Could the Crash of 1929 Be Repeated

Post on: 16 Март, 2015 No Comment

Seventy years ago, a major event took place in the history of the global economic markets the Wall Street crash of 1929. Ever since then, periodical plunges have followed a common script: a speculative peak accompanied by a widespread feeling of prosperity, and then a sudden collapse in the market. Experts consider it improbable, but not impossible that the market will crash soon. Yet they point out potential risks for stock markets in the cycle of interest rates, given todays historically low levels; in the extraordinarily high oil prices, and in the U.S. s current account balance.

1914, 1929, 1987, 1997, 2001 Stock market crashes keep recurring, and thats something that worries investors, short- and long-term. In principle, the market cannot disregard any reaction, no matter how adverse, says Jos A. Gonzlez Angulo, professor of financial economics and accounting at the University of Alcal. Nevertheless, over the past three years weve see a considerable drop in average share prices, which were probably inflated after the euphoric movements of the late 1990s. You could say that the market has already suffered a hit from its peak, and it is doing a good job of handling the increase in oil prices, which theoretically should have depressed prices. I cant entirely discount the possibility of a catastrophe, but I consider that improbable.

Some say the stock market is a mirror of underlying economic conditions. Others say that it is only dressed up with estimates and economic projections to look like an accurate reflection. In any case, markets manage to crystallize the business expectations of publicly traded companies. In October 1929, along with the abrupt collapse of capital markets, all the confidence and optimism of preceding years was shattered. Historians and students of the event still mark October 24 as the starting point [of the collapse.]

On Black Thursday, as posterity calls the date, 12.8 million shares were traded on the New York Stock Exchange after panic broke out. That figure was three times higher than the usual trading level. But the worst violence in the crash of 1929 took place on October 28 and 29, when the Dow Jones Industrials fell 12.8%, and 11.7%, respectively. Both declines are still among the four largest drops in the history of the index, behind only December 12, 19 14. and October 19, 1987. when the collapse reached 22.6%. The latter day is known as Black Monday.

The Importance of Stock Market Regulators

In developing countries, stock markets are now regulated, says Gonzalo Angulo. Stock market commissions in Europe. the U.S. and Japan are becoming more and more effective, uncovering fraud and deception. Market regulators dont get involved in controlling prices but in preserving a clean game. Buyers and sellers must be certain that they have all the information [they need] before making decisions.

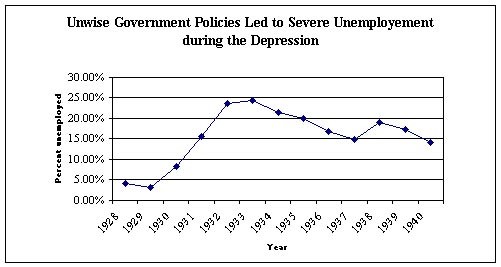

The ultimate causes of the crisis of 1929 were a contraction of demand and personal consumption; excessive production leading to [corporate] losses; and a collapse of investment that caused declining prices. Other factors were the declining monetary supply and a policy of high interest rates that the Federal Reserve followed after 1928, in order to combat stock market speculation rampant during the second half of the 1920s.

The Twenties and the Nineties

Sponsored Content:

In the U.S. the second half of the 1990s was as happy as the 1920s, but the two periods cannot be compared, says Gonzalo Angulo. The Twenties were the product of a capitalism engaged in savage rearmament between two world wars. In the past decade, we saw the flourishing of the global economy.

According to Maroto, If you compare the 1920s with the 1990s, you see a significant difference in economic goals. In the 1920s, technology was industrial, applied to new product processes and real sectors. In the 1990s, the technology involved information and telecommunications applied to existing productive processes and the generation of intangibles, synthesized under the term knowledge.

Happiness is often associated with ignorance of the future forced or voluntary. In the 1990s, although everyone boasted that they could predict the future, almost everyone failed to realize that the future was beyond reasoning, and the cyclical character of many economic events means that peaks wind up leading to recessions, concludes Maroto.

An Election Year Crash?

When it comes to predicting a crash, statistics dont tell us if this year is more likely than any other. All we can say is that the likelihood is now as high as at any moment in history. There are plenty of reasons for Wall Street to pay close attention to the possibility. The presidential election on November 2, the galloping trade and budget deficits, combined with the decline in interest rates from historically low levels, are all components of the current state of the economy.

There is very little time for a crash to take place before the elections, says Gonzalo Angulo. If there were a crash, it would mean that the policy of the President was wrong, and that would help his opponent [Senator Kerry]. The mere fact that a barrel of crude oil is sky high is decisive for those voters who feel threatened by the future and will vote against the current president.

The rise in raw material prices to record heights provides an additional unpredictable factor. Since January, the price of West Texas Intermediate (WTI) crude, the American benchmark, has risen by 65%. Over the past two years, the price of WTI has more than doubled to $55 a barrel, a record high level.

Discounted for inflation, oil prices are higher than they have been since after the energy crisis of 1979. Expensive crude-oil prices are a destabilizing factor, according to Oriol Amat, professor at the Pompeu Fabra University. Amat agrees that a sudden collapse in the stock market is not likely unless there is a major deterioration in such factors as Iraq or the price of oil.

The Menace of Crude Oil

The high price of energy could cast a dark cloud over inflation forecasts, but the financial community is currently more concerned about the impact of energy prices on economic growth. Last week Alan Greenspan, president of the U.S. Federal Reserve, forecast that high oil prices will cut the GDP of the U.S. by three-quarters of a point. Essentially, high oil prices represent a tax on consumers. Obviously, the consequences will be even greater if the price of petroleum continues to rise, he added.

In recent months, U.S. companies have been letting go of workers at an increasing pace. According to consulting firm Challenger Gray & Christmas, the pace grew by 41% in September. Employment indicators have returned to the same levels as at the beginning of 2004, before the Fed raised interest rates three times, from 1% up to 1.75%.

A crash could damage Bush, because he failed to predict the degree to which the war in Iraq could distort the power of the arms industry, and lead to rising energy costs for other sectors. Or it could hurt Kerry, for having generated a crisis in confidence about the U.S. economy and society, in order to boost his chances of becoming president, notes Maroto.

Confidence in the Future

The events of October 24, 1929. are not likely to be repeated. However, if another crash does take place, it would have clear economic consequences. More than one-third of the U.S. population participates directly or indirectly in stock markets. If a crisis occurred, that segment of the U.S. population would automatically suffer a decline in income, which would limit consumption and spending, and have an indirect impact on the use of credit.

Authorities are aware of the potential risks involved in todays massive indebtedness by both consumers and the private sector. In early October, Robert McTeer, governor of the Federal Reserve in Dallas. warned of the U.S. s record high current account deficit. Fundamentally, the imbalance stems from the U.S. consuming more than it produces, and borrowing the difference.

According to McTeer, the day will arrive when the inflow of foreign capital will no longer finance the deficit, at least according to theory. The dollar will suffer a crisis that leads to a rapid decline in its value, and an equally abrupt rise in interest rates. When the imbalance is large enough, the markets will once again snap apart. Fortunately, the economy is not simply the stock market or the expectations of analysts. It is also the decisions made everyday by many sensible people who bet on the future of their jobs and their income, says Maroto.