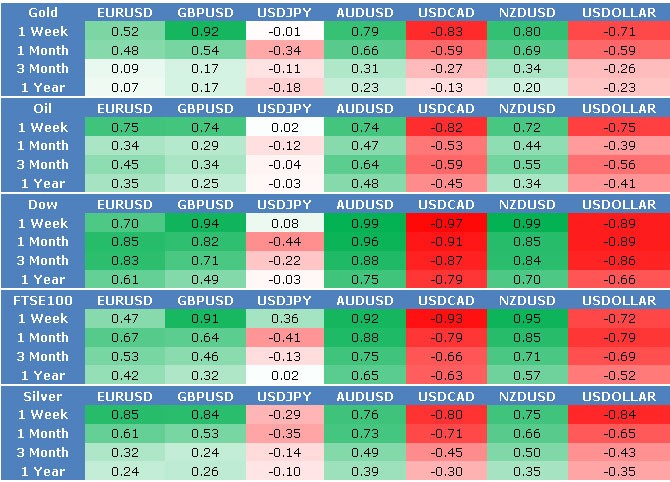

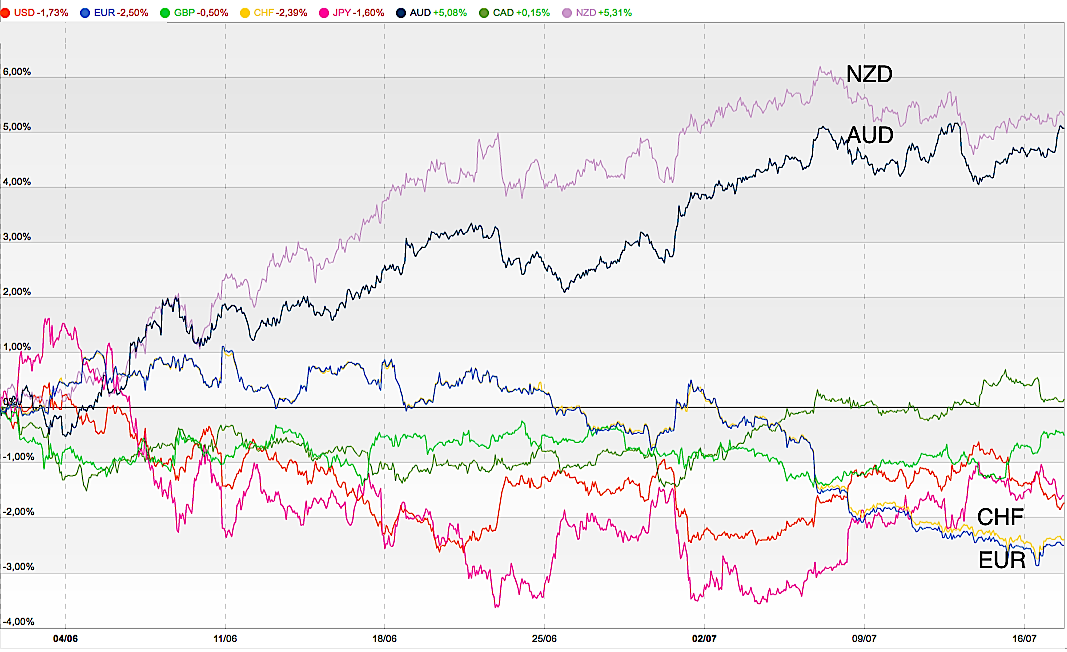

The above is the essence of currency correlation. To summarize again and in other words; some currency pairs tend to move in the same direction most of the time, some currency pairs tend to move in the opposite direction most of the time and some currency pairs do not show any relationship and their moves are completely random in relation to each other. These are positive correlation, negative correlation and no correlation respectively. Lets see some of the practical and live examples of currency correlations as follows and we will be talking about the details of Forex correlation on other sections of this site.

Why Currency (Forex) Correlations are Important

Forex correlation need to be understood on macro level and need to be kept in mind, especially when we trade with multiple currency pairs. There is no need to check it on daily basis if the trades are not based on some kind of correlation system. In fact we would always recommend to avoid trading any suggested correlation system. It would simply be too complicated and not worth your time and risks.

We need to be simply aware of the correlation in different Forex pairs so that we avoid cancelling any profits by taking any opposite positions for any Forex pairs which have strong positive correlation or taking the similar positions for two Forex pairs which have strong negative correlation.