CPI Data to Fuel Volatility in The Forex Market

Post on: 21 Июль, 2015 No Comment

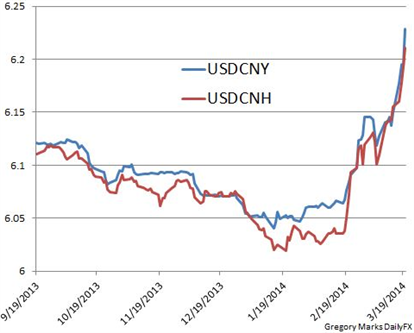

In the first full trading week of 2015, the US Dollar had a mixed performance against other major currencies. The overall US Dollar Index (I.USDX) traded higher for most of the week, but gave up some ground on Friday as stronger-than-expected December employment report was overshadowed by a decline in wage growth. Contraction in hourly wage growth convinced investors about the possibilities of the Fed keeping patience before raising its benchmark interest rate. Meanwhile, the ISM non-manufacturing PMI remained firmly in expansion territory and narrowing trade balance data supported the US Dollar during the early half of the week.

Elsewhere, a drop in Euro-zone CPI for the month of December to a five-year low, fueled expectations of ECB announcing fresh easing measures at its meeting on Jan. 22. This accompanied with the Greece uncertainty kept the Euro-zone common currency under pressure. Despite of its drop on Friday, the overall US Dollar Index managed to register a gain for the week.

Entering into the fresh trading week, the US Dollar started on the back-foot as investors now foresee the risk of deflation in the US as is expected to be reflected from this weeks CPI data. Apart from the US inflation data, investors await for the release of US retails sales data along with the release of Empire state and Philly Fed manufacturing index, to gauge the strength of US economic recovery. Also, UK CPI and Australian employment data will be on investors radar during the course of the week. Lets have a brief overview on some major market moving releases scheduled for the up-coming week.

For a complete list of economic releases, refer Forex Calendar

After Novembers surprisingly better-than-expected reading, market participants will now focus on retail sales data, scheduled for release on Wednesday. For the month of December economists are expecting the retail sales to register a growth of 0.2% as against 0.7% growth recorded in November. Meanwhile core retail sales, which excludes automobile sales, is expected to remain muted and register a nominal growth of 0.1% as compared to a growth of 0.5% in the previous month.

Moving on to the US manufacturing sector, investors will confront the release of two regional manufacturing indices for fresh signs of strength in the ongoing US economic recovery, which could also be helpful in determining further strength for the US Dollar. Manufacturing data for the month of January includes the release of Empire State Manufacturing Index and Philly Fed Manufacturing Index, both scheduled for release on Thursday. Following an unexpected sharp drop in December, the Empire State manufacturing index is expected to rebound and come-in at 5.3 for January. Meanwhile, the Philly Fed Manufacturing Index is expected to register a decline and reach 20.3 from lower-than-expected 24.5 recorded in December

Apart from the retail sales data and manufacturing indices, investors will have a close look at the latest reading on US headline inflation, consumer price inflation (CPI) for December, which is scheduled for release on Friday. Of-late continuous slide in crude oil prices has been putting pressure on the headline inflation number, with the November reading dropping -0.3% on a month-on month basis. Going ahead, the December reading for the overall CPI is expected to remain soft and fall by another 0.3%. However, the Core CPI, which excludes volatile food and energy prices, is expected to register a rise of 0.1%. Also watch-out for the preliminary release of University of Michigans consumer sentiment index, scheduled for release on Friday. The Preliminary University of Michigans Consumer Sentiment Index reading for January is expected to improve further to 94.2 from 93.6 in December.

US CPI

20CPI_0.jpg /%

Source: Bureau of Labor Statistics

From UK, the only dominant economic data is the inflation data, which is scheduled for release on Tuesday. After dropping to 1% in November, which happens to be the lowest level recorded in 12-years and lower than the BoEs target of 2%, this weeks release is now expected to even fall below 1% mark on the back of continuous decline in oil prices. Lower inflation reading, even matching consensus expectation of 0.7%, is likely to push BoEs decision to hike interest rates further beyond second-half of 2015, possibly triggering a fresh leg of weakness for GBP pairs.

This weeks dominant Australian data, that could materially impact the currency market include Australian employment report, scheduled for release on Thursday. Following a big surge in the month of November, surpassing the most optimistic expectation, economists this time are expecting the number of people employed during December to rise by 5.3K. Meanwhile, the unemployment rate for the month of December is expected to remain stable at 6.3%. Also watch out for trade balance data from Australias largest trading partner, China, which is scheduled for release on Tuesday and could lead to some volatile moves in AUD pairs.

With the US Dollar already in short-term overbought condition, this weeks inflation data seems to provide sufficient head-room for the US central bank to keep patience and maintain lower interest rates. This, in the short-terms, might compel investors to table some profits and trigger a corrective move for the US Dollar. However, the Greek political uncertainty is unlikely to pose some any risk to the well-established medium-term bullish trend for the US Dollar, at-least in the near-future.

Haresh Menghani

Senior Market Analyst

Admiral Markets

At any use of the analytical material taken from the site of company Admiral Markets, and the secondary publication on any other resources, the rights to intellectual property for a dealing center Admiral Markets, reference to the company site is obligatory.

Get connected on twitter @Fx_Haresh for latest market updates